We are living in a golden age for Pakistani car buyers. You may have scoffed at that statement — you may have arched your brows — and you may even be dumbfounded. We are in the grip of an automotive crisis, after all. But trust us on this. Just look at how far we’ve come in the past five years. It’s a whole new world altogether.

As consumers, we have been treated to a plethora of new brands, a feat that seemed unimaginable a few years ago. We had, after all, become so accustomed to repeating the same three names like a broken record. We have witnessed the rise of the — now ubiquitous — crossover sports utility vehicles (C-SUV), and there are hints of more to come. It is in this juxtaposition of chaos and variety that we might have missed a milestone: Pakistan is on the precipice of the one year anniversary of its first locally produced hybrid — the Haval H6 HEV.

The silence around this car might be a homage to the more discreet engine combustion that the company flaunts. But don’t be fooled: the market has been buzzing. The car has sold like hotcakes. It sits alongside Pakistan’s automotive elite — with the likes of the Sportage and the Fortuner, to name a few. It, like these other titans, has done something phenomenal: created an entirely new segment in the market.

So how well has the market embraced the Haval HEV? And more importantly, can it retain its crown in the midst of the current automotive revolution — are we on the edge of hybrids defining the next zeitgeist of our industry?

And what about electric cars? Weren’t they supposed to be the future? Hybrid cars are passé, right? They go back to the Toyota Prius, after all — so what gives?

Let’s start with the market’s reception to Haval’s HEV.

Seated next to the king

The Haval HEV boasts a formidable 1.5-litre turbocharged engine, capable of producing an impressive maximum power of 113kW, coupled with a robust 130kW motor. According to the literature, this translates to a staggering combined power of 179KW or 240HP. In comparison, the Fortuner GR-S, equipped with a diesel engine, produces 201HP and is burdened by an additional 330 kg in weight compared to the HEV.

In addition to what’s under the hood, the HEV’s interior is replete with an array of features. The market is already well-acquainted with the car’s interior. The more economical hybrid engine makes it what is known in the industry as a ‘fully-loaded’ car.

“At present, the feedback I have received from its owners is overwhelmingly positive. It outpaces most locally assembled cars, is gentle on the wallet (being a hybrid), and boasts a plethora of features,”, exclaims Shaheel Shahzad, Co-Founder of Bloombig Overdrive.

Sazgar — the manufacturer of Haval in Pakistan — is also cognisant of the market’s fondness for the HEV even when compared to its other offerings. “We are immensely gratified with the HEV. The market has responded with unbridled enthusiasm,” exclaims Ammar Hameed, Director at Sazgar.

To interject, it’s not as if the H6 1.5 and H6 2.0 aren’t brimming with a plethora of similar features. However, the HEV is the first locally assembled hybrid in Pakistan and represents Haval’s top-of-the-line model. Industry experts believe the HEV is more alluring to local customers who have a predilection for the top variant in any model line. This sort of customer behaviour is one that we see across the ranges provided by other companies as well.

Perhaps the most straightforward way to verify these claims would be to examine the sales figures. Haval does provide sales figures as it is part of the Pakistan Automotive Manufacturers Association. However, as most Pakistani automotive consumers are undoubtedly aware, Haval — though new — in true Pakistani automotive fashion, would rather have us do some legwork than simply provide any discernible sales data. What this means is that Haval, like the rest, provides model specific data whereby we have the cumulative sales for the H6 — we do not have specific data for the H6 HEV.

Nonetheless, as most Pakistani automotive buyers are again cognisant of, there’s another metric we can use to gauge market interest: the on-premium. For those who have never heard of this, the on-premium is the premium over the ex-factory price of a vehicle that a customer would pay to walk out of a showroom with their car of choice the same day rather than having to wait months for delivery.

This is because Pakistani automotive companies only manufacture the car after receiving an order for it. Some individuals take advantage of this production method by hoarding cars and reselling them on the second-hand market to drive up waiting times and subsequently charge higher on-premiums to prospective customers. Needless to say, the more in-demand a car is, the more it will be hoarded, and in turn, the higher the on-premium will be for it.

