The rupee depreciated slightly in the interbank market on Tuesday, bringing to an end almost a month of every day gains.

Data shared by the State Bank of Pakistan (SBP) showed the rupee lost 20 paise against the US dollar to close at Rs 277.03, a depreciation of 20 paise or 0.07% from yesterday’s close of Rs 276.83.

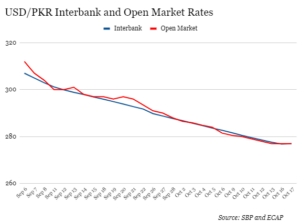

The rupee had fallen to a record low of Rs 307.09 per dollar on September 5. But following a crackdown by agencies on illegal foreign exchange trading and structural reforms introduced by the central bank, the rupee had recovered every day in the interbank market since then. It had gained Rs 30.26 or 9.85% prior to today’s depreciation.

Sana Tawfik, a senior analyst at Arif Habib Limited, attributed today’s depreciation to “rebalancing”. This implies that the rupee has become overvalued following 28 days of appreciation and needs to fall again to its ‘actual value’.

“Given that we have a flexible exchange rate, this was bound to happen because our import restrictions have been lifted and debt repayments have to be made. The rupee’s appreciation was going to be halted at some point. The day-on-day depreciation is driven by demand and supply,” she commented.

Pressure on rupee in future

Tawfik said the rupee was “rebalancing” itself because of increased demand for the dollar following an uptick in imports. She noted that the International Monetary Fund’s (IMF) World Economic Outlook report released last week projected Pakistan’s economy would grow 2.5% in the current fiscal year compared to a 0.5% contraction last year.

“Pakistan’s economic recovery is consumption-driven and linked to imports. As the economy recovers and imports rise to an increase in aggregate demand, obviously the rupee will come under pressure,” the analyst said. She added, however, that the devaluation might not be as steep as last year’s when it depreciated by 28%, especially after the administrative measures such as shutting down illegal foreign exchange trading and consolidating exchange companies for better regulation.

“The rupee will continue to move up and down slightly; this just shows the rupee will adjust itself according to demand and supply in a flexible regime.”

High REER, uncompetitive exports

Meanwhile, Yousuf Saeed, head of research at Darson Securities, pointed out that the rupee had already appreciated significantly without any fundamental changes or major inflows. The REER (Real Effective Exchange Rate) index had gone above 100, which indicated that exports were not competitive, he added.

What is REER? A country’s currency can be overvalued, undervalued or in equilibrium, with the last indicating that prices will remain stable as demand and supply are balanced. The REER indicates how well the equilibrium is being maintained. Economists use REER to analyse how competitive a country’s exports are compared to its major trading partners.

If the REER is high, it means the country’s currency is overvalued compared to its trading partner, thus rendering its exports uncompetitive. For example, if the rupee appreciates against the dollar, it means that people in the United States would need more dollars to buy products from Pakistan as its exports have become more expensive. This would mean a loss in trade competitiveness. On the other hand, it would make imports from the US to Pakistan cheaper as Pakistanis would need less dollars to buy those products.

According to data shared by brokerage house JS Global Capital, Pakistan’s REER now stands at 103, which is a one-year high. This means the rupee is overvalued and needs to undergo a correction or rebalancing.