Duopolies around the world are not a common sight; however, there are some notable examples that have managed to hold onto their position and consolidate market share over time. The most prominent ones include the Apple – Google duopoly in the smartphone operating systems market, and another is the Visa – Mastercard duo in the credit card industry.

While global duopolies have kept their competitors on their toes, there exists a domestic duopoly that once perfectly exemplified two players engaged in a fierce battle. However, the dynamics have shifted, with one player now surging ahead while the other lags behind. This is the case with Pakistan’s hydrogen peroxide (HPO) industry, where one company has attained great heights while the other has struggled to stay afloat.

Welcome to the bleach wars: the opponents are Sitara Peroxide and Descon Oxychem. Both companies were founded not too long ago, in 2008 and 2009 respectively; and at least until 2016, both companies were neck-in-neck in competition. But then, their paths diverged. What happened?

What is hydrogen peroxide?

Before we wade into the details, let’s understand what HPO is. HPO is a colourless, sticky liquid with strong oxidising properties. It can bleach, oxidize, and sterilize anything from textiles to paper to food which makes it an important chemical in the industrial sector. It is used in a variety of industries including textile, paper, food packaging and healthcare sectors.

The major consumer of HPO is the textile industry, accounting for more than 70% of the total domestic demand, followed by the mining, paper and board, and food industries. It is also eco-friendly, as it breaks down into water and oxygen.

The cost of producing HPO depends largely on the raw materials and power. The raw materials are hydrogen and oxygen, which can be obtained from different sources and chemicals. According to a report by PACRA, raw materials account for around 30% of the cost of production, power on average accounts for approximately 18% of the cost, and other expenses account for the remaining 34% of the cost.

The industry’s reliance on gas and electricity as the basic raw materials for the production process generates substantial risk since prices remain volatile and the supply of gas is not always assured. Worse, the government has hiked gas prices. Rao Aamir Ali, vice president of research at securities brokerage Arif Habib Limited told Profit that the government has recently hiked gas prices from Rs 1,100 per mmbtu to Rs 2,400 per mmbtu.

Hydrogen peroxide industry

Sitara Peroxide marked the genesis of Pakistan’s HPO industry in 2008, establishing the first large-scale plant. Before Sitara’s commercial operations, HPO was usually imported and the domestic industries had to incur transportation, storage and handling costs as well as contamination risk.

The local general public is the largest shareholding category of Sitara Peroxide Limited with a stake of 49.3% in the company. This is followed by Directors, CEO, their spouse and minor children holding 37.3% shares of Sitara Peroxide Limited. Sitara Chemical Industries Limited, the parent company of Sitara Peroxide, holds about 6% share in Sitara Peroxide.

Sitara was soon followed by Descon Oxychem, which began its production in 2009, with a capacity of around 28,000 metric tons per year. Descon Oxychem is a part of the Descon Group. Abdul Razak Dawood, advisor to the former Prime Minister for Commerce, Textile, Industry & Production, is the founder and former Chairman of Descon Group. The principal sponsor of Descon Oxychem holds a majority shareholding of around 72.6% through associated companies while the remaining 27.4% stake rests with the general public and financial institutions.

