After surging past 54,000 points level during intraday trading, profit-taking activities reversed the gains at the Pakistan Stock Exchange (PSX) on Tuesday, causing the benchmark KSE-100 Index to shed 125 points.

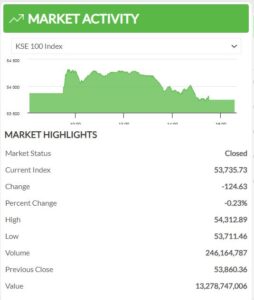

The KSE-100 index started the day with an upward trajectory by gaining 452 points or a 0.78% increase and reached a peak of 54,312.05 points.

However, the market experienced selling pressure before closing hours, causing the KSE-100 to conclude the day at 53,735.73 points, reflecting a decline of 125 points or 0.23%.

On Monday, the PSX gained 737.33 points or a 1.39% increase, and closed at 53,860.37 points.

Commercial banks, oil and gas exploration companies, and oil marketing companies (OMCs) showed gains, while automobile assemblers, chemical, and fertilizer sectors recorded losses.

The driving factors behind recent trajectory at PSX included expectations of a potential rate cut in the monetary policy and the better financial performance of companies listed on the exchange.

Additionally, the announcement of upcoming general elections appeared to boost investor confidence, as it signaled the political stability in the country.

Bloomberg reported on Monday that Pakistan’s world-beating stock market is approaching overheated levels as a widely tracked measure of momentum rises to the highest in 18 years.

The KSE-100 Index 14-day relative strength index exceeded 90 for the first since March 2005. In the previous 14 instances when the metric surpassed this reading, the gauge declined over the next 20 days on eight occasions by an average 4.2%, data compiled by Bloomberg shows.

Stocks have rallied to become the best performer globally since July as Pakistan secured a deal with the IMF to avoid a sovereign default.

In related development, Pakistan is currently hosting an IMF review mission to carry out the first review under the $3 billion loan program. The outcomes of this review may lead to the release of the second tranche of $700 million by the end of December 2023.

The Pakistan Stock Exchange (PSX) has been experiencing a dynamic journey lately. After surging past the 54,000-point mark during intraday trading, profit-taking activities caused the benchmark KSE-100 Index to shed 125 points by the end of Tuesday. The day began on a promising note, with the KSE-100 index gaining 452 points, marking a 0.78% increase and reaching a peak of 54,312.05 points. However, as the trading day progressed, selling pressure mounted, leading to the KSE-100 concluding at 53,735.73 points, reflecting a decline of 125 points or 0.23%.

In contrast, Monday had seen a significant surge, with the PSX gaining 737.33 points, amounting to a 1.39% increase, and closing at 53,860.37 points. This fluctuation has been influenced by various factors, including the performance of different sectors. Commercial banks, oil and gas exploration companies, and oil marketing companies (OMCs) posted gains, while automobile assemblers, chemical, and fertilizer sectors recorded losses.

The recent momentum in the PSX has been driven by expectations of a potential rate cut in the monetary policy and the improved financial performance of listed companies. Furthermore, the announcement of upcoming general elections has boosted investor confidence, indicating political stability in the country.

A Bloomberg report also highlighted that Pakistan’s stock market is approaching overheated levels, with a widely tracked measure of momentum hitting an 18-year high. The KSE-100 Index’s 14-day relative strength index exceeded 90 for the first time since March 2005, a metric that historically led to declines in the index on multiple occasions.

Despite these fluctuations, Pakistan’s stock market has been the best performer globally since July, thanks in part to the country securing a deal with the IMF to avoid a sovereign default. In a related development, Pakistan is currently hosting an IMF review mission to conduct the first review under the $3 billion loan program. The outcomes of this review may lead to the release of the second tranche of $700 million by the end of December 2023, further impacting the dynamics of the market. Thank you! We’re delighted that you found our discussion thread amazing. I would like to refer Rentacarisb.pk.