MG Motors has slashed the price of the MG HS by Rs 6 lakh, bringing the car’s price down from Rs 87 lakh to Rs 81 lakh. The company states that it has made the decision in order to pass on the foreign exchange benefit it has benefited from, on account of the Pakistani’s Rupee’s appreciation, to the customers.

This revised pricing will be applicable to all vehicles purchased from October 16 onwards. Why have they done this?

“MG has preemptively passed on the foreign exchange benefit to its customers,” states Syed Asif Ahmed, General Manager of Sales and Marketing at MG Motors. “Initially, we were primed to trail the path carved by the automotive industry’s leaders. However, our leadership chose to take the reins and not indulge in a game of patience with the rest of the industry when it came to disseminating the foreign exchange gains,” Ahmed continues.

This decision trails closely behind Lucky Motors’ announcement of a reduction in their own prices just over a week and a half ago, a move also spurred by the Rupee’s strengthened position in the global market. However, it’s worth noting that MG stands apart from its counterpart in one crucial aspect — unlike Lucky Motors, MG never hiked their prices in the first place.

Beyond the headlines

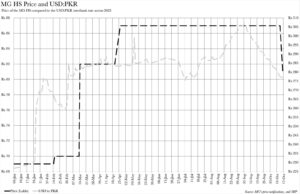

MG’s pricing strategy, akin to their Chinese peers and distinct from their non-Chinese rivals, has exhibited remarkable stability throughout the year. The decision constitutes the fourth overall price revision that MG has undertaken this year, with the price of the vehicle being largely responsive to fluctuations in the value of the Rupee against the US Dollar.

Nonetheless, for the astute and patient buyer, it has been possible for a while now to acquire it at a lower price in the secondary market than the ex-factory price for which the company offers it. For anyone familiar with Pakistan’s automotive industry, these discounts, or off prices as they are commonly known, signify a car’s poor performance in terms of customer demand. A Rs 6 lakh price reduction can engender the perception that MG merely realigned the price of their vehicle with what customers perceive as its fair value.

“The HS isn’t trading at a markdown. The entire industry is. You can find vehicles in the second-hand market, their prices with discounts ranging from Rs 80,000 to a staggering Rs 20 lakh,” Ahmed elaborates with a hint of gravity.

Ahmed’s remarks refer to the broader slump in the automotive industry. September’s sales, though superior to August’s figures, are a third of what they were in the same month last year. Moreover, total sales for the first quarter of fiscal year 2024 are almost half of what they were over the same period last year. It is here that Ahmed believes that foreign exchange gains should be transferred to the customer in order to revive the industry.

“Why are consumers refraining from buying vehicles, or analogous commodities? It’s because they’re bracing for foreign exchange recalibrations,” Ahmed postulates. “Channelling the benefits of currency appreciation to the consumer is the judicious trajectory for the automotive industry. It will invigorate consumer confidence, and we foresee others emulating this approach. However, anyone wishing to do so should execute it with alacrity” Ahmed continues.