Interloop Limited, a leading textile enterprise, has reported its impressive half-year financial results for financial year (FY) 2024, ending in December 2023. The company has showcased a remarkable surge in net profits, nearly doubling from Rs 4.6 billion in FY 2023 to Rs 9 billion in FY 2024.

Interloop has five distinct business segments each catering to specific markets and needs. The hosiery segment produces 796 million socks annually for global brands like Nike and Adidas.

The denim segment, renowned for its eco-friendliness, currently produces more than 500,000 sustainable garments monthly with plans to expand by 2025.

Apparel, attracting brands from various continents, features a new eco-friendly facility with advanced machinery and sustainability features, producing 22 million garments annually.

The activewear segment has a capacity of 4 million pieces annually, utilising advanced machinery and a dedicated design team. Finally, the yarns segment spins 32 million pounds annually, using recycled and sustainable fibres. Over 50% is used internally: while the rest is supplied to other manufacturers.

Previously, Interloop Limited defied a turbulent global and domestic economic landscape to deliver strong results in FY 2023, showcasing its resilience and adaptability.

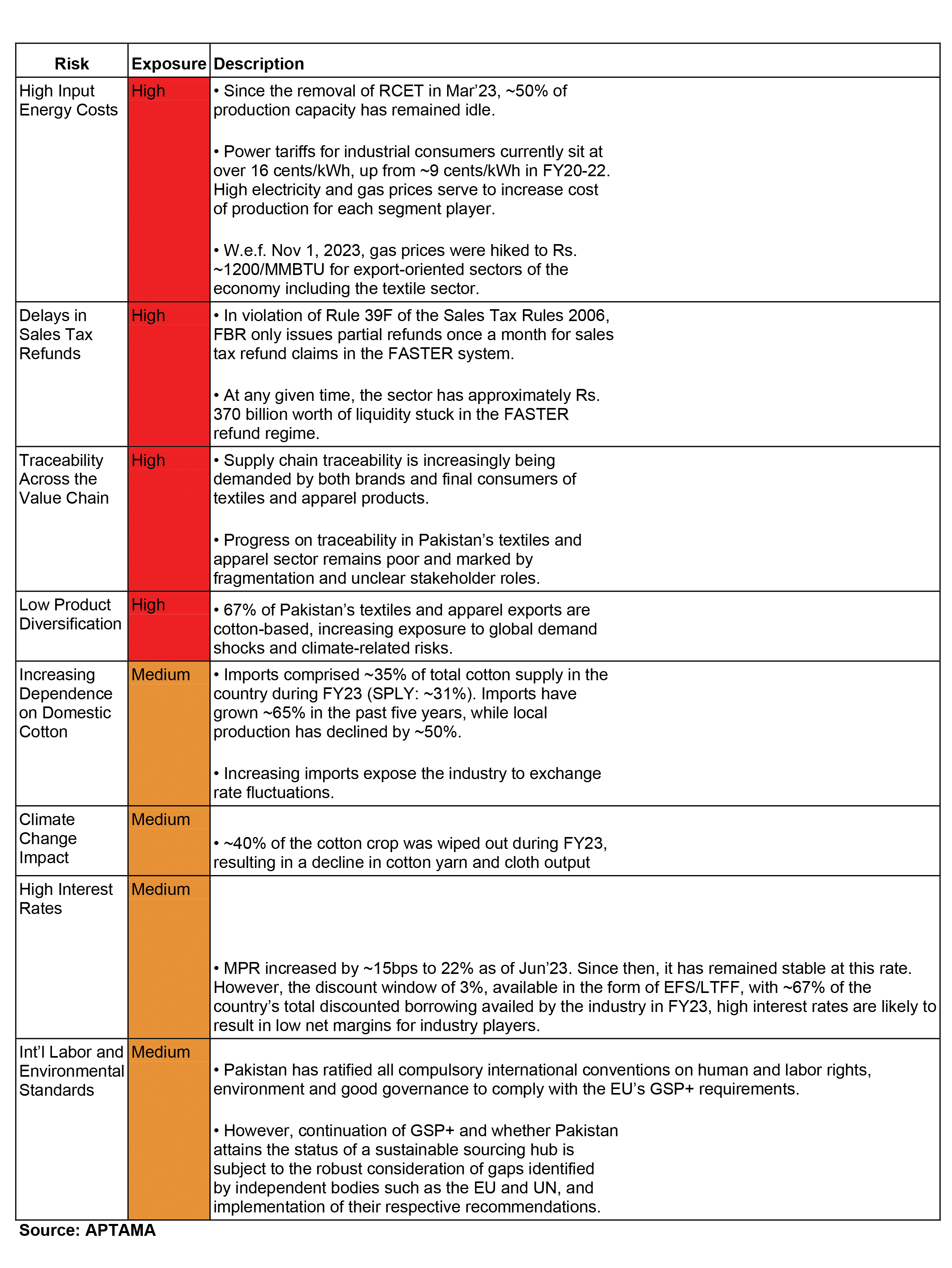

“The global economic slowdown further dampened prospects, impacting Pakistan’s GDP growth and causing a decline in textile exports. Pakistan’s textile industry, in particular, faced a 14.6% drop in exports, with knitwear, readymade garments, and bedwear experiencing significant declines,” read the company’s director report for 2023.

The recent half-year financial report highlights a significant uptick in sales, soaring by 39% from Rs 53 billion in FY 2023 to Rs 74 billion in FY 2024. Correspondingly, the gross profit experienced a substantial leap of 66%, escalating from Rs 14 billion in FY 2023 to Rs 23 billion in the current financial year.

This upswing in revenue and profit can be largely attributed to Interloop’s acquisition of a majority stake, 64% shares, US firm Top Circle Hosiery Mills, consummated in December 2023. The acquisition aligns with Interloop’s strategic vision aimed at augmenting shareholder value, fortifying its global market presence, and bolstering its long-term sustainability, as reported by Profit earlier.

