Pakistan’s biggest eCommerce company Daraz is going through management changes with the CEO Bjarke Mikkelsen leaving the company, and layoffs including in the higher management are on the cards as the company looks to cut costs.

Earlier this morning, Bjarke announced that he has stepped down as the CEO of e-commerce platform Daraz after eight years, with James Dong, the CEO of Lazada Group, another subsidiary of Alibaba, taking over as the acting CEO of Daraz in the interim.

While addressing his employees, Mikkelsen said, “My North Star has always been to build Daraz into a business that is strong enough to survive in our markets for the long term. This is the reason I’m now handing over the keys to the next generation of leaders in the company and my good friend James Dong, who will take over as acting CEO and work on a deeper integration between Daraz and our sister companies.”

The announcement points towards ‘personal reasons’ for the CEO’s decision to resign and highlights that this decision will enable the company to achieve a more concentrated strategy and streamlined business model. “I firmly believe that this structure is optimal for ensuring Daraz’s long-term success. Now, I will dedicate some time to prioritise my family and offer support to my exceptional wife in her new career,” Mikkelsen said.

According to a statement from Bjarke, the incoming interim CEO will work on a deeper integration between Daraz and sister companies Lazada, Trendyol, AliExpress and Alibaba.com.

Sources affiliated with Daraz have said that the outgoing CEO had been acting mostly as a figurehead at Daraz, implementing decisions given by bigshots at Alibaba. A former investment banker, Bjarke had been at the helm of Daraz for eight years. Daraz is a market of five countries – Pakistan, Bangladesh, Myanmar, Nepal and Sri Lanka – having over 450 million population.

At the same time, there are reports that Turkish eCommerce company Trendyol has been in talks to takeover Daraz. There are even reports that Daraz now operates under Trendyol, which is also an Alibaba Group company, 86% owned by the Chinese technology giant. Bjarke leaving the company could be a precursor to Trendyol taking over the management of Daraz. Daraz has not responded to Profit’s request for comment on Trendyol acquisition.

Is there more to this development?

With Bjarke leaving the company, there are also reports of Daraz announcing its annual layoffs spree, with plans to let up to 25% of its global workforce go. Without dispelling that the layoffs wouldn’t happen, representatives from Daraz only said that no layoffs have happened as of now.

Credible sources tell Profit that the company is planning to lay off around 25% of its employees at Daraz globally, which could be 250-400 people in Pakistan. Other sources have quoted as high as 800 people that Daraz could be laying off in Pakistan, including people holding C-level positions in the company. In fact, some of the high-ranking employees, including the chief marketing officer of Daraz Pakistan, the chief customer officer of Daraz Group, and the managing director of Daraz Sri Lanka, have already been asked to leave the company.

The decision to layoff employees comes as the company looks to boost its revenue and cut costs, according to sources.

Daraz has in the past gone on firing sprees. Around the same time last year as well, the now former CEO Mikkelsen had announced that the company would be letting go of 11% of the company’s global workforce, quoting reasons such as the conflict in Europe, substantial disruptions in the supply chain, surging inflation, escalating taxes, and the elimination of crucial government subsidies in target markets, for the tough decision. It was also said that the workforce had been reduced in order to enhance profitability and cut costs, entailing a renewed emphasis on the core business, streamlining the organisation, and adopting a more efficient approach across all departments.

The layoffs this time look different, however, and more like an AliBaba thing than a Daraz specific thing. AliBaba Group’s valuation has been spiralling downwards due to increasing costs and competition and its companies have been cutting costs across the board, also letting senior executives go. Earlier this month, Lazada, whose CEO has now taken charge at Daraz in the interim, also went through a round of layoffs, sizing down the company by 30%. The layoffs at Lazada affected people in all roles including the C-Level executives.

According to Bloomberg, Alibaba, as of March last year, was gearing up for external fundraising through the IPO of the Alibaba International Digital Commerce Group (AIDC) and hence cutting costs. The AIDC includes all eCommerce entities such as Lazada, Daraz and AliExpress, of the Alibaba Group. The AIDC was created in March last year as part of Alibaba’s move of splitting its businesses into six units. AIDC is one of those six units.

For companies like Daraz, the easiest way to boost bottomline numbers is either to cut marketing budgets or cut employee numbers. Since cutting down marketing costs is going to slow down sales, it’s the employees that get the axe.

