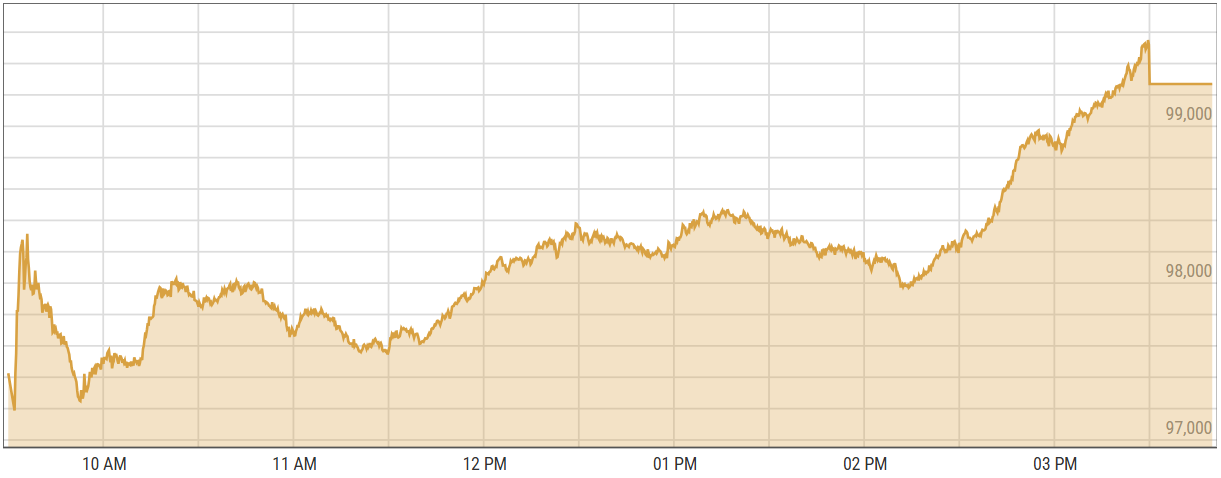

Karachi: The Pakistan Stock Exchange (PSX) staged a remarkable recovery on Wednesday, with the KSE-100 Index surging by 4,695.09 points, or 4.96%, to close at 99,269.25.

This comes as a sharp rebound following Tuesday’s historic slump of 3,505.62 points.

During intraday trading, the index hit a high of 99,549.81 points, coming within touching distance of the key 100,000 mark. The market also recorded a low of 97,188.27 points. Trading volume was robust, with 495.6 million shares exchanged at a total value of Rs29.7 billion.

The rally was primarily driven by decisive overnight action by law enforcement agencies, which cleared key PTI protest sites such as Blue Area and D-Chowk, and the State Bank of Pakistan’s (SBP) removal of the Minimum Deposit Rate (MDR) requirement for conventional banks.

Additionally, Islamic Banking Institutions (IBIs) were directed to pay at least 75% of their investment pool’s gross yield as profit on PKR savings deposits, boosting investor confidence.

Sectoral gains were led by commercial banks, automobile assemblers, cement, oil & gas exploration companies, pharmaceuticals, power generation, and refineries.

Index-heavy stocks including HBL, NBP, MCB, OGDC, SSGC and HUBCO, all traded in the green territory. Even in the final few minutes the market still saw a buying interest, showing that the buying trend would most likely carry on in the next day’s trade.

This marks a significant recovery from Tuesday’s sharp decline, where the KSE-100 Index fell 3.57% to 94,574.16 points amid political unrest and violent clashes in Islamabad.