So, what’s the on-premium for the HEV that already costs an eye watering Rs 1.21 crore? Rs 11 lakh 77 thousand based on our calculations. Now if you think this is outrageous — which it is — it gets crazier. This is the second highest premium after the one attached to the Fortuner GR-S — which at Rs 2 crore and 11 lakh is the most expensive locally manufactured vehicle. The Fortuner edges it out with a Rs 1 lakh higher on-premium at Rs 12 lakh and 70 thousand. However, considering that it’s worth Rs 1 crore more, one might have expected the difference to be higher.

Profit looked at a total of 65 vehicle models in the Pakistani automotive space. A sample size of 30 vehicles was utilised wherever possible for each model. All in all, we looked at the prices of 1,842 vehicles in the secondary market.

Whilst looking at these vehicles, we hierarchised them in order of kilometres driven to ensure we captured as many of those vehicles that had been bought solely for earning on-premiums as possible.

As part of our findings, we discovered that the HEV was one of 35 vehicle models across all models Profit sampled that are retailing for a premium. Furthermore, it has the highest premium as a percentage of ex-factory price — 8.9%.

Employing on-premiums as a metric might seem like a makeshift solution; however, it is an undeniable reality of the market. The metric serves as the great equaliser, with demand for the vehicle being the only thing underpinning it. In terms of customer demand alone, it is second only to the Fortuner GR-S — if not superior — based on our findings.

However, as with the other two aforementioned vehicles, creating a new market entails one thing: there are going to be new competitors on the horizon. Very soon in this particular case.

What do you do after you’ve opened the floodgates?

“We had one C-SUV come into the market, and become a market leader. Merely a year after its launch, we witnessed a surge of C-SUVs permeating the market,” says Hameed.

“Similarly, we were the first to launch a hybrid, and I foresee that in the ensuing year, you will be presented with a plethora of options for hybrids as well,” Hameed expounds.

“Despite the impending onslaught, we remain steadfast in our confidence about our product. It’s physically the most colossal in its segment and boasts an impressive array of features,” Hameed asserts.

How well Haval can fortify its position against the impending competition, remains to be seen. The largest automotive conglomerates in Pakistan — colloquially referred to as the Big 3: Toyota, Honda, and Suzuki — are the global pioneers of hybrid technology. Toyota’s hybrid C-SUV — the Corolla Cross — is poised for imminent release. And, if memory serves, KIA also showcased their own hybrid earlier this year.

Shahzad elucidates, “The HEV has the first-mover advantage, much like the Kia Sportage once had in the C-SUV segment.” He further adds, “I believe it would be premature to predict how well the Corolla Cross and HR-V Hybrid will fare in Pakistan.” Shahzad explains that “as of late, the ‘Big 3’ haven’t launched a vehicle that has garnered an overwhelming response like they used to in the past.”

In a situation like this, one might wonder if it would have been more prudent for Haval to have just weathered the hybrid storm and proceed directly for an electric vehicle. Especially since some of its competitors have mentioned that they are bullish on electric vehicles in Pakistan.

“The market was in dire need of a hybrid vehicle,” elucidates Hameed on Haval’s decision to opt for the HEV. “With petrol prices skyrocketing, we foresee that in the coming years, other brands will also gravitate towards hybrids. Hybrid is the bridge between electric and internal combustion engines.”

“We’re not ready for electric vehicles yet,” Hameed continues. “Our infrastructure is not yet equipped to handle it. We don’t have the electricity. Overall, our country’s electricity is not up to par to sustain such a large load. If all cars were to turn electric today, it would be catastrophic for the entire country. So there will be a transition with time – the infrastructure will improve, but in the meanwhile, hybrids can serve as that bridge between electric and petrol.”

“Electric vehicles have already started arriving in Pakistan,” Hameed adds. “But for mass adoption to occur, the price would need to decrease – it has to make financial sense for consumers to purchase the car. Worldwide, adoption will also only happen when the cost becomes reasonable, when it becomes comparable to petrol vehicles.”