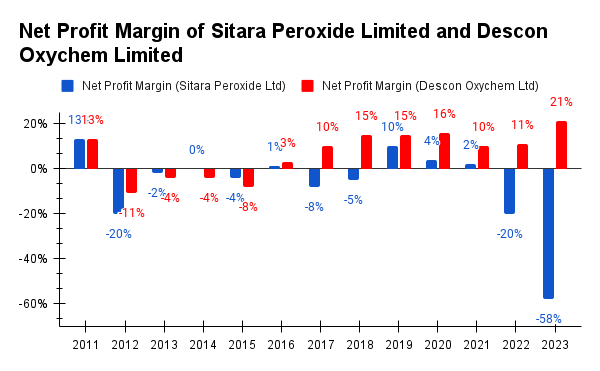

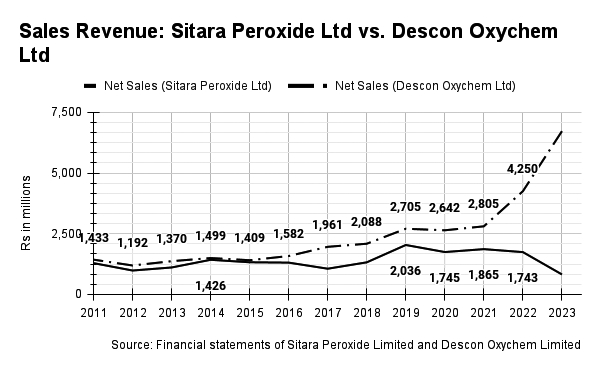

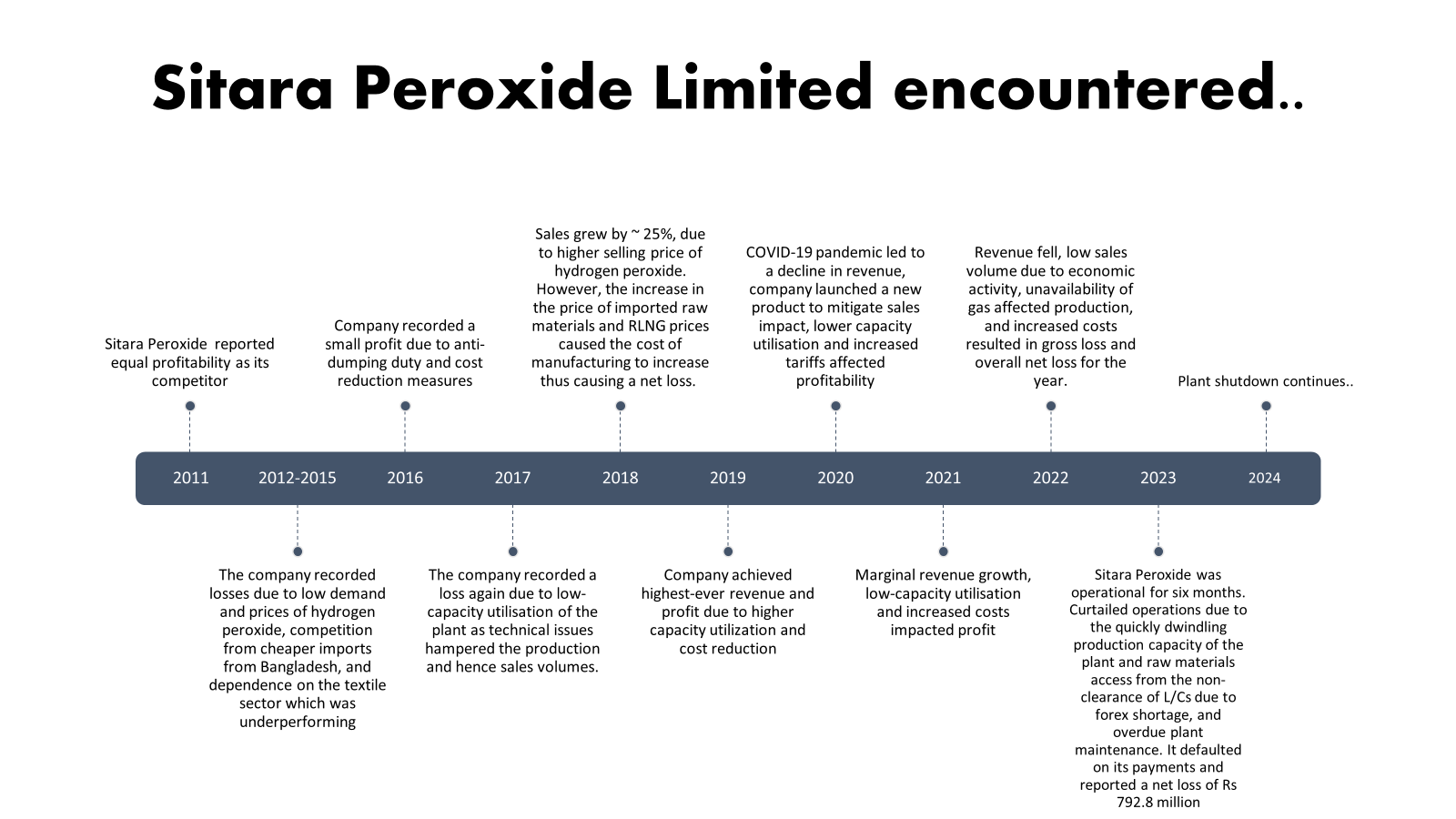

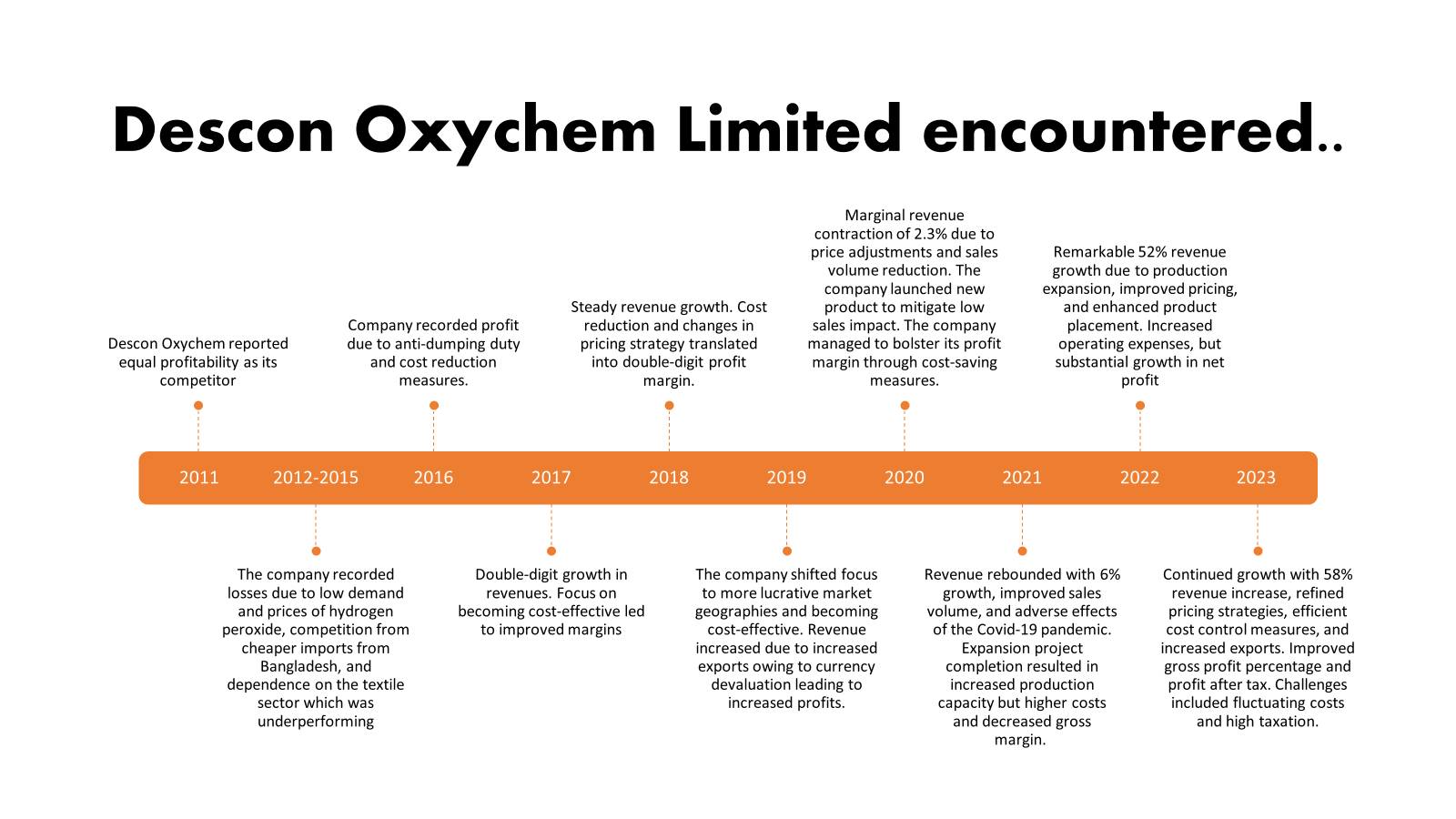

In the financial year 2011, both Descon and Sitara enjoyed a spell of profitability, but soon plunged into losses in the next few years. The main reasons for the poor performance were the low demand and prices of HPO. Cheaper imports from Bangladesh, which had emerged as a new hub for hydrogen peroxide manufacturing, gave stiff competition. Moreover, revenue and margins for this sector are dependent on the performance of the textile sector as it is a major consumer of hydrogen peroxide. The underperformance of the textile sector, along with high power tariffs and prices of imported raw materials affected profitability.

The situation improved slightly in 2016 when the National Tariff Commission (NTC) imposed an anti-dumping duty on imported hydrogen peroxide for five years to protect local players from competition from cheaper imports.

Up until financial year 2016, both Descon and Sitara were engaged in a stiff neck-to-neck competition battling for market share as demonstrated by their profit margins and sales revenue. The gap between their revenues and profits started widening from financial year 2017 onwards.

