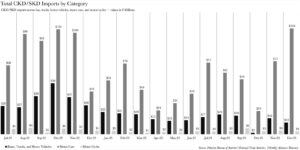

For the first time since November 2022, the import of completely knocked down (CKD) and semi-knocked down (SKD) automotive kits in Pakistan surpassed the $100 million mark, reaching a staggering $119 million. This figure not only eclipses the combined values of November and October, but also surpasses the average monthly import figure of $89 million recorded from July 2022 to December 2023. However, this comes amid the eighteenth month of the automotive industry’s turmoil, with no signs of respite. All of this has fuelled conjecture that the automotive industry might be poised for a comeback.

So, what’s going on?

Let’s begin with the breakdown of the figure itself. The $119 million CKD/SKD imports are divided into three categories: bus, trucks, & heavy vehicles, cars, and motorcycles. Examining the specific breakdown of import categories, the cause for the increase is evident: a surge in CKD/SKD kits for cars.

CKD and SKD kits for cars amounted to $104 million in December. This is the single highest figure from July 2022, when the current economic crisis erupted, till date.

Before proceeding further, let’s elaborate on what the CKDs and SKDs that we’re talking about even are. Both SKD and CKD are terminologies used to delineate the extent to which a product has been assembled prior to its arrival at the recipient’s end. SKDs are partially assembled products that require some assembly work to be undertaken by the recipient. Some of the assembly work has been accomplished at the origin point, yet some remains to be executed. Conversely, CKDs are essentially individual components of a product that are shipped collectively, but necessitate full assembly at the destination by the recipient to render the product operational as intended.

The increase in import of CKD and SKD kits for cars defies logic. According to the Pakistan Automotive Manufacturers Association (PAMA) latest figures, car sales for December 2023 clocked in at 5,342 which was a drop of 10% compared to November, and a colossal 65% decline compared to December 2022.

| Sub 1000cc | 1000cc | 1300cc and Above | Jeeps | Total | |

| Dec-23 | 2,425 | 706 | 1,785 | 426 | 5,342 |

| Nov-23 | 2,113 | 729 | 2,033 | 967 | 5,842 |

| Oct-23 | 2,745 | 525 | 1,580 | 895 | 5,745 |

| Sep-23 | 2,780 | 691 | 2,939 | 1,449 | 7,859 |

| Aug-23 | 2,935 | 664 | 2,310 | 1,374 | 7,283 |

| Jul-23 | 1,586 | 422 | 1,694 | 1,050 | 4,752 |

| Jun-23 | 2,175 | 429 | 1,653 | 1,507 | 5,764 |

| May-23 | 2,059 | 430 | 1,445 | 1,264 | 5,198 |

| Apr-23 | 983 | 276 | 1,585 | 1,413 | 4,257 |

| Mar-23 | 3,324 | 964 | 2,913 | 1,636 | 8,837 |

| Feb-23 | 635 | 165 | 2,842 | 2,236 | 5,878 |

| Jan-23 | 600 | 1,214 | 4,207 | 4,249 | 10,270 |

| Dec-22 | 7,362 | 1,929 | 4,489 | 1,385 | 15,165 |

| Nov-22 | 7,755 | 1,850 | 5,827 | 2,355 | 17,787 |

| Oct-22 | 4,461 | 1,897 | 4,771 | 1,993 | 13,122 |

| Sep-22 | 2,981 | 1,517 | 4,715 | 1,626 | 10,839 |

| Aug-22 | 2,520 | 776 | 5,684 | 2,477 | 11,457 |

| Jul-22 | 4,971 | 943 | 4,464 | 951 | 11,329 |

| Source: Pakistan Automotive Manufacturers Association | |||||

What is happening then? A correction by the looks of it.

“At first glance, it seems the industry is sanguine and gearing up for a post-election economic revival; however, the data suggests that the increase is due to a backlog cleared by customs,” explains Syed Asif Ahmed, General Manager of Sales and Marketing at MG Motors.

Whilst there is still no clarity on when this backlog is from, October seems to be the most plausible candidate due to the $23 million in CKD/SKD imports that were recorded in that month — the lowest across the 18 months of data we’re looking at. However, this is not to rule out protracted backlogs that might have accrued.

“A $100 million of imports in a month shouldn’t be a surprise considering auto imports has been a least priority sector for letter of credits during the last year or so. Hence, there could be some backlog/pending letter of credits of automobile manufacturers that may have gone through considering reserves buffer have been somewhat improving,” posits Azfer Naseem, Co-Founder and Executive Director Research at Akseer Research.

Import on CKD/SKD kits for automotive industry should lift ban after elections and then after that ask the manufacturers to make 100% automotive parts in Pakistan and no kits will be allowed to import after this release.

The automotive industry prices will come down and then there will be lot of opportunity for local assemblers to continue there work in long run.

These car assemblers/ principal’s minting money. We are spending our precious foreign exchange just to enhance petrol/ spare parts consumption. Why govt not make mendatory for car assemblers to export some portion of their production.

Suzuki/ Honda/ Toyota are in this country for many decades. some are even more than 50 years of working in Pakistan. whose Interest these car assemblers are serving.

.

There in no reason for blame auto manufacturers for increased import of vehicles in the country. Automaker are meeting our demand within parameters decsribed by the Govt. If we want to change it, it has to be done by Govt. of Pakistan by redefining parameters of import.. please ask govt. to change import rules according to economic situation of the country.