“Currently, because the cost is high and customer buying power in Pakistan is limited, it will take much longer for Pakistan to transition fully to electric,” Hameed explains. “Hybrids, in contrast, are more affordable than their electric counterparts, and the fuel savings are immense – the return on investment is immediate, and perhaps even better when adjusted for local purchasing power.”

There are two aspects that warrant our attention: firstly, the precise nature of the purported cost savings by using the HEV, and secondly, the practicality (or lack thereof) of electric vehicles.

Will your wallet enjoy the H6 HEV?

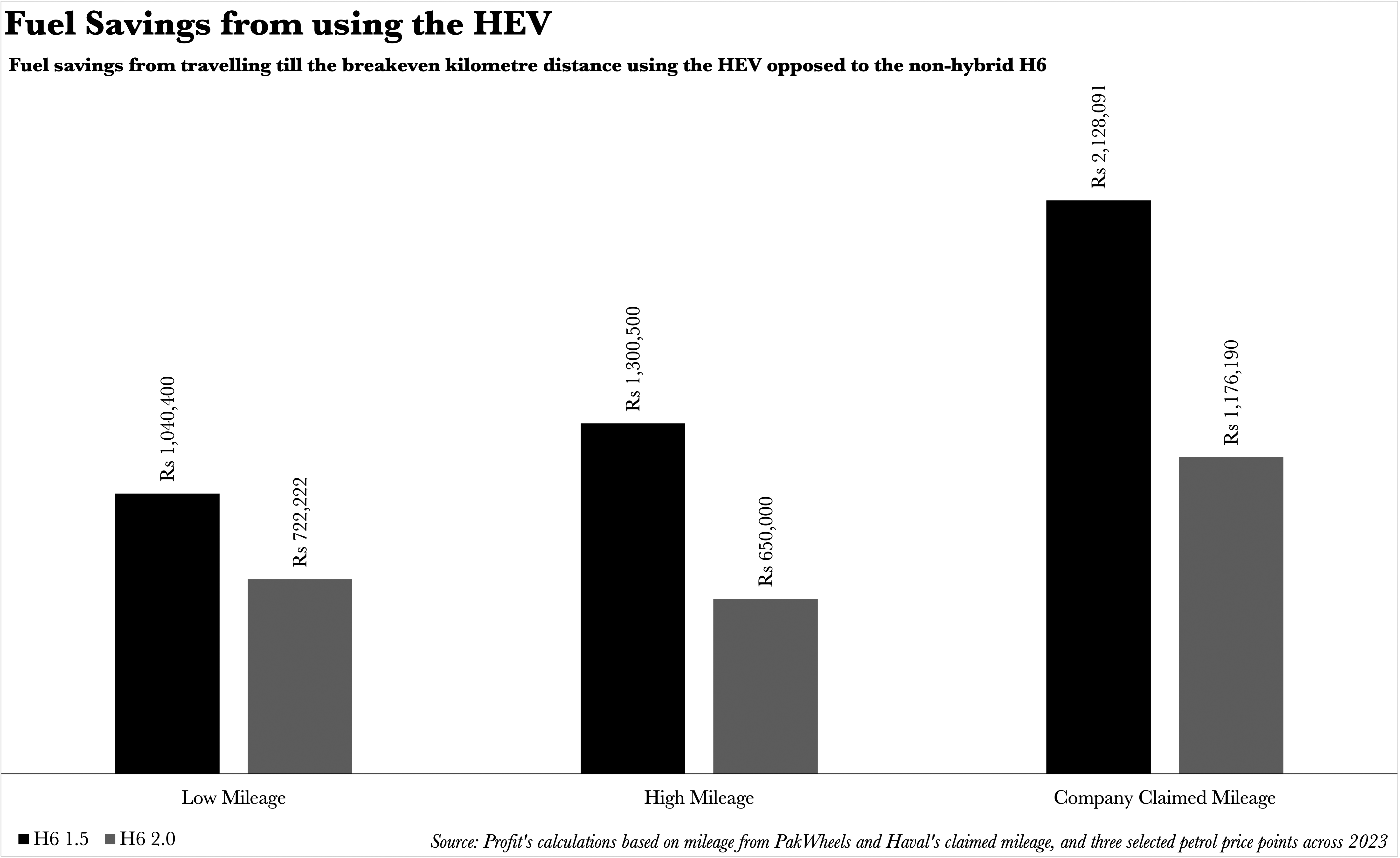

To commence, it is imperative to note that the H6 HEV comes with a significantly higher price tag than its counterparts, the H6 1.5 and H6 2.0, costing an additional Rs 26 lakh and Rs 13 lakh respectively at the time of writing this article. This raises the question: how many kilometres must one traverse to recoup the difference in cost?

