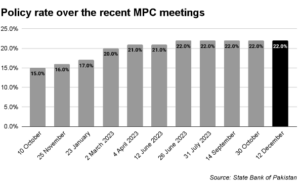

KARACHI: The State Bank of Pakistan (SBP) decided to keep the policy rate unchanged at 22%, at the Monetary Policy Committee (MPC) meeting held on December 12, 2023. The decision is in line with most analysts’ expectations.

The central bank last hiked the policy rate by 100 basis points (bps) to 22% in an emergency meeting in June ahead of an agreement with the International Monetary Fund (IMF). Since then, it has maintained the rate in meetings held on July 31, September 14, October 30 and December 12.

In a poll conducted by Reuters of 12 analysts, the median estimation projected no change in the rates, with just one analyst advocating for a 100 basis point cut. Looking ahead, there is a general consensus that rates might gradually decrease in the first half of the following year, depending on how inflation progresses.

The MPC took note of several significant developments since October. Firstly, the successful finalisation of the staff-level agreement under the International Monetary Fund (IMF) Stand By Agreement (SBA) programme, is expected to bolster financial inflows and enhance SBP’s foreign exchange reserves. Secondly, the gross domestic product (GDP) growth in the first quarter of 2024 met expectations for a moderate economic recovery. Thirdly, recent surveys indicated a positive shift in consumer and business confidence. Finally, core inflation persists at elevated levels, showing a gradual decline.

Considering these developments, the committee affirmed that the current monetary policy stance is suitable to meet the inflation target of 5-7% by the end of the fiscal year 2025. This assessment hinges on sustained targeted fiscal consolidation and timely realisation of planned external inflows.

The MPC’s decision took into account the recent hike in gas prices in November, which pushed inflation higher than initially expected. However, there are some balancing factors, like the recent drop in international oil prices and increased availability of agricultural produce, which could offset these effects.

Positive real interest rate

The MPC assessed that the real interest rate continues to be positive on a 12-month forward-looking basis and inflation is expected to remain on a downward path. However, SBP did not provide inflation estimates in today’s MPC. The Governor emphasised that SBP reassesses its inflation forecast twice a year, in July and January. To highlight, in July 2023, SBP projected an average inflation for fiscal year 2024 in the range of 20-22%.

In simple words, the SBP expects the future inflation rate to be below the 22% interest rate it has decided to maintain. What exactly does this mean? Let’s say the interest rate offered by a bank on your deposited savings is 20%. If you kept Rs 1 lakh in that account, at the end of the year, you would have Rs 1.2 lakh. However, the annual inflation that year was 21%. This means that while the amount of money in your account increased, in real terms, you could buy less with that money because the cost would be Rs 1.21 lakh. This means the real interest rate was negative. If the real interest rate was positive — let’s say 23% — then you would have had Rs 1.23 lakh at the end of the year.

Positive real interest rates encourage people to save and keep their money in banks as it protects them from inflation. So, raising the benchmark interest rate to a point where the real interest rate is positive means less money is going towards purchases, which decreases demand — one of the primary tools a central bank uses to curb inflation.

Inflation to decline

Following the IMF agreement, the Fund asked the SBP to maintain an appropriately tight monetary policy that counters inflation. While inflation clocked in at 31.4% in September, the SBP’s Monetary Policy Statement said it was expected to decline in October and then maintain a downward trajectory, especially in the second half of the fiscal year. It cited downward adjustments in fuel prices, easing prices of some major food commodities, and a favourable base effect for this projection.

However, the headline inflation in November stood at 29.2% according to data from the Pakistan Bureau of Statistics (PBS) which is a slight increase from October of 26.9%.

The MPC noted that the higher-than-expected increase in gas prices contributed 3.2 percentage points to the 29.2%year-on-year inflation in November 2023.

Moreover, core inflation, which removes volatile factors such as food and energy prices when measuring inflation, remained sticky at 21.5% during the month, slightly lower from its peak of 22.7% in May 2023. Inflation expectations of both consumers and businesses, though improving in recent months, remain at an elevated level and is coming down gradually.

The MPC continues to expect that headline inflation will decline significantly in the second half of the fiscal year 2024 due to contained aggregate demand, easing supply constraints, moderation in international commodity prices and favourable base effect.

The SBP’s stance regarding inflation is in line with analyst expectations. In a report released earlier this month, Topline Securities said inflation was expected to decrease because of an average decline of 11% in domestic fuel prices, stable international oil prices and the rupee’s strengthening against the dollar by 8.49% since September 5.

Both Arif Habib Limited and Topline Securities expect average annual inflation in fiscal year 2024 to remain between 23-24%, compared to 29.2% in fiscal year 2023.

Strengthening economy

Looking at the economy, the MPC expects a moderate recovery in real GDP for fiscal year 2024. The agriculture and manufacturing sectors showed improvement, while the services sector remained sluggish. There was a positive shift in the current account balance, with reduced deficit and increased exports, especially of food items like rice. The current account deficit narrowed by 65.9% year on year to $1.1 billion during the first quarter of fiscal year 2024.

Further, workers’ remittances also improved in October and November 2023 as compared to the corresponding months last year. Despite these positive indicators, there have been modest official inflows since July, and ongoing debt repayments have affected the SBP’s foreign exchange reserves. The successful completion of the IMF program’s first review is expected to bolster financial inflows and FX reserves. The IMF will release a tranche of $700 million in January 2023. The SBP governor Jameel Ahmed stated that they will ensure that the Net Domestic Assets (NDA) and Net Foreign Assets (NFA) targets for December 2023 are met.

The IMF expects Pakistan’s foreign exchange reserves to reach $9 billion by June 2024. However, the IMF’s detailed country report will be released after the board meeting in January 2024, where revised numbers may be provided.

Fiscal indicators show positive growth in tax and non-tax revenues, emphasising the need to sustain fiscal consolidation for macroeconomic stability by broadening the tax base and restraining unnecessary expenditures.

SBP released a profit of Rs 972 billion to the government for fiscal year 2023 compared to Rs 371 billion in fiscal year 2022. Ahmed highlighted that fiscal year 2024 will be higher than fiscal year 2023 which will support fiscal operations.

The governor stated that the total external financing requirement for fiscal year 2024 is $24.6 billion out of which $5.4 billion has already been paid. According to him, SBP estimates rollovers worth $12.4 billion of which $9 billion have already been committed. The net principal payable in fiscal year 2024 stands at $4.3 billion.

Finally, the governor highlighted that the decision to reduce the policy rate will be data-driven, based on factors such as inflation and the rupee’s movement.