By Hammad Ali

K-Electric is the only privately owned and vertically integrated utility in Pakistan. The utility’s heavy reliance on fossil fuels for power generation, and slow adoption of renewable energy has led to high electricity generation costs, requiring substantial government subsidies. Embracing sustainable alternatives earlier on could have had reduced costs, achieved greater self-sufficiency and would have provided relief to consumers.

K-Electric is the primary electricity provider to Sindh’s metropolitan capital and some surrounding regions. On the other hand, NTDC supplies electricity to all the other areas of Pakistan through its transmission network except the zone of K-Electric. The systems of NTDC and K-Electric have a tie-line which allows for K-Electric to import up to 1100 MW of electricity from the national grid at a very low cost. The total existing capacity of K-Electric is 4,485 Megawatt (MW), out of which 2817 MW is K-Electric’s own generation fleet, 526 MW is supplied by the Independent Power Producers (IPPs), and 42 MW is contributed by the Captive Power Producers (CPPs).

During FY 2022, about 45% of K-Electric’s energy demand was served by the electricity being imported from the national grid through the tie-line, indicating that the utility relies significantly on the national grid for its generation supply. It is important to note that the utility has been pursuing additional supply of up to 2050 MW from the national grid by building two new interconnections, which has not yet received approval from the government. This dependency on the national grid reflects poorly on utility’s efforts in the past to become self-sufficient by making timely and effective generation planning decisions.

Furthermore, the utility depends heavily on costlier thermal power generation plants, particularly gas/RLNG, furnace oil (FO), and imported coal. As of now, nearly 97% of the utility’s total installed capacity is based on these thermal sources of energy. According to the Power Purchase Price (PPP) references set up by NEPRA for FY 2023-24, price for RLNG, FO, and imported coal is 51.42 Rs/kWh, 48.56 Rs/kWh, and 40.54 Rs/kWh, respectively. Therefore, this reliance on imported fossil fuels subjects the company and its consumers to fluctuations in international fuel prices, directly impacting electricity tariffs.

NEPRA attributes the high electricity generation costs in the K-Electric system to several factors, including the low efficiency of its newly added gas-based power plants as well as generation of power through furnace oil/RLNG using low efficiency steam turbine thermal power plants.

The problem of expensive electricity generation in KE region is also reflected in the provision of subsidies by the federal government to bail out the consumers in Karachi. According to the federal budget, the total subsidy to pick up K-Electric’s tariff differential for FY 2022 alone was PKR 56 billion.

Moreover, the fact that renewable energy technologies, particularly solar and wind power, have witnessed significant advancements and cost reductions over the past decade cannot be overlooked. This has made them increasingly competitive with conventional fossil fuels.

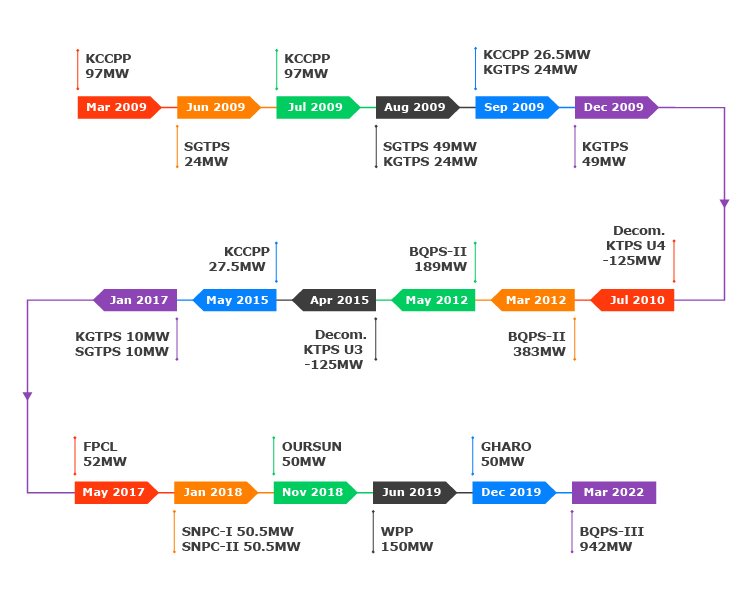

Yet, looking at the generation timeline of K-Electric from March 2009 to March 2022, it is evident that renewable energy sources did not get the attention they deserved in the generation planning of the utility. Out of 2132 MW capacity that K-Electric decided to add in those thirteen years, more than 95% of it was fossil fuel based. Whereas, only two solar power plants (Gharo and Oursun) of 50 MW capacity each were added into the system. A large share of the fossil fuel based plants installed run on RLNG, which is currently the most expensive source of electricity generation in Pakistan (per unit cost of Rs. 51.42) and subject to international market volatility.

Zooming in on this, we can see that five different thermal power plants were installed in K-Electric’s system in just one year. KGTPS & SGTPS (both RLNG/natural gas based) in January 2017, FPCL (imported coal based) in May 2017, and SNPC-I & SNPC-II (both natural gas based) in January 2018. Based on the data available in NEPRA’s State of Industry Report 2022, these five plants generated a cumulative 1322 Gigawatt-hour (GWh) of energy during FY 2022, with a total cost $124 million approx.

According to an estimation, wind and solar power plants of about 460 MW capacity could supply more amount of energy (1326 GWh) than these five thermal power plants did in FY 2022 at a cost of only $53 million, a mere 43% of the latter’s cost. K-Electric could have saved its consumers nearly $71.2 million in FY 2022 alone by banking on renewable energy technologies.

The people of Karachi had high hopes from K-Electric when it first entered the market as a private entity. Yet in the 18 years since, it has neither solved the problem of load shedding nor been able to provide relatively cheaper electricity. Had K-Electric made timely decisions to diversify its energy portfolio, it would surely have been able to ensure cheaper electricity tariffs for its consumers, providing much needed relief to households, businesses, and industries across Karachi. However, there might still be a way forward. Embracing renewable energy now can pave the way for a sustainable and economically viable energy future for the utility and its consumers.

Hammad is currently working as a Research Analyst at Renewables First, an energy and environment think tank based in Pakistan.