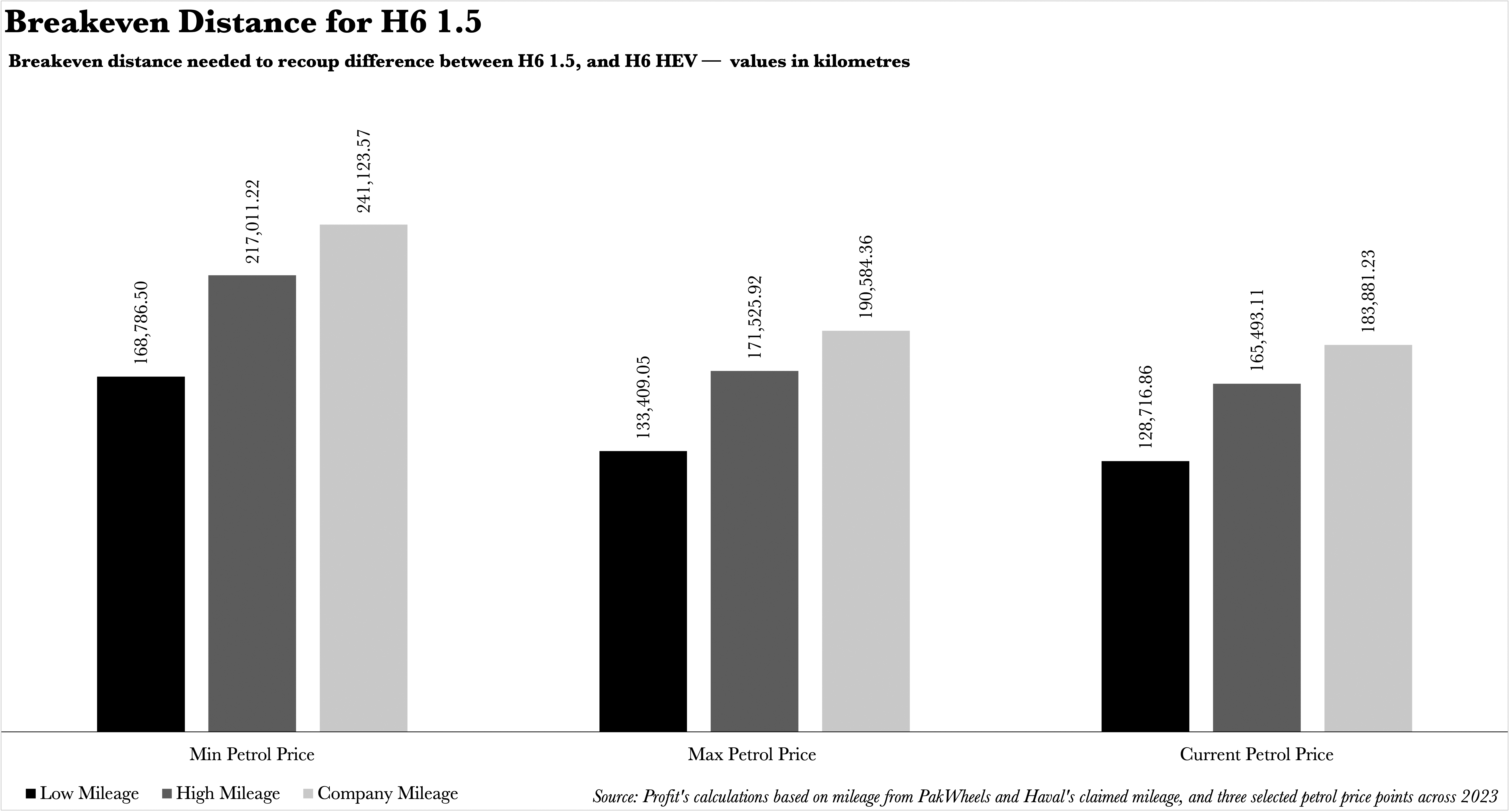

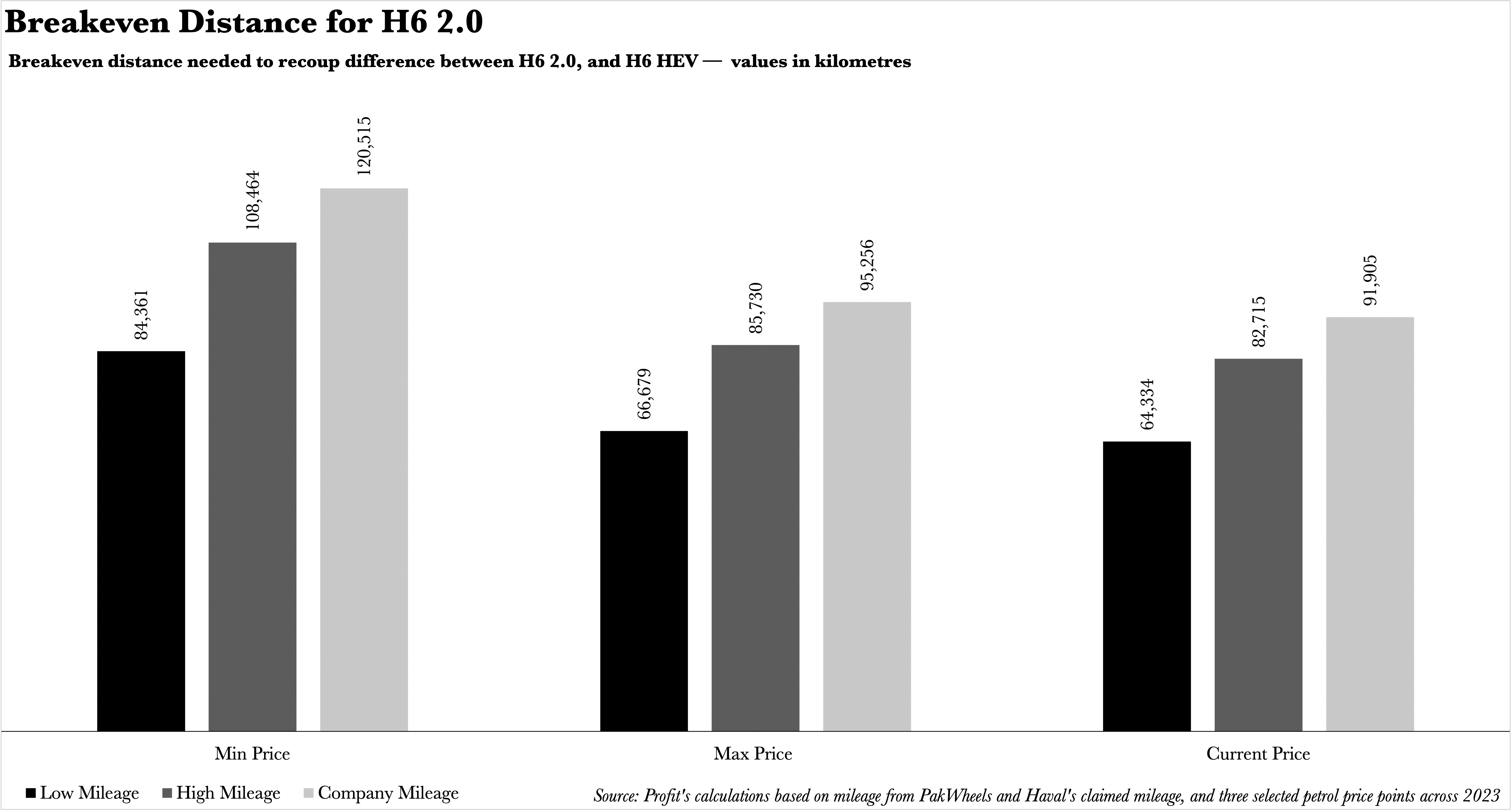

The base argument is that hybrids will allow customers to recoup their savings due to the reduction in fuel costs. Profit examined fuel prices across 2023, utilising the minimum and maximum prices during the year — Rs 215.74 per litre and Rs 282.9 per litre — alongside the current price of Rs 272.95 per litre. The objective? To accurately calculate both the breakeven distances and requisite savings for hybrid vehicles, to make up for the additional cost.

