KARACHI: The outlook for Pakistan’s equity market remains favorable, driven by expectations of continued monetary easing and an improving macroeconomic environment.

Analysts at AKD Research noted, “The disinflationary environment, coupled with easing external financing requirements, makes equities more attractive, especially with the market trading at a P/E of 5.0x and DY of 10.2%.”

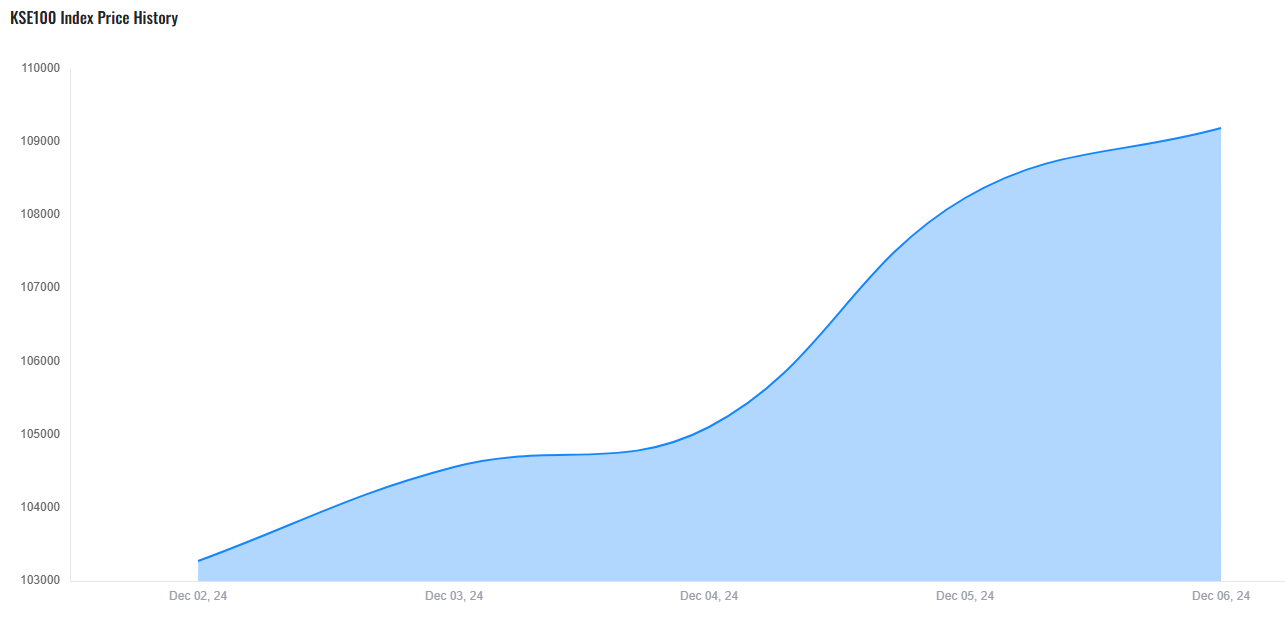

The KSE-100 Index recorded its highest-ever weekly gain, surging by 7,697 points to close at a record high of 109,054 points, up 7.6% week-on-week (WoW). These gains marked the highest weekly return in 4.7 years, supported by a November inflation rate of 4.9% year-on-year (YoY), the lