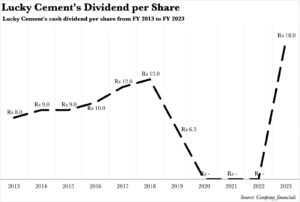

Lucky Cement has resolved to conclude a three-year intermission in its dividend disbursements to shareholders by dispensing a Rs 18 per share dividend to end its fiscal year (FY). At Rs 18 per share, this is the most substantial dividend payment per share the company has made since FY 2018 — when the company made a payment of Rs 13 per share.

However, cement companies are renowned for not paying large dividends to begin with. The matter is further bewildering when viewed in conjunction with Lucky’s share buyback activity over the past few months.

“Lucky Cement’s flagship business is cement, but now only 20% of our profits emanate from local cement operations,” elucidates Atif Kaludi, Chief Financial Officer at Lucky Cement. “The remaining 80% are derived from our portfolio of autos, power, chemicals, and international operations. Thus, you must perceive Lucky Cement as a conglomerate of diversified businesses,” Kaludi continues.

Why the high payout?

“Cement companies are amassing a considerable amount of cash, and with limited necessity for expansion within the cement industry, there are merely two options: either redistributing cash to shareholders or allocating funds towards other ventures,” elucidates Yousuf Farooq, Director of Research at Chase Securities.

Nonetheless, Kaludi insinuates that this may not hold true for all players in the sector. “In regards to local cement manufacturers, all of them are highly leveraged, and are subsequently burdened with high financial charges. In contrast, we have a cash surplus – Alhamdulillah!” expounds Kaludi.

“Our disbursement this time appears substantial because we are remunerating it after an interlude of three years. Future dividends will be contingent upon our forthcoming capital expenditure and investment plans,” Kaludi persists.

Why the necessity for the intermission, though? They were exceedingly consistent prior to 2020.

Why the three year wait?

In this particular instance, Profit did not receive a direct response. However, there is a rationale to Lucky’s apparent irrationality.

“Dividends were not disbursed in the past three years due to the capital expenditure obligations associated with the company’s endeavours to diversify,” elucidates Waqas Ghani, Deputy Head of Research at JS Global Capital. “Reflecting upon the past, in the preceding year, Lucky initiated operations for an additional cement line with a capacity of 3.15 million tons per annum at its facility in Pezu, Khyber Pakhtunkhwa. Furthermore, the company commissioned a 34 MW solar power project at the Pezu plant,” Ghani expounds.

Let’s circle back. Lucky Cement paid out dividends because it’s cash rich, unlike its competitors, because apart from being a Cement company, it’s also a conglomerate. They were also busy in expansion projects over the past year or so, which is why they had cash tied up. So far, so good. However, there are also murmurs of the cement industry simply having excess capacity as demand has collapsed given the macroeconomic position of Pakistan.

Does Lucky believe this to be the case? More importantly, in the theme of this news piece, can we expect more dividend payouts similar to the one just disbursed by Lucky Cement?

What’s on the horizon?

“Yes, there is surplus capacity in the sector,” asserts Kaludi. “That’s an undeniable fact for now. This is the second consecutive year that demand for cement has stayed negative.” “However, as soon as the economy improves — the construction sector, along with a multitude of other sectors, will bounce back,” Kaludi continues. “We have unwavering faith in Pakistan!”

And what about dividends?

“I feel the sector will payout more than the last cycle,” declares Farooq. “In the last thirty years, all the cash that cement companies have generated has been funneled into increasing capacity. Since low demand has eliminated the need for expansions, payouts and buybacks have increased and could continue to escalate.” “So far, Maple Leaf Cement, Lucky Cement, and Kohat Cement have announced buybacks, and now Lucky has announced a dividend,” Farooq adds.

That is amazing. Thank you so much for sharing this post.