Despite the substantial increase in revenue and profit, expenses witnessed a marginal escalation in the first half, attributable to the burgeoning inflationary pressures in the economy. Distribution costs surged from Rs 1.9 billion in FY 2023 to Rs 2.6 billion in FY 2024, while administrative and operating expenses rose to Rs 4.4 billion and Rs 1.2 billion, respectively, in the current financial year.

Nevertheless, the operating profit doubled in the first half of FY 2024, scaling from Rs 7.9 billion to Rs 15.7 billion. With the company registering an overall profit, the earnings per share surged to Rs 6.4 in the current financial year from Rs 3.3 in the preceding year.

Delving into the quarterly performance, the data reveals a deterioration across key metrics. Sales fell by 8%, from around Rs 39 billion in the first quarter of financial year 2024 to Rs 35 billion in the second quarter. Similarly, the gross profit declined by 24% in the latest quarter, falling from Rs 12.8 billion to Rs 9.7 billion. Profit from operations plummeted by 30%, from Rs 8.6 billion to Rs 6.1 billion.

The appreciation of the rupee eroded export competitiveness while rising gas prices added another layer of pressure on production costs. This, coupled with persistently high finance costs led to a decline in earnings in the recent quarter. Resultantly, quarter on quarter profitability suffered as net profit margins were down from 22.7% to 17.2%.

Challenges and beyond

Interloop and the broader textile industry face a complex situation marked by promising growth, erratic gas supplies, and a looming cotton shortage.

While grid power is available, the industry relies on gas-fueled captive power plants for electricity generation due to the unreliability and high cost of government supply. However, the industry is facing a challenge with reliance on imported Regasified Liquefied Natural Gas (RLNG) and declining domestic reserves, which is impacting its captive generation capabilities.

