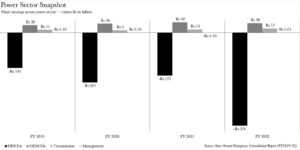

The Federal Footprint, State-Owned Enterprises (SOE) consolidated report for fiscal year 2020-2022, unveiled on Sunday, depicts a bleak scenario. It exposes the shocking truth that Pakistan’s 31 SOEs across eight sectors have collectively suffered a staggering loss of Rs 730 billion in the fiscal year 2022 alone. The power sector, with losses amounting to Rs 321 billion, stands as the most significant contributor to this financial haemorrhage. The remarkable aspect is that the losses solely originate from one sub-sector — the DISCOs.

The Government of Pakistan’s footprint across the power sector comprises distribution companies (DISCOs), generation companies (GENCOs), management companies, and one transmission company. Of these four sub-sectors, only one has incurred losses. Dissecting the Rs 321 billion in losses reveals that all the aforementioned sub-sectors except the DISCOs jointly generated profits to the tune of Rs 55 billion. The DISCOs, in contrast, dragged down the entire sector with their Rs 376 billion in losses.

It’s crucial to note that the DISCOs under scrutiny are those within the Central Power Purchasing Agency-Guarantee (CPPA-G) system. The report excludes K-Electric and predates the establishment of the Hazara Electric Supply Company. As such, it is limited to the ten based in Faisalabad, Hyderabad, Quetta, Lahore, Islamabad, Sukkur, Multan, and the two nestled in Peshawar.

We have previously delved into the nature of the DISCOs, their genesis, and the reasons behind their debacle. However, to put it succinctly, these are the companies whose names adorn your electricity bill at the commencement of each month. They are also the ones we reach out to when we find ourselves bereft of electricity for interminable hours, when there’s a hiccup in the wiring, or when our local transformer is out of commission.

Read more: A brief history: The rot in our DISCOs

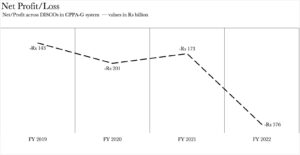

The DISCOs are all loss-making entities. Not a single DISCO turned a profit in fiscal year 2022. Is this surprising? Not particularly. The DISCOs have generally been loss-making in the three years preceding fiscal year 2022 as well. The Tribal Electric Supply Company stands out as an exception, having achieved profitability from fiscal years 2019 to 2021. Other anomalies include the Faisalabad and Multan Electric Supply Companies, which achieved profitability in fiscal years 2020 and 2021, and the Gujranwala Electric Supply Company, which registered profits in fiscal years 2019 and 2021.

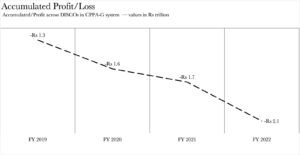

From fiscal year 2019 to 2022, the DISCOs have recorded a cumulative loss of Rs 893 billion, with the accumulated loss for the aforementioned DISCOs standing at a staggering Rs 2.1 trillion at the end of fiscal year 2022.

Why are the DISCOs the way they are?

What lies at the heart of the woeful performance of these DISCOs? The answer, in its most distilled form, is their sheer dysfunctionality. However, let us delve into the more elaborate answer.

“Pakistan embarked on involving the private sector in various segments of the electricity supply chain under the auspices and assistance of USAID and World Bank in the 1980s. Although a similar model has been successful in many countries, our experience with it has been abysmal. Based on my evaluation, it is chiefly because the programme was never executed with resolve, resulting in several crucial deadlines being missed and vital institutions envisaged therein not established in time. In certain cases, we are 40 years too late,” explains Syed Hasnain Haider, a former Chairman of the Faisalabad Electric Supply Company.

“Continued ownership of the various companies by the government has not been advantageous to the sector; in fact, it has proven detrimental. This is evident from the monumental losses, capacity surplus, bottlenecks in transmission lines and distribution systems, scarcity of adequate managerial skills, lack of customer-centric focus, and a poor health and safety record, amongst other issues,” Haider continues.

The National Electric Power Regulatory Authority’s (NEPRA) State of Industry Report for 2022 lends credence to Haider’s assertions and lays bare the grim state of affairs for the DISCOs. In the fiscal year 2022, the average distribution losses for DISCOs stood at 17%, exceeding the permissible limit of 13%. This resulted in a financial repercussion of Rs 113 billion. Furthermore, NEPRA, in its determinations, presumes 100% recoveries by DISCOs against the billed amount to consumers. In reality, the recoveries by DISCOs fall short. In the fiscal year 2022, DISCOs managed to recover a mere 91% against the billed amount, thus incurring a loss of Rs 230 billion.

Highly Recommended!

Very insightful, i will also say this here. Investment is one of the best ways to achieve financial freedom. For a beginner there are so many challenges you face. It’s hard to know how to get started. Trading on the Cryptocurrency market has really been a life changer for me. I almost gave up on crypto at some point not until saw a recommendation on Elon musk successfully success story and I got a proficient trader/broker Mr Bernie Doran , he gave me all the information required to succeed in trading. I made more profit than I could ever imagine. I’m not here to converse much but to share my testimony; I have made total returns of $10,500.00 from an investment of just $1000.00 within 1 week. Thanks to Mr Bernie I’m really grateful,I have been able to make a great returns trading with his signals and strategies .I urge anyone interested in INVESTMENT to take bold step in investing in the Cryptocurrency Market, you can reach him on WhatsApp : +1(424) 285-0682 or his Gmail : BERNIEDORANSIGNALS@ GMAIL. COM bitcoin is taking over the world, tell him I referred you

From my experience, I guess the best way to avoid online scam is by having a very thorough investigation about the subject matter. If i had this advice i would probably have not gone through the ordeal i went through some months past. Binary Options is a blessing to some and curse to many, it almost ruined me. Gracefully, i got in contact with a certified recovery specialist ( Mr WALLINCE ) who helped me with refunds. I can’t say for any other recovery expert but this ( MR WALLINCE ) came to my rescue and I RECOMMEND ONLY his service.

Contact hes support team for further assistance:

COINSRECOVERYWORLDWIDE at G M A I L dot C O M