The years 2017 to 2019

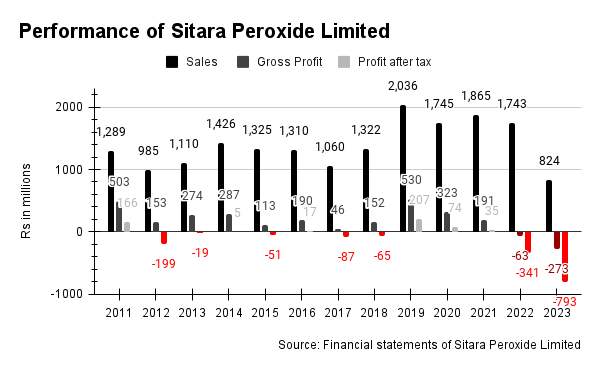

Sitara Peroxide slipped into losses again in 2017 and 2018 due to low capacity utilisation of the plant as technical issues hampered the production and hence sales volumes. In the first half of financial year 2017, capacity utilisation dropped to 60%, picking up later in the second half after corrective measures had been taken. Hence, the volumes sold were also comparatively low. Since costs remained more or less unchanged, margins declined resulting in a net loss of Rs 87 million.

During the financial year 2018, sales grew by nearly 25%, owing to the higher selling price of HPO, specifically in the second half of the year. However, the increase in the price of imported raw materials and RLNG prices caused the cost of manufacturing to increase. Other income from the sale of catalysts brought some relief, however, it was not sufficient to cover the increase in costs overall, thus causing a net loss.

The year 2019 was a turning point for Sitara Peroxide, as it achieved its highest-ever revenue and profit. The company benefited from the higher selling price and production of hydrogen peroxide, which resulted from higher capacity utilisation. The company also managed to lower its cost of manufacturing, as a percentage of revenue, significantly. The company finally emerged from a period of loss, despite the economic instability caused by the change of government in 2018.

Unlike Sitara Peroxide, whose revenues and profits kept fluctuating, Descon Oxychem experienced a steady growth in revenues and profitability. Revenues grew by 24%, 6.5%, and 30% in financial year 2017, 2018 and 2019 respectively.

This surge can be attributed to several strategic factors. Firstly, Descon Oxychem focussed on becoming cost-effective. In the financial year 2016, production costs accounted for over 78% of the revenues. This came down to 74%, 70%, and 69% in financial years 2017, 2018 and 2019 respectively. In financial year 2017, Descon converted sponsor loans into preference shares capital which eradicated finance costs that accounted for almost 5% of revenue. However, in the financial year 2019, finance costs again increased due to “intercompany borrowing for the redemption of preference shares”.