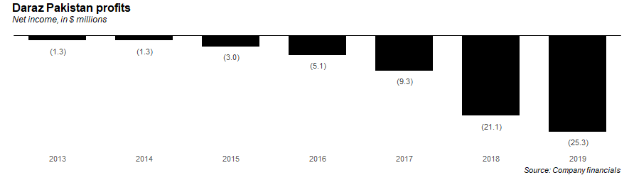

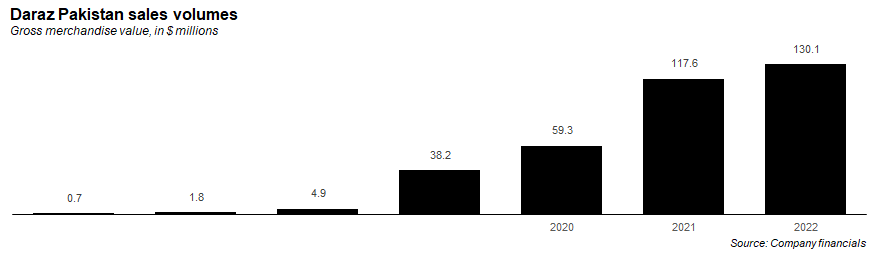

While Daraz Pakistan’s numbers have grown until 2019, its losses have also been mounting. For the financial year 2019, Daraz Pakistan’s GMV (gross merchandise value) was $130.1 million and its net losses $25.3 million, according to financials available with Profit.

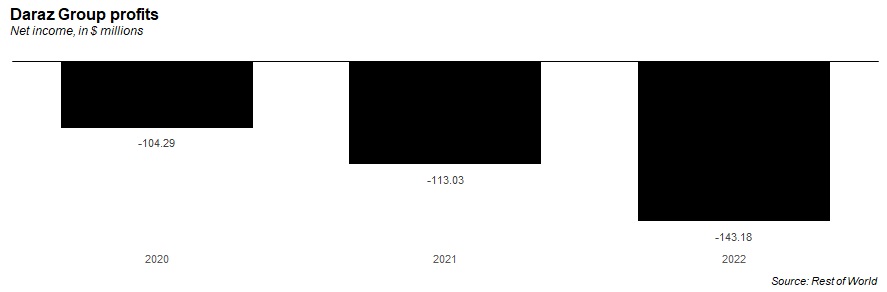

According to Rest of World, group level (all countries including Pakistan) losses at Daraz had amounted to $143 million in 2022. The losses had increased from $113 million in 2021.

In the context of Pakistan, growth for Daraz would have been affected because of the challenging macroeconomic situation. A CEO of a prominent 3PL (third party logistics) startup that does deliveries for eCommerce companies such as Daraz told Profit that there has been a decline in the eCommerce volumes because of the ongoing macroeconomic challenges since last year and the decline is going to continue further because of the election season and the holy month of Ramzan is also around the corner.

Daraz’s growth would have been further affected by the rise of vertical eCommerce companies such as Bagallery that does fashion eCommerce and PriceOye which sells electronics. Vertical eCommerce companies are focused on certain segments instead of everything they can get their hands at. For instance, in fashion in the case of Bagallery which would give competition to Daraz in that segment. Whereas PriceOye would be a competition to Daraz in the electronics segment. Both Bagallery and PriceOye have raised $4.5 million and $7.9 million in their last rounds.

In fact the creation of AIDC by Alibaba was to counter competition in bigger countries like Pingduodo in China and Shopee in Southeast Asia. The change is expected to bring efficiencies for all Alibaba eCommerce companies. One way would be by allowing cheaper prices through group buying for all of the eCommerce companies of Alibaba Group, according to Rest of World.

Who else is going to be affected?

Whatever pushes Daraz down is also going to push eCommerce delivery companies, also known as 3PL (third party logistics companies) down because Daraz, which is arguably the biggest in eCommerce in Pakistan, outsourced a portion of its deliveries to third-party logistics companies such as TCS, Leopards, Rider, Swyft and others.

As of late 2021, Daraz outsourced as much as 50% of its deliveries to 3PL companies, while it did the remaining through its logistics arm DEX Logistics. So if Daraz is planning to cut costs because of the slowdown, 3PL companies would also lose business. We can expect some downsizing at these companies as well.

This story was updated on January 25, 2024, at 02:50 PM

This report on Daraz – gives a gloomy picture not only for Daraz itself but for their valuable staff and for the logistic companies too. This also reflect how internationally the overall economy is behaving? In most of the businesses the high rise in freight plus the levies plus the customs duties all are creating big problems.

Bagallery is not something that will effect Daraz in the short or medium term any user of Daraz who switches to Bagellery will return after just one experience

30

At some point Baglerry and PriceOye will be sold out to Amazon, Walmart or Merged into Alibaba group. Or File for Bankruptcy, these 2 companies are run by VC money. VC model makes profit at exit.

daraz becoming next amazon but with more innovation and services their procedure and working mechanism is up to mark the CEO really did great effort to facilitate people with different options and express delivery services and daraz mart is great add in online market place for house wives