After more than a year of looking for buyers, Telenor Pakistan has finally been sold to Pakistan Telecommunication Company Limited (PTCL). The acquisition marks a 100% transfer of Telenor Pakistan Pvt Limited’s equity to PTCL for an enterprise value of PKR 108 Billion on a cash free, debt free basis.

The sale is part of Telenor’s strategy to exit the Asian markets where the operator has been lagging. It concludes the strategic review of the telco operations in Pakistan, which was announced in July 2022.

The e& group (formerly Etisalat)-backed, Pakistan’s partially-state-owned PTCL group acquired Telenor Pakistan through a share purchase agreement which was signed between Telenor B.V. and PTCL group. The completion of the acquisition is subject to regulatory approvals and customary closing conditions.

As per Sigve Brekke, CEO, Telenor Group, “Our decision to pursue the sale of our Pakistan operations follows 18 successful years of operations in the country, which started as a greenfield rollout. We are proud of the company Telenor Pakistan is today. It is an efficient and future-ready telco operator, with a strong distribution network and talented team serving 45 million customers. By selling to the country’s largest integrated ICT company, we believe this consolidation move would help strengthen Pakistan’s telecoms sector, creating opportunities in new areas of growth to the benefit of consumers in Pakistan.”

The milestone will surely add to PTCL’s growth and market expansion, solidifying its position as a key player but what goes in the background?

Why did telenor leave Pakistan? How and why did PTCL buy it and what does it all mean for the market and the consumers?

Telenor’s Exit?

Telecom companies in Pakistan have one of the worst average revenue per user (ARPU) in the world, at $0.8/month and for the Norwegian company, ARPU was a big concern, considering that other subsidiaries of the Telenor group in countries like Malaysia, Thailand and Bangladesh were doing much better.

Telenor entered the Pakistani market in 2005 and over the years managed to amass a subscriber base of approximately 45 million customers. However, operating in a highly saturated market presents its own challenges. One such challenge is the steady decrease in ARPU, which is a concern for the entire industry.

For Telenor, ARPU was also affected by its strategy of targeting the low-income rural population in order to quickly build a significant consumer base. However, a similar strategy in India did not yield the desired results. Telenor initially experienced significant growth in the Indian market but faced a legal obstacle that drastically reduced its operations in the country. As a result, the company restructured its operations to focus on low-value customers who primarily demanded voice and SMS services. With the rise of 3G/4G services and OTT apps like WhatsApp, Telenor began losing its stronghold in voice and SMS services and eventually exited the Indian market in 2017.

The events leading to Telenor’s decision to exit the Pakistani market closely resemble what happened in India. While the telco’s targeted market consisted of low-income customers, it opted to acquire the 850 MHz spectrum at a substantial cost of $395 million when it came to purchasing spectrum for its 3G/4G services. Unfortunately, this investment did not yield the expected returns, as the frequency was supported by relatively expensive smartphones that were beyond the affordability of Telenor’s primary user base.

However, there are additional factors to consider. Telenor and other telecommunications companies in the market also faced challenges related to spectrum and licence fee rationalisation. For example, Telenor encountered difficulties with licence renewal fees, which it initially contested in the supreme court but received an unfavourable ruling. Alongside this, the worsening macroeconomic conditions played a role, leading Telenor ASA to write off $250 million of its Pakistani operations in the second quarter of the 2022 financial year. These challenges, coupled with an increased cost of capital resulting from interest rate hikes and a deteriorating political climate, made it increasingly impractical for Telenor to sustain its operations in Pakistan.

All of this culminated in Telenor announcing its intention to exit the market in November of last year. However, it took a year for Telenor to find a worthy buyer, a buyer with enough foothold in the domestic market to take on additional consumers, and backed by a group large enough to have the risk appetite.