Moreover, in the financial year 2018, Descon Oxychem made changes to its pricing strategy which enhanced gross margin.

Secondly, the company successfully shifted its focus to more lucrative market geographies. In the financial year 2019, Descon Oxychem’s revenue increased due to currency devaluation which made exports more favourable in the global arena.

Consequently, profit margins improved substantially from 2.8% in the financial year 2016 to around 10%, 15%, and 15% in the financial years 2017, 2018, and 2019 respectively.

COVID strikes

The financial year 2020 was another challenging year as the COVID-19 pandemic disrupted the textile industry and the overall economy. Both Sitara Peroxide’s and Descon Oxychem’s revenues contracted by 14% and 2.3% respectively as demand and production declined.

To cope with the situation, both companies introduced disinfectants and sanitisers which helped mitigate the impact of low sales.

Sitara Proxide’s plant operated at 78% capacity in 2020 and produced 23,295 metric tons of HPO – 6% lower than the previous year which resulted in a lower cost of sales. However, the gross profit margin also decreased to 18.5% due to an increase in tariff on RNLG. The company incurred higher distribution and administrative expenses due to increased payroll, commission, and advertisement costs for its new product. On the other hand, the company reduced its other expenses by 70% year-on-year and increased its other income by 17% year-on-year, mainly from the sale of catalyst in 2020. Yet, these measures were not enough to offset the weaker sales and the company’s net profit dropped by 64% year-on-year to Rs 74.2 million in 2020, with a net profit margin of 4%.

On the other hand, despite implementing selling price cuts, Descon Oxychem managed to bolster its gross margin through cost-saving measures, with production costs accounting for 67% of revenue. Consequently, the gross margin improved to a commendable 32%. These enhancements translated to the bottom line, as overall expenses remained relatively steady year-on-year, resulting in a net profit margin of 15.8%.

Post-COVID performance

In financial year 2021, revenue for Sitara Peroxide and Descon Oxychem grew marginally by 7% and 6% respectively, reaching Rs 1.9 billion and Rs 2.8 billion.

In financial year 2021, plant operations for both companies were disrupted, but for completely different reasons. In the case of Sitara Peroxide, the lack of demand coupled with a shortage of gas led to lower plant utilisation as only 73% of plant capacity was utilised to produce 22,006 metric tons of HPO. Low capacity utilisation rendered the company unable to absorb the fixed overhead cost, pushing up the cost of production per unit.

Moreover, increased tariffs on RNLG as well as the high cost of chemicals and packaging materials impacted gross profit adversely. Other expenses grew due to inflation. Despite a 169% year-on-year increase in other income from the sale of catalyst, unwinding gain on GIDC provision and exchange gain, the net profit shrivelled by 53% year-on-year to clock in at Rs 34.7 million with a margin of 1.9%.

On the other hand, Descon Oxychem undertook and successfully concluded its expansion project, resulting in a substantial 25% augmentation in production capacity. However, this expansion incurred additional costs, including a depreciation expense of Rs 120 million, alongside shutdown expenses and heightened utility prices, causing production costs to surge to 78% of revenue. Consequently, the gross margin contracted to nearly 22% while net profit margin declined to approximately 10% for the year.

Meagre revenue growth attained by Sitara Peroxide in 2021 was reversed in 2022 as its revenue fell by 7% year-on-year on the back of low sales volume due to constricted economic activity despite higher prices of HPO during the year. Owing to the unavailability of gas, Sitara couldn’t even meet the reduced demand and operated at 61% capacity and produced only 18,247 metric tons of HPO in 2022. The cost of sales of the company increased to Rs 1.8 billion due to the huge rise in the tariff of RLNG, resulting in a gross loss of Rs 63 million in the financial year 2022. The company recorded a net loss of Rs 341 million during financial year 2022.

