On Monday 04, 2024, the Governor State Bank of Pakistan (SBP) Jameel Ahmad inaugurated the first-ever Pakistan Financial Literacy Week (PFLW) at an event at SBP Karachi.“This is a first-of-its-kind endeavor in Pakistan champion financial literacy and inclusion on a national scale”, remarked Ahmed in his keynote address.

The event was attended by Presidents and CEOs of commercial banks, senior officials from the World Bank, Alliance for Financial Inclusion, and other stakeholders.

In his keynote address, the Governor said that SBP fully recognises access to financial services as a fundamental right, and SBP’s mission is to empower every citizen by providing them with the tools and knowledge needed to participate fully in the economy.

The Governor said that an inclusive financial sector is not only important for the overall growth of the banking industry but also augments monetary policy transmission channels and increases its effectiveness: “Financial inclusion is a cornerstone of a thriving and equitable economy. When more people have access to financial services, it creates a broad base of consumers, savers, and entrepreneurs, and helps stimulate economic growth.”

Mr. Ahmad went on to add that SBP has always been working on increasing the availability and utilisation of financial services for people and businesses to meet their financial services needs in a fair and dignified manner.

The state of financial inclusion

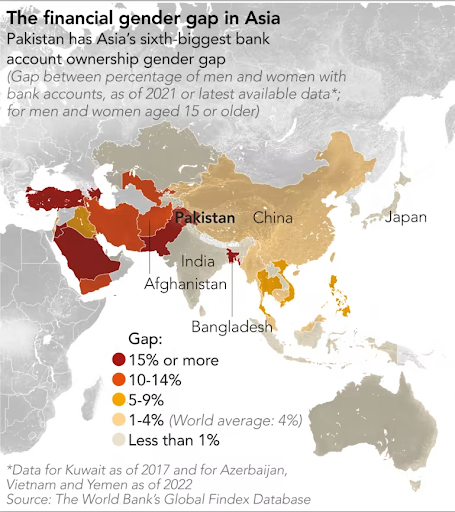

Pakistan has been tardy in implementing financial inclusion measures compared to its regional counterparts like India and Bangladesh. The primary reasons for this disparity include high illiteracy rates, a significant gender gap in financial services access, and a historical lack of policy initiatives. However, recent efforts by the SBP including the National Financial Inclusion Strategy in 2015, and the Banking on Equality Policy in 2021 aim to enhance access to financial services among underserved populations.

The Governor of SBP highlighted recent statistics: “As of June 2023, there were around 177 million bank accounts in Pakistan. Of these, 83 million are unique accounts, which is 60% of the 137 million adult population. It is also important to note the total number of accounts owned by women are 49 million, of which unique accounts are 29 million. These 29 million unique accounts represent more than 43% of the female adult population.”

Mapping the progress

The key initiatives taken for expanding financial services to the unbanked and underbanked segments of the society include the implementation of national-level strategies and policies such as the National Financial Inclusion Strategy, National Financial Literacy Program and Banking on Equality Policy. The Governor shared that SBP has been implementing several initiatives under the national level policies which are uniquely positioned to benefit all segments of the population, i.e. RAAST, ASAAN Digital Account, ASAAN Mobile Account and more recently Digital Banks and specialized schemes to enhance access to finance. The specialized schemes include the SME Asaan Finance Scheme (SAAF), Refinance and Credit Guarantee Scheme for Women Entrepreneurs, line of credit for MSMEs, and Prime Minister’s Youth Business and Agriculture Loan Scheme (PMYB&ALS).

In his speech, the Governor reiterated that financial literacy is a collective responsibility, and all stakeholders – the government, financial institutions, non-profit organizations, and educational institutions – have a role to play in promoting financial literacy in Pakistan. “It is our duty to dispel common misconceptions about formal financial services, and to engage the public in an informed, yet non-technical manner, to build their trust in the financial system. This is all the more important in developing economies like Pakistan, where the informal economy has a substantial share in overall economic activity and contributes to the widespread prevalence of informal and unsafe savings and investment avenues. Better knowledge about financial services and products will help channelise resources towards productive use.”

After the Governor’s inaugural speech, the awards were conferred upon various commercial banks that actively participated in the National Financial Literacy Program since its commencement in 2017 and contributed to improving financial literacy among the beneficiaries.

The second session of the event included a panel discussion, where experts and thought leaders explored the future landscape of digital finance. The discussion delved into emerging trends, challenges, and opportunities in the rapidly evolving digital financial ecosystem. Panelists, representing diverse sectors, shared insights on how technology is reshaping the financial industry and discussed strategies to ensure a secure and inclusive digital finance landscape.

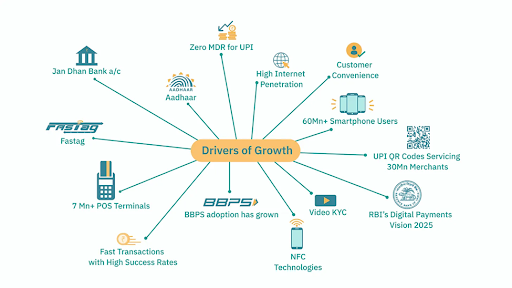

Many in Pakistan view advancements in financial inclusion across the border as a case study of overcoming challenges in establishing an inclusive financial system. In India, a rapid increase in internet access and mobile phone penetration alongside the introduction of the Unified Payment Interface (UPI) catalyzed the growth of its digital financial services ecosystem.

Educating the masses

PFLW will be held from March 04 to March 08 and will comprise both on-ground and virtual activities designed to raise awareness and educate citizens on the importance of financial literacy in the evolving digital era. The theme for the week is ‘Digital Bankari – fori aur asaan’.

During the week commercial banks and SBP field offices will hold 150 Financial Literacy Camps in 60 cities across the country. These camps will provide practical insights into digital financial services including RAAST, QR code, and Asaan Mobile / Digital Accounts, along with other general topics of financial literacy. An important segment of PFLW is outreach to students of all levels across the country in recognition of the pivotal role of financial education in shaping their future.

Competitions on different themes of digital finance will be organized in 16 field offices of SBP-Banking Services Corporation to instill financial awareness and responsible money management from an early age. An online video/poster competition for the public has also been arranged in this regard.