Enters PTCL

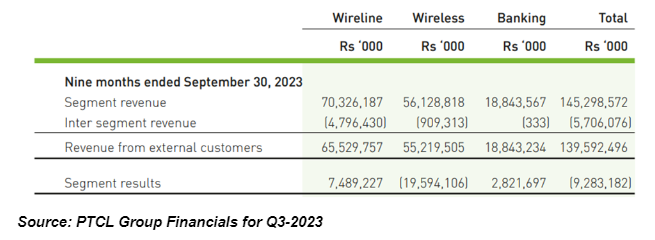

PTCL has had a rough ride in terms of turning around its cellular mobile wing, Ufone (Wireless). While PTCL’s other group companies have been doing well, Ufone lags behind. As per the 2023 quarterly financial results for the group, the bottom line of the group remained negative dragged down by high operational and finance costs of Ufone.

Ufone’s abysmal performance over the past many years can be partially attributed to the strategic blunder of delayed entry into Pakistan’s 4G market. While other telecom operators like Zong, Jazz, and Telenor were quick to adopt 4G technology, Ufone remained the only company without 4G services for a significant period of time. This placed Ufone at a major disadvantage and resulted in a steep loss of market share.

By the time Ufone finally launched its 4G services in August of 2019, other operators had already captured a large portion of the market, including Ufone’s high-paying customers. This late entry into the 4G arena proved to be too little, too late for Ufone users who were already enjoying the benefits of faster internet speeds and better connectivity.

Furthermore, Ufone’s persistent reliance on 3G technology even after the widespread adoption of 4G by other operators negatively impacted its subscriber base. While the rest of the industry made a rapid shift towards 4G, Ufone still had a larger number of 3G subscribers compared to 4G subscribers. This inability to keep up with industry trends further contributed to Ufone’s decline.

As if this was not enough of a drag on the profitability, Ufone subsequently acquired high amounts of debt to finance capital expenditure including spectrum payments. This led to a surge in finance costs post the rapid interest rate hikes in the past two years.

All of this translated into Ufone being a minnow in the country’s telecom space. Prior to the acquisition, Ufone’s consumer base was at around 25 million subscribers, almost half of Telenor’s.

But the question remains, what does Ufone in particular and PTCL Group in general has to gain from this acquisition?

The Synergies

The acquisition, In terms of business, does wonders for the Group. Post merger, Ufone’s subscriber base is expected to cross 70 million, bringing it on par with Jazz, which currently is the largest player in the telecom sector. The move also leaves at Ufone’s disposal, the vast resources, and infrastructure network, not to mention the human capital and tech stack Telenor has developed over the years.

“The recent strategic acquisition agreement with Telenor is set to propel Ufone toward substantial revenue expansion. Telenor Pakistan is a robust mobile operator and caters to approximately 45mn subscribers with reported revenue of Rs112 billion and an EBITDA margin of 43% based on last 12-month financials. Following the acquisition, Ufone’s subscriber base is expected to reach 70mn, bringing it on par with Jazz, which has been the largest player in Telecom sector. This strategic move also positions Ufone to leverage Telenor’s resources and expertise, fostering synergies that will further enhance its positive trajectory,” remarked Waqas Ghani, Deputy Head of Research at JS Global Capital.

Apart from consumers, Ufone gains a significant competitive advantage from the assets and infrastructure inherited from Telenor. With Ufone’s own telecom tower network combined with Telenor’s, totaling over 20,000 towers, The CMO is on the verge of controlling nearly 50% of the country’s entire tower market.

Further, PTCL holds the position of the largest market player in the fiber infrastructure segment with its extensive 60,000 Km fiber network. This network plays a pivotal role in connecting the country’s telecom infrastructure, with PTCL serving all major CMOs.

Coupled with the post merger tower network, the group is set to dominate the infrastructure segment.

While explaining the operational benefits Aslam Hayat, the former Chief Strategy Officer at Telenor told Profit that, “The merger between Telenor and Ufone/PTCL is expected to bring numerous synergies for the merged company. Firstly, the spectrum of Telenor and Ufone in both 900 MHz and 1800 MHz are adjacent, which will provide a significant advantage to the merged company and better quality of service to their customers. The merged company will possess the largest telecom tower infrastructure in the country. After removing duplicates, the merged company can reuse the dismantled towers to further improve its coverage. Historically Telenor has better coverage in the rural areas of Pakistan, while Ufone has a stronger presence in urban centres. As a result, the merged company can benefit from improved coverage in both regions.”

