The banks have done it again. They have once again managed to avoid paying the Advance to Deposit Ratio (ADR) based income tax. According to a report by Express Tribune, commercial banks and the federal government have reached a consensus to abolish the ADR income tax.

As per another report by Dawn, the Pakistan Banks Association (PBA) remained engaged with the finance ministry and the Federal Board of Revenue (FBR) on ADR-linked taxation as well as other levies on the banks in the weeks leading up to the Finance Minister and former banker’s budget announcement. . The PBA argued that how the sector’s balance sheet look should remain within the regulator, the State Bank of Pakistan (SBP)’s purview. It seems their efforts have finally come to fruition.

The PBA asserted that the ADR tax was unsustainable as the 2022 data showed it did not result in a sustainable increase in banking sector advances and that it was was merely a revenue collection measure.

What is the ADR tax?

The ADR has been a contentious issue for the past couple of years. Very basically explained, a bank’s business is to accept deposits from customers and lend funds to other customers. But over the past few years, the interest rate in Pakistan has been so high that banks have found it easier to accept deposits compared to lending money.

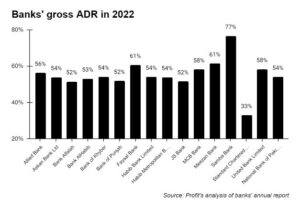

So what do the banks do? They lend to the one entity that does constantly need money no matter what: the government. This proved a pretty good system for the banks which have been making huge profits. But the government felt this was bad business. In a bid to force banks to lend more rather than just buy government-backed securities, the government placed an additional tax on any bank with an ADR lower than 50% in 2022. ADR is basically advances (lending) divided by deposits. Banks had to pay a 10% additional tax if the ADR is between 40% and 50%, a 16% additional tax if the ADR falls below 40%, and no additional tax if the ADR is above 50%. This additional tax was applicable on income from federal government securities.

This was seemingly a way to encourage banks to lend more and encourage business at a time when the economy has been in the doldrums. But a lot went down behind the scenes, and the banks were able to window dress their accounts to avoid these taxes despite successive finance ministers doubling down on it.

Read: Pretty outside, ugly inside: How Pakistani banks window dressed their books to avoid new taxes

Impact of the ADR Policy

To avoid paying hefty taxes, the banks had no option but to increase their lending. “Previously, maintaining a 50% ADR was a top priority for banks in 2022. This led to aggressive loan book expansion and restrained deposit growth. Consequently, sector advances witnessed a healthy 17% year on year growth, while deposits saw a meagre 7% year on year rise, pushing ADR to 53%”, said Amreen Soorani in her report ‘Potential removal of ADR-related tax: Banks to cheer, government may get more borrowing’.

Therefore, the policy did not last too long. In 2023, banks were exempted from this tax as announced in the fiscal year 2024 budget, so that banks had enough liquidity to lend to the cash-strapped government. However, the tax was to be effective in calendar year 2024. The removal of tax in 2023 resulted in rebound in deposit growth. As per JS research report, deposits grew by 24% year on year in 2023 as compared to 2022, while the ADR dropped to 44%.

FBR jugaads

For the next fiscal year, the government has set a Rs12.97 trillion tax collection target, requiring an unprecedented 40% growth within a year.

Thus, to ensure that the banking sector does not avoid paying less ADR tax through window dressing, the FBR proposed calculating the tax liability based on average annual lending to the government rather than on the last day of the year. As the banking sector’s current average ADR is around 42%, this move could have generated an additional 10% income tax for the government. However, instead of closing the loophole, the government plans on abolishing this ADR income tax altogether.

So what is in for the government to abolish this tax?

Firstly, more finances to fund fiscal deficit. For the next fiscal year, the government plans to borrow Rs 24 trillion from banks to service existing debt. Thus, the removal of ADR tax presents a positive development for the government facing a widening fiscal deficit and limited borrowing avenues. As per JS Researhc, in the last two years, lower external borrowings have necessitated the need for increased domestic borrowings. As per JS Research, the government received Rs 493 billion in the first nine months of fiscal year 2024 in external borrowings as compared to budgeted amount of Rs 2.7 trillion.

In fiscal year 2024, the government’s domestic borrowings have increased significantly. “Our estimates indicate the government has already borrowed a net Rs 11 trillion through government security auctions (gross issuance minus maturities) in fiscal year 2024, out of which Rs 6 trillion were raised in the first half of fiscal year 2024. This figure represents the potential investments, whose income would have been subject to the higher tax policy”, reads JS Research report.

At the same time, the government plans on increasing domestic borrowing in fiscal year 2025. “The fiscal year 2025 Budget outlines a net increase of Rs2.5trn in domestic debt, with Rs19trn in repayments and Rs21.5trn in fresh borrowing. Given the Budget also reflects heavy reliance on banks for financing, to absorb this Rs2.5trn net increase banks would likely need to maintain their current low ADR of around 42%, assuming 12% year on year deposit growth in FY25 (~Rs3.5trn fresh deposits).” added the report. Analysts anticipate repo borrowings levels to remain elevated in the coming fiscal year.

Moreover, as per the Express Tribune report, banks would pay advance income tax for the first quarter of the next fiscal year before June 30. They will also pay the super tax for 2023 and 2024. In return, the government has agreed to abolish the additional tax.

Impact on the banking sector

Currently, sector’s ADR is at its all-time low levels of 42%. At the smae time, deposits continue to grow year on year by around 20%. This policy shift of abolishing ADR tax would reduce the pressure on banks to maintain artificial ADR levels. Instead the banks could potentially focus on prioritising deposit growth and/or increased borrowings for investments in governemnt securities. “This trend could favor longer-tenor and fixed-income securities, aligning with the recent monetary easing cycle,” reads the JS Research report.

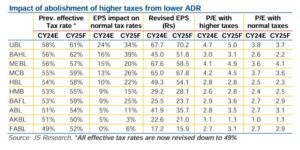

As per JS Research, the abolishment of ADR tax is expected to translate to a 5% – 24% increase in earnings for banks in JS Banking Universe for 2024 and a 3% – 39% boost for 2025, with United Bank (UBL) and Bank Al Habib (BAHL) likely to benefit the most.