While grid power is available, the industry relies on gas-fueled captive power plants for electricity generation due to the unreliability and high cost of government supply. However, the industry is facing a challenge with reliance on imported Regasified Liquefied Natural Gas (RLNG) and declining domestic reserves, which is impacting its captive generation capabilities.

As per Wasi Haider, a research analyst at an energy think tank based out of Islamabad, “The textile sector has relied heavily on affordable gas to fuel its captive power plants due to concerns about the government grid’s reliability. Additionally, energy obtained directly from the government is relatively costly, making textile exports less competitive.”

“Following 2022, the RLNG crisis escalated, leading to a rise in the weighted average cost of gas as expensive fuel was integrated into the local mix. Consequently, the substantial impact on cross-subsidies disproportionately affected export-oriented sectors like textiles. As a result, major textile industry players are now confronted with an energy dilemma, with revised gas prices resulting in nearly 45% of cross-subsidies,” he added.

Despite these challenges, the industry has seen positive developments. The depreciation of the Pakistani rupee in the first half of the year made exports cheaper, boosting competitiveness.

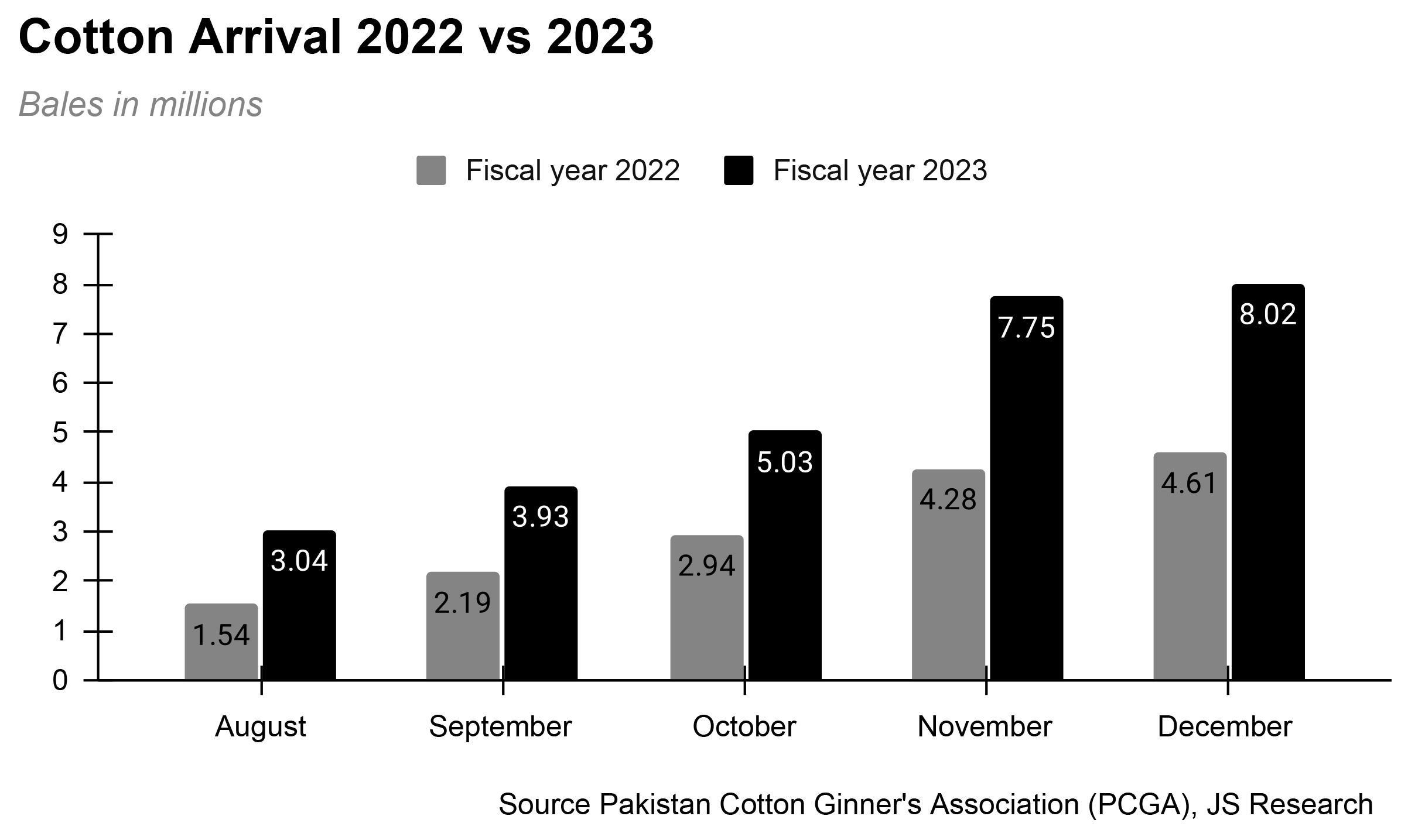

The recent cotton harvest surged by 67% compared to the previous year. Additionally, lower cotton prices initially benefited mills, and significant operational expansion in the past year increased production capacity. However, domestic demand exceeds current production, necessitating imports.

As per an analyst note by JS Global Capital, “Pakistan remained as one of the cheapest sources of cotton, when compared to regional exporters. Local prices have reached $0.73/pound compared to last month’s average of $0.75/pound. When compared to the global producers, Pakistan remained the cheapest source of origin compared to $0.9 for benchmark Cotton A Index. Global prices are expected to remain soft on weaker global demand when compared to last year, lower imports by Bangladesh, Pakistan and Turkey will be slightly offset by higher volume in China and Brazil.”

Similarly, the record-high cost of borrowing and the phasing out of the export refinance scheme by the State Bank at the request of the International Monetary Fund (IMF) have continued to put pressure on the bottom line.

