The Pakistan Stock Exchange (PSX) showed the worst weekly performance since the Covid-19 crash, shedding 4,425 points or 6.69% week-on-week. Meanwhile, the Pakistani Rupee (PKR) maintained its appreciation momentum by gaining 0.26% WoW against the US dollar, closing at PKR 282.53 at the weekend.

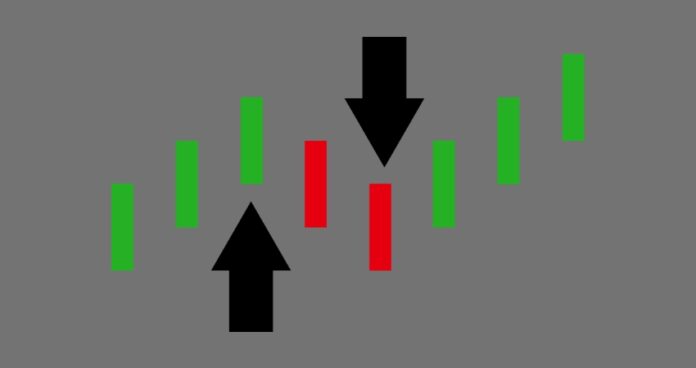

According to a report by brokerage firm AKD Research, after surpassing each high for the last two months, the benchmark KSE100 index experienced a downward trend, losing 6.69% WoW to close at 61,705 points on Friday. Overall, selling in scrips was witnessed as the year closed.

The stock market, which had been soaring to new heights of over 67,000 points since September 2020, entered a ‘correction phase’ this week, dropping more than 8% from its highest level.

Sector and company performance

As per the brokerage report, market participation witnessed a slight decline, with daily traded volumes averaging 1.22 billion shares (down 3% WoW).

On the sectorial front, textile weaving and automobile parts & accessories were amongst the best performers with a growth of 2% and 0.6% WoW, respectively.

Whereas, close ended mutual funds, modarabas, and investment banks were the top laggards with a decline of 14.7%, 11.9%, and 11.5% WoW, respectively. Flow wise, major net selling was recorded by Mutual funds with a net sell of US$14.26 million. On the other hand, Insurance companies absorbed most of the selling with a net buy of US$9.31 million, the report added.

Company-wise, top performers during the week were, i) Pak Suzuki Motor Company (PSMC) (up 10% WoW), ii) Honda Atlas Cars (Pakistan) Limited (HCAR) (up 4.3% WoW), iii) Pakistan State Oil Company Limited (PSEL) (up 2.6% WoW), while top laggards were, i) Pakistan International Bulk Terminal Limited (PIBTL) (down 19% WoW), ii) Arif Habib Limited (ANL) (down 18.4% WoW), iii) Pak Elektron Limited (PAEL) (down 17.7% WoW), iv) Dawood Hercules Corporation Limited (DAWH) (down 17.7% WoW), and v) Pakistan Stock Exchange Limited (PSX) (down 15% WoW).

The market turnover remained heightened during the week, with an average traded volume of 687.36 million shares. However, the traded value fell significantly to Rs15.96 billion as compared to Rs22.48 billion in the previous week, marking an increase of 9.1% month-on-month (MoM) in the number of shares while a decrease of 29% MoM in traded value.

Moreover, the overall PSX All-Share was recorded at 1.21 billion shares worth Rs 22 billion, marking a decrease of 3% MoM in the number of shares while a decrease of 27.46% MoM in traded value.

Currency outlook

On the currency front, the Pakistani Rupee (PKR) maintained its appreciation momentum by gaining 0.26% WoW against the US dollar, closing at PkR282.53 at week-end.

The PKR appreciated by around 73 paisa against the US dollar this week and settled at PKR 282.53 per USD, compared to the previous session’s closing of PKR 283.26 per USD.

The local unit saw an intraday high (bid) of 282.75 and a low (ask) of 282.65.

In the open market, the PKR gained 25 paisa as Exchange Companies quoted the dollar at 281 for buying and 284 for selling, compared to the previous session’s closing of 281.25 for buying and 284.25 for selling.

This marks the sixth consecutive weekly gain witnessed by the local unit against the greenback, whereas, on a daily basis this is the ninth consecutive victory.

Other positive developments

Despite the bearish sentiment, some positive developments also took place during the week. The Election Commission of Pakistan (ECP) issued the elections schedule for 8th February 2024, which is expected to bring political stability and clarity to the investors.

Pakistan also recorded a current account surplus of $9 million in November 2023, after having seen four consecutive deficits in the previous months.

The Ministry of Energy authorized the plan to settle Rs. 262 billion payables to WAPDA and GPPs in accordance with IMF’s direction, which is expected to curb the rising power circular debt.

Foreign Direct Investment (FDI) for the first five months of this fiscal year showed a total of $656 million, reflecting an increase of 8% year-on-year (YoY).

However, power generation cost surged by 20% YoY in November 2023 (to Rs. 7.17/kWh), which may pose a challenge for the government’s efforts to reduce the energy tariff.