ISLAMABAD: The National Tax Council (NTC) has decided to strengthen tax harmonization and implement key reforms to address under-taxed sectors, including real estate, property, and agricultural income.

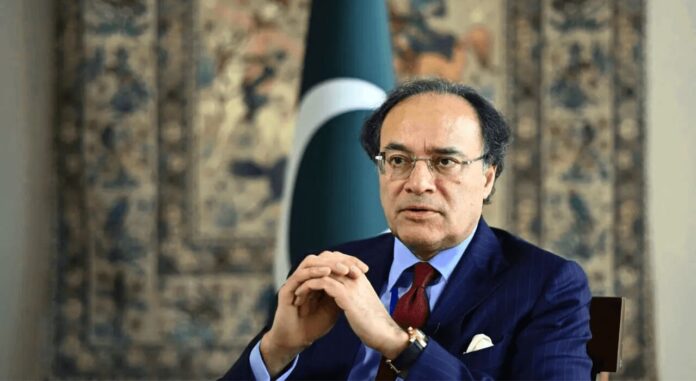

These measures, discussed during a meeting held on Wednesday at the Finance Division under the chairmanship of Federal Minister for Finance and Revenue, Senator Muhammad Aurangzeb, are part of efforts to realize the goals of the recently signed National Fiscal Pact between the Federation and the Provinces.

As per details, the council resolved to enhance data-sharing mechanisms between the Federal Board of Revenue (FBR) and provincial revenue authorities, leveraging digital tools to improve compliance and streamline tax collection.

It was also agreed to expedite efforts to harmonize the General Sales Tax (GST) across provinces by transitioning to a unified tax portal. Reforms in agricultural income tax and property taxation were prioritized to align with federal policies while addressing provincial challenges.

Additionally, strategies to broaden the GST framework for services were discussed, focusing on aligning with international standards to reduce ambiguities and improve administration.

The meeting emphasized cohesive policy implementation, capacity building, and robust stakeholder engagement as critical to achieving these reforms, which aim to strengthen fiscal stability and promote equitable growth.

Participants in the meeting included Minister of State for Finance and Revenue Mr. Ali Parvez Malik; Punjab Finance Minister Mian Mujtaba Shuja-ur-Rehman; Khyber Pakhtunkhwa Finance Minister Mr. Muzzamil Aslam; Balochistan Finance Minister Mir Shoib Nausherwani; the Chairman of FBR; chairpersons of provincial revenue boards; and federal and provincial finance secretaries.

Experts from the World Bank and senior officials from the Finance Division and provincial finance departments also attended the meeting.

The Federal Minister reiterated the government’s commitment to fostering collaboration among all stakeholders to establish a unified and efficient tax framework. The meeting ended with actionable steps to advance the agreed-upon reforms on time.