The JS analysis also emphasizes that the rise in short-term financing rates (due to the gradual phasing out of Export Finance Schemes – EFS) and the increase in working capital requirements resulting from year-on-year higher procurement needs will continue to weigh down the bottom line for textile players. The EFS rate, previously fixed at 3% until March 2022, was later linked to the benchmark policy rate with the spread gradually reduced to minus 300 basis points by December 2022. In accordance with IMF recommendations, the EFS rate will gradually align with the benchmark rate.

This, in particular, also impacts Interloop due to the high levels of leverage it carries on its books. As per the company’s 2023 audit report, Interloop has significant amounts of borrowings from banks and other financial institutions amounting to around Rs 60 billion, accounting for 73.9% of total liabilities.

For Interloop, however, strategic acquisitions and diversification played a crucial role in the past two quarter’s performance. The company expanded its international presence and tapped into new markets, mitigating risks associated with any single region. Furthermore, a steadfast commitment to sustainability and innovation helped Interloop differentiate itself in a competitive landscape. In August 2023, Interloop made an investment of $100 million towards sustainability and expansion in circular knitting capacity. This move is accompanied by ambitious Science Based Targets (SBTi) approval for reducing greenhouse gas emissions by 51% by 2032.

This made Interloop the first large-scale Pakistani textile company with SBTi-approved targets. The company is committed to reducing both direct and indirect emissions, investing in clean energy and process improvements. The report also stated that the expansion plans include opening a new high-tech apparel plant in Faisalabad which will produce 50 tons of fabric and 3 million garments monthly.

Additionally, Hosiery Plant VI is planned for the 2023-24 financial year. The company plans to further expand its international presence and explore new markets, while staying committed to responsible manufacturing practices.

Following the acquisition of Top Circle Hosiery Mills in December 2023, Interloop has successfully diversified its revenue streams, thus mitigating the adverse effects of inflationary pressures on its operations. This strategic move underscores the company’s commitment to sustained growth and resilience in an ever-evolving market landscape.

While promising opportunities exist in the form of recent export orders and anticipated rate cuts, challenges like gas supply issues, cotton sourcing, and volatile currency fluctuations demand pose a threat to the company’s performance.