Spectrum is like an invisible highway that allows wireless devices to communicate with each other. It’s divided into different sections, just like lanes on a road. Each section is designated for different types of devices, such as cell phones, Wi-Fi, or television broadcasts. When we use our devices, they send and receive information through specific sections of the spectrum. It’s important for devices to use their assigned sections so they don’t interfere with each other’s signals. So, spectrum is like a carefully divided space that enables our devices to talk to each other wirelessly, ensuring smooth communication and avoiding any traffic jams.

As per the former CEO of USF and ICT Policy & Regulation expert, Pervaiz Ifitikhar, “One of the key synergies resulting from the merger would be the utilisation of adjacent spectrums held by Ufone and Telenor. These spectrums offer numerous benefits to the company, such as increased bandwidth, improved network capacity, enhanced service coverage, and better interference management. Similarly, availability of infrastructure in rural as well as urban areas has its advantages. These advantages will enable the telco to deliver higher data speeds, accommodate more users, expand their coverage area, and minimise interference.”

The acquisition’s financials also add up. As expounded by Mohammad Sohail from Topline Securities Research, “Assuming PTC raises debt of US$380mn at 18% (8% interest expense + 10% currency devaluation), the annual interest cost would be Rs19bn, compared to Telenor’s EBITDA of Rs112bn in the last 12 months. This along with the combined infrastructure of PTC, Ufone, and Telenor will unlock synergies, we believe.”

Editor’s Note: Topline Securities Research erroneously mentioned Rs 112bn as the EBITDA number. In fact, as earlier mentioned in the article, Rs 112bn is the revenue, while EBITDA is 43% of the revenue.

He quotes the example of the Mobilink-Warid merger, reminding that in a press release from then, predicted Mobilink and Warid’s merger to create capital and operating expenditure synergies of about US$500mn. The combined revenue of both companies for the year leading to Sept 2015 was US$1.4bn. The PTCL CFO, when asked about the valuation of these synergies, did not quote a figure, and stated that it would only be revealed after the regulatory approvals but would definitely be more than Rs 108 billion (the acquisition cost).

It is clear that Ufone not only wanted, but also needed telenor’s business, but it had a very fundamental problem. When telenor went up for sale, Ufone did not have the money to buy it. That was until October, the group was reported to have asked for a loan of $400 million from the International Finance Corporation, IFC. A bidding offer was made to telenor which was subsequently accepted.

However when asked about the source of the financing, Group Chief Financial Officer PTCL, Nadeem Khan, did not disclose IFC’s name and stated that the financing channel was reliable enough for the Telenor Group to sign the SPA.

Industry’s Response

Kamal Ahmed, the newly appointed Secretary General of the Telecom Operators’ Association of Pakistan termed the announcement of PTCL’s acquisition of Telenor Pakistan an important development in Pakistan’s telecom sector. He emphasised that the resulting structural change will be beneficial for both the telecom sector and its customers.

Talking to media at a Press conference, PTCL Group CEO, Hatem Bamatraf said that, “With 4 players the telecom market was not sustainable. If we compare Pakistan to neighbouring countries, we are far behind and one reason for that is the structure of the market because players are not in a healthy position. It will benefit the entire market to have stronger players.”

He said that we are trying to attain the best of both worlds, increasing revenues and improving services.

A win for the consumers?

When one predicts that the industry margins will improve and ARPU will go up, this automatically means an increase in prices. With less competition and only 3 players now left in the market, one of the key takeaways for customers is an expected increase in prices, however, an increase does not necessarily mean a bad thing. With more profitability, more money gets invested in capital pertaining to technological advancement. In such circumstances consumers reap the benefits in the longer run.