We used the high and low mileages for all three vehicles as listed on PakWheels. The estimated mileages stood at 10 (low) and 12 (high) kilometres per litre for the H6 1.5; 9 (low) and 12 (high) kilometres per litre for the H6 2.0; and 14 (low) and 18 (high) kilometres per litre for the H6 HEV.

Employing these numbers, Profit calculated the cost per kilometre for the HEV based on its various mileages. At a petrol price of Rs 215.74 per litre, the cost was Rs 15.41 per kilometre (low mileage), and Rs 11.99 per kilometre (high mileage). At a petrol price of Rs 282.9, it was Rs 20.21 (low mileage) per kilometre and Rs 15.72 (high mileage) per kilometre.

At the current petrol price of Rs 272.95, it was Rs 19.5 per kilometre (low mileage) and Rs 15.16 per kilometre (high mileage). At the company claimed mileage of 20 km per litre, the cost was Rs 10.79 per kilometre at a petrol price of Rs 215.74 per litre, Rs 14.15 per kilometre at a petrol price of Rs 282.9 per litre, and Rs 13.65 per kilometre at a petrol price of Rs 272.95.

Profit also took into consideration the company’s claimed average of 20 kilometres per litre due to the variability in mileage reported by users – perhaps giving it the benefit of the doubt. You are free to utilise any of these mileages in your own calculations.

To effectively recover the additional cost paid for the HEV, over its non-hybrid counterparts, one would need to traverse a distance ranging from 241,124 km to 128,717 km with the HEV compared to the H6 1.5, and from 120,515 km to 64,334 km with the HEV compared to the H6 2.0, depending on the mileage achieved with the HEV.

Understanding the customer

What do the numbers truly signify for a prospective HEV buyer? Perhaps, nothing at all if you’re already in this price range. “There’s an emotional component to this decision that transcends the logic behind buying the car,” expounds Shahzad.

“Many individuals with substantial disposable income (who can afford to spend Rs 1 crore and 20 lakh on a car) have an innate desire to acquire the ‘top-of-the-line’ variant in Pakistan. I believe that an average household that would purchase a Rs 1 crore and 20 lakh car would already have four cars in their garage, making it even more difficult to rationalise the decision to choose the HEV over the H6 2.0,” adds Shahzad.

Shahzad explains that, once in this price bracket, there is another facet to consider entirely — the driving experience. According to him, the H6 2.0 offers a superior driving experience compared to the HEV, and Haval could address this discrepancy in their hierarchy by releasing a hybrid version of the H6 2.0, as the current HEV is the hybrid version of the H6 1.5.

However, for both the ardent enthusiast and the circumspect buyer, wouldn’t an electric vehicle be the quintessential choice? It could potentially reap considerable savings and may be brimming with features for the aforementioned enthusiast buyers that Shahzad alludes to. Isn’t it a win-win scenario? Are electric vehicles truly as impracticable, given the current infrastructure, as Hameed contends?

How long can hybrids hold out till electric vehicles arrive?

The preponderance of electric vehicles being imported into Pakistan are high-end luxury models. A tertiary glance of social media or import records reveals that the lion’s share of electric vehicles entering the country are manufactured by the German triumvirate of Audi, Mercedes, and BMW. Needless to say, these three aren’t famous for making the most affordable of vehicles.

The rationale behind individual importers’ decision to eschew more affordable options from manufacturers such as Kia and Hyundai remains an enigma. Similarly, it’s confounding why these companies have not taken it upon themselves to import their vehicles into Pakistan, despite having a presence in the country.

