Constantly pointing out the flaws in Pakistan’s power sector may seem repetitive, but the magnitude of its challenges keeps it in the headlines. In early November, the Government of Pakistan announced its Circular Debt Management Plan (CDMP) for the power sector. While the projected growth in debt liability is a modest 1.5%, the outstanding liability has already reached Rs2.4 trillion, and these projections rest on some generous assumptions that warrant closer examination. The question remains: are we headed for doom, or does hope still flicker in Pakistan’s power corridor?

Making of the crisis

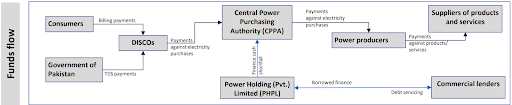

Pakistan’s power sector struggles with a persistent circular debt problem rooted in a complex web of unpaid obligations that has grown increasingly intricate over the years. At its core lies the unfunded outstanding liability of power distribution companies (DISCOs) and K-Electric (KE) to the Central Power Purchasing Authority-Guarantee (CPPA-G), a situation that has become more precarious with each passing year.

When DISCOs fail to clear their dues to CPPA-G, it creates a cash shortfall, prompting Power Holding Private Limited (PHPL) to borrow funds to cover CPPA-G’s liabilities. This cycle of delayed payments represents the accumulated circular debt in the country.

The growth of this circular debt can be attributed to five fundamental factors that have created a perfect storm in Pakistan’s power sector. High power generation costs have severely undermined DISCOs’ ability to effectively collect revenues and manage their operations, creating a persistent gap between costs and collections. The content in this publication is expensive to produce. But unlike other journalistic outfits, business publications have to cover the very organizations that directly give them advertisements. Hence, this large source of revenue, which is the lifeblood of other media houses, is severely compromised on account of Profit’s no-compromise policy when it comes to our reporting. No wonder, Profit has lost multiple ad deals, worth tens of millions of rupees, due to stories that held big businesses to account. Hence, for our work to continue unfettered, it must be supported by discerning readers who know the value of quality business journalism, not just for the economy but for the society as a whole.To read the full article, subscribe and support independent business journalism in Pakistan