While talking to the press, the PTCL group leadership also revealed that the brand strategy for Telenor is yet to be decided upon by PTCL. Meaning that the company is yet to decide upon what brand name would be associated with the existing Telenor consumers’ sims.

Pervaiz Iftikhar, Ex-Chairman USF also stated that “While the merger is good news for the industry as a whole, there is a lingering issue with the prevailing low average revenue per user (ARPU) that, if not addressed, can have detrimental effects on the remaining players. Additionally, Telenor’s departure signifies the departure of another reputable investor from the country, which has a negative impact on the overall perception of the Pakistani market.”

Telecom sector experts suggest that policies like spectrum pricing in dollars, excessive taxation, high right of way charges are a major factor in driving out foreign investors. With Warid and Telenor gone, the government might need to look at a revision in its policy around governing telcos.

It is also important to note that 62% of PTCL is owned by the government of Pakistan. Which means that any loan that it acquires means additional exposure on the national exchequer.

What about Telenor Microfinance Bank and Easypaisa?

Contrary to some claims, it is also important to address that despite being closely integrated with Telenor Pakistan, the leadership and ownership of Telenor Microfinance Bank and, by extension, of Easypaisa remains the same. The bank as of now is jointly owned by Ant group (Alibaba) and Telenor’s Norwegian parent company. It was made clear by the PTCL leadership that the Share Purchase Agreement referred to the operations of Telenor, the telco alone.

With the previous ownership structure, Telenor Microfinance Bank enjoyed cross-marketing and other preferential pricing like the SMS costs for transaction prompts on USSD supported easypaisa accounts. These are likely to be discontinued/ However, the Telenor Group will still retain its ownership of the digital bank unless announced otherwise.

after aquisitiom will telenor be part of Ufone/PTCL or will continue to work as Independent brand

very bad news I have to say welcome from Darkness to another Darkness.

PTCL is is one of the most useless company in the world so will make Telenor Worst.

thats great

welcome to PTC say bless

best deal in telcom sector in pak

best deal in pak telecom sector

Having so much business and clients in this market and part of world, why Telenor is leaving!

The Indian comparison of Telenor ops is incorrect it got mired in telecom spectrum scam and then had to unwind its Uninor JV it exited India as post re-bid it only got licenses for limited circles resulting in lack of nationwide coverage

Highly appreciable strategic decision which will further bring breathtaking revolution in telecom sector of Pakistan.

This acquisition will generate lot of new revenue streams for the PTCL Group and state of art services for the people of Pakistan.

PTCL is really a worst i don’t think they will grow telenor as much as per the expectations of the people let’s see

TELENOR WAS THE WORST I AM GLAD THEY ARE GONE. UFONE HAS NEVER FAILED ME EVEN IN RURAL AREAS.

Hi slight correction to the following:

“The acquisition’s financials also add up. As expounded by Mohammad Sohail from Topline Securities Research, “Assuming PTC raises debt of US$380mn at 18% (8% interest expense + 10% currency devaluation), the annual interest cost would be Rs19bn, compared to Telenor’s EBITDA of Rs112bn in the last 12 months. This along with the combined infrastructure of PTC, Ufone, and Telenor will unlock synergies, we believe.”

The article previously stated that revenue is 112 BN not EBITDA, which was put at 43% of revenue, which should come to around 48 BN. So the statement above “EBITDA of 112 BN” should be corrected.

While talking to the press, the PTCL group leadership also revealed that the brand strategy for Telenor is yet to be decided upon by PTCL. Meaning that the company is yet to decide upon what brand name would be associated with the existing Telenor consumers’ sims

Kya Telenor ka name change ho ga

felt so bad hear that because i used to work in telenor Pakistan.

as we know that telenor is facing downfall after their equipment changed in 2012, so we hope for betterment of telenor network.

Our village telenor tower is not working how can i contact them.

really sad to hear that. countries ecoonomic conditions are already on downwards trend. how come these companies going to survive.

Amazing Information .

We’re delighted that you found our discussion thread amazing.

good for customers of both companies