If we were to rewind just a few years to when the Audi e-tron first launched in Pakistan, it was just a hair higher than the HEV’s current price. This is the price at which the car spiked in popularity, and became common on the roads of Islamabad, Karachi, and Lahore. It was only when the rupee depreciated in value that the e-tron nearly tripled in value and we suddenly saw fewer ones being purchased.

No small sized affordable all-electric options have since been introduced by either the big three, the new players or the ‘Germans’. This perhaps has a lot to do with the ancillary requirements of electric cars at home and the lack of infrastructure available in the country to cater to a larger number of such vehicles on the roads.

“It’s a conundrum akin to the chicken and egg scenario: will the infrastructure be established first, or will the vehicles arrive prior to that?” ponders Dr Waseem Akram, Director of the Transport Planning Unit at the Punjab Transport Department. “I believe that, as in India, the State will ultimately have to intervene to facilitate the launch of electric vehicles,” he continues.

This is not an insurmountable task for the State to accomplish either. “They could mandate petrol pump owners to incorporate electric charging stations into their existing infrastructure,” argues Dr Fiaz Chaudhry, Director of the LUMS Energy Institute. “They already offer diesel and petrol, so why not cater to electric four-wheelers as well?” he adds.

“Furthermore, amidst the current fiscal the country may not be able to import electric vehicles en masse,” Akram adds. “To ensure equal access to their desired electric vehicle, the federal government would have to liberalise imports; otherwise, access will remain limited to enthusiasts. Does the federal government have the fiscal space and forex reserves to do this?” Akram asks.

“Until sufficient fiscal space is available for the State, private companies introducing electric vehicles will create the necessary infrastructure,” Akram continues. “The current infrastructure is based on demand. Cities such as Lahore and Islamabad already have sizable populations of electric vehicles, hence infrastructure exists there. Where it doesn’t exist is where there isn’t any demand,” he adds.

“It is the government’s duty to create an enabling environment; the private sector will capitalise on it. If the government were to give a commercial model to pump owners — say a 1% discount on a certain delivery of fuel in exchange for them setting up an electric vehicle charging station — you would be surprised at the rate at which the pump owner would comply,” Chaudhry continues.

“As the hybrid vehicle market flourishes, manufacturers will inevitably be confronted with developing a robust electricity infrastructure. After all, plug-in hybrids necessitate such infrastructure,” Chauhdhry muses.

The conundrum of plug-in-hybrids is a crucial one. If we consider hybrids as the transitional link between petrol and electric vehicles, then it stands to reason that plug-ins represent the final frontier before we traverse that bridge. Right?

The next best thing, for the time being

This is indeed a conundrum that manufacturers will have to grapple with. Plug-in hybrids represent the next evolutionary step in the conventional hybrid portfolio for many manufacturers. If they invest in electrical infrastructure to support plug-in hybrids, wouldn’t it be prudent to take the leap now and catapult the industry into the realm of electric vehicles?

It could even provide the first company to do so with a significant first-mover advantage.

“Transitions require time to come to fruition. The discourse surrounding hybrids suggests a desire by those in the petrol engine value-chain to continue selling their traditional engines while also incorporating batteries into their vehicles,” says Chaudhry.

One thing remains unequivocal — there is no definitive timeline for when electric four-wheelers will dominate the market. Perhaps Haval will release the first vehicle in this segment, or maybe KIA will once again pull off a surprise? As consumers, we stand to benefit either way. This is a far cry from the days when our choices were limited to the Big Three.

However, until the dust settles on this debate, we have a new inductee into our automotive hall of fame — albeit a costly one. But then again, the market seems to be clamouring for an even more exorbitant version of the vehicle.

We should move towards Electric Vehicles🙌 instead of hybrid ones😛

Wow, this car’s sleek design and powerful performance truly exemplify the perfect blend of style and substance. Every curve and contour seems to be meticulously crafted to not only turn heads but also enhance aerodynamics. With its cutting-edge technology and luxurious interior, it’s no wonder this model sets a new standard for automotive excellence. A true masterpiece on wheels!” 🚗✨ #AutomotiveElegance #PerformancePerfection