The struggle for the management of the Bank of Khyber has come to a boiling point after the bank’s managing director left the organisation. His departure has been followed by a string of resignations from board members including the Senior Executive Vice President and Chief Risk Officer Haroon Zameer, and a private board member by the name of Mir Javed Hashmat.

The exodus from the bank has come after months of back and forth in which the bank’s MD, Ali Gul Faraz, was at the centre of disagreements within the bank’s board over its financial performance. The bank has already appointed Irfan Saleem, who was the bank’s Chief Financial Officer before this, as the acting MD and is looking for a permanent replacement.

One source who was privy to the meeting of the bank’s board said that the members of the board coming from the government, who make up a majority, were in the habit of making decisions without really considering the input of private members of the board which irked them. The main bone of contention were appointments made by the former MD, Ali Gul Faraz, which these private members think were made on a political basis. Separately, KP’s anti-corruption body has also called Ali Gul Faraz, former finance minister Taimur Jhagra, and other members of the board in for questioning.

Financial troubles

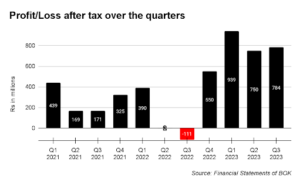

The Bank of Khyber (BoK) has been in an interesting situation for the past couple of quarters. BoK’s recent trajectory has been nothing short of intriguing. Through the last couple of quarters, its financial performance mirrors the internal challenges the bank has been grappling with. Initially, there was a significant setback as the bank witnessed a staggering drop of over 60% in its profit after tax during the second quarter of 2021. Subsequently, there was a noteworthy recovery evident in the following quarters of 2021 until the first quarter of 2022. However, this upward trend was short-lived, as the bank’s profit after tax plummeted dramatically by a staggering 99.6% in the second quarter of 2022, almost nearing a complete wipeout. To compound matters, the subsequent quarter resulted in a significant loss of Rs 11.1 crore for the bank.

In its half-yearly reports of 2022, BoK highlighted that the profit downturn was primarily attributed to several factors: a surge in inflation and petroleum prices, a persistent devaluation of the currency against the dollar, and a substantial increase in the policy rate. Notably, the rapid escalation of the policy rate within a brief timeframe significantly diminished the margins associated with fixed-rate investments. Additionally, the bank had been heavily investing in expanding its branch network, consequently leading to a notable uptick in operating expenses. Despite the current decline in profitability, the bank clarified that this downturn was short-term as the expansion of the branch network would ultimately contribute to future profit growth by broadening their deposit base.

In the third quarter reports of 2022, BoK again attributed the decline in profits to the impact of changes in the market interest rates which eroded margins on fixed-rate investments, and the increase in operating expenses due to branch expansion as well as provisions made against non-performing loans.

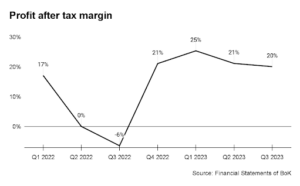

The bank made a turnaround in subsequent quarters as profit after tax increased on the back of increased interest income. The bank set an impressive financial milestone in the first nine months of 2023, recording a noteworthy profit after tax of nearly Rs 247.3 crores. This achievement marks a remarkable feat of increase of almost nine times compared to the same period last year. However, despite this substantial growth, it’s worth noting that BOK’s net profit margin currently stands at a modest 20%.

Operating expenses stood at Rs 476.5 crore in the nine months ending September 2023 as compared to Rs 372.6 crore in the nine months ending September 2022.

In June 2023, BoK recorded a profit of around Rs 169 crore. According to sources, BoK’s half-year accounts recorded a profit of Rs 169 crores was not due to the bank’s performance but due to the booking of Rs 100 crore income as a penalty for early encashment of government deposits by the provincial government and Rs 60 crores from foreign exchange business. Otherwise, the bank had a loss of Rs 20 crores in the half-year.

The conflict

It is important to note here that the Bank of Khyber like other provincial banks is majority owned by the KP government which holds the majority shares at 70.2% while Ismail Industries Limited holds 24.4%. BoK is one of the three Provincial Public Sector Commercial Banks in the country.

As such members of the board nominated by the government are usually on the same page and can very easily make any important decisions including appointment. It is on this front that the main disagreements have risen rather than the bank’s financial troubles. Although, some of the former members of the board have told Profit that the bank’s performance has suffered as a result.

According to sources within the bank, Gulfaraz faced frequent disagreements with private members of the board, resulting in a division within the board. Private members reportedly expressed their criticism of Gulfarz in a letter to the former caretaker chief minister. The sources also claimed that despite repeated requests, Gulfaraz’s performance report was never presented to the board of directors. Under the Code of Corporate Governance, the MD’s performance should be reviewed annually, but for the past two years, it has not been reviewed.

In particular, the appointment of the new company secretary of the bank became an issue within the private members of the board. One source that represents the stance of private members of the board said that the newly appointed company secretary has no experience in commercial banking and has no knowledge of corporate governance laws. She was previously in charge of legal affairs at KE Solar. The appointment of the acting group head of Islamic banking, who was given the acting charge until June 30, 2023, also became an issue.

Meanwhile, responding to Profit, a spokesperson for BoK said that the bank was formerly managed by the Finance Secretariat, but the pivotal role of appointing the Managing Director (MD) has now been entrusted to the Board of Directors, affording them complete autonomy in the selection of the Chief Executive Officer (CEO) and MD for the bank.

“This strategic decision reflects Bank of Khyber’s steadfast commitment to strengthening its leadership transition process, with a paramount focus on identifying the most qualified and capable candidate to steer the institution toward future growth and success. Following a rigorous evaluation of nominated candidates for the acting MD position, Mr. Irfan Saleem Awan has emerged as the fit choice. Mr. Awan, who concurrently serves as the Chief Financial Officer (CFO) of the bank, possesses a comprehensive skill set, extensive experience, and an unwavering dedication to the institution, making him the ideal candidate to lead Bank of Khyber through this transitional phase. It is noteworthy that among the candidates, the other executive referred to in your statements was not nominated as a potential candidate for the said role,” they said in a statement.

Anti-corruption proceedings

Meanwhile, the Khyber Pakhtunkhwa Anti-Corruption Establishment (ACE) has directed former Provincial Finance Minister Taimur Saleem Jhagra and multiple Bank of Khyber (BoK) board members to appear on November 27 in connection with an alleged corruption case.

The ACE is investigating appointments made during the previous government, including the hiring of the former BoK MD Ali Gul Faraz and other top positions. Additionally, the National Accountability Bureau (NAB) is conducting its own inquiry into the bank’s recruitments, seeking details of appointments made during the last Pakistan Tehreek-e-Insaf government.

Allegations of favouritism in high-ranking appointments through board approvals have emerged. However, former BoK board member Rashid Ali rejected the allegations and affirmed that decisions during their tenure had board approval and stated his commitment to responding in accordance with the law once officially notified by ACE.

Former Finance Minister Jhagra also dismissed the allegations as “part of an ongoing political victimisation campaign”, expressing concern that such actions by ACE and NAB could discredit the accountability process in the future.

Jhagra said he had not received any notice from ACE and pledged to respond once informed of the specific charges. Jhagra added that former board members Shakil Qadir and Shahab Ali Shah were not invited. He indicated a plan to challenge ACE in court at the appropriate time.

nice content keep it up dear