In financial year 2022, Descon Oxychem reaped the rewards of its 2021 capacity expansion, as it achieved astounding 52% year-on-year growth in revenue due to heightened production, improved pricing strategies, and enhanced product placement. The expansion also facilitated economies of scale, elevating the gross profit margin to 26%. The bottom line experienced substantial growth, increasing by 69% to reach Rs. 470.9 million. Notably, the net profit margin, which had decreased to 10% in 2021, slightly improved to 11% in 2022. Production cost decreased from 78% in 2021 to 74% of revenues in 2022.

Sitara’s 2023 report card

The troubles that began in financial year 2022 for Sitara Peroxide continued in financial year 2023 as the company was hardly operational for six months. According to a notification filed on the Pakistan Stock Exchange (PSX), Sitara Peroxide had only been operational from July to September 2022 and March to June 2023. That means the plant was only operational for five to six odd months in the financial year 2023. The company had to curtail operations due to the quickly dwindling production capacity of the plant. This was due to a series of unfortunate circumstances: from the economic downturn that Pakistan experienced this year, to limited access to raw materials from the non-clearance of LCs due to forex shortage, to overdue plant maintenance.

“Sitara has been on a shutdown for the past many months which has given Descon the market”, Waqas Ghani, deputy head of research at JS Global Limited told Profit.

According to the notification, the company has defaulted on the instalments of long-term financing and rental payments of Sukuk. The company’s material uncertainty has proven to be a roadblock in production. Consequently, Sitara Peroxide reported a gross loss of Rs 273.4 million and a net loss of Rs 792.8 million in the financial year 2023.

Read: Sitara Peroxide Ltd struggles to resume production

The situation took a dire turn in financial year 2024 as the company has not been operational for a single month. The company has not resumed production since June 2023, and now Sitara Peroxide’s company profile on the PSX features a bright red sign that reads “DEFAULTER” in all upper-case bold fonts.

Descon’s 2023 report card

In financial year 2023, Descon Oxychem continued to grow, with revenue soaring by 58% year-on-year. This surge was fueled by increased production, refined pricing strategies, and enhanced product placement, resulting in a notable uptick in gross profit margin at 41%. The company continued its prudent cost control measures that led to efficient utilisation of resources which led to an increase of around Rs 1 billion in net profit — net profit surged to Rs 1,401 million from Rs 471 million – despite facing the impact of high taxation. Challenges such as fluctuations in gas and packaging material costs persisted, but the company managed to offset these by leveraging improved pricing strategies and enhanced product placements. Moreover, the capacity expansion generated economies of scale, allowing for increased exports and the exploration of new markets, contributing significantly to the company’s overall growth trajectory.

Future of the hydrogen peroxide industry in Pakistan

The HPO industry in Pakistan is not a static one, however, and there are new developments on the horizon. According to Ghani, “There are two players in the HPO business: Descon Oxychem Limited (Descon) and Sitara Peroxide Limited (Sitara). The only two for now. Engro will also enter this segment in a few months,” he said.

Engro Polymer and Chemicals Limited (EPCL) is a subsidiary of Engro Corporation and one of the largest conglomerates in Pakistan. EPCL plans to set up a new HPO plant with a capacity of around 28,000 metric tons per year.

This will increase the competition and supply in the market. However, according to PACRA estimates, the domestic demand for HPO lies between 80,000-110,000 metric tons per year, all of which is currently not met by local production. As a result, around 10%-15% of the demand is fulfilled by imports, which creates an opportunity for local producers to expand their market share and reduce their dependence on foreign suppliers. Hence, EPCL’s entry might help substitute imports.

Nonetheless, with continually rising local demand and enhanced capacity expansion, Descon Oxychem is expected to remain the leading player in the industry. According to a May 2023 PACRA report, Descon Oxychem has been dominating the market, with a market share of more than 50%.

On the other hand, despite being the pioneer of the industry, Sitara Peroxide is grappling with staying operational. Sitara Peroxide has not been operational for a single day in financial year 2024 so far. The latest notification dated December 11, 2023, notified an extension of 30 days in the suspension of plant operations. Will Sitara Peroxide be able to make its rebound or will it make this almost chronic ‘temporary’ closure a permanent one? Only time will tell.

Great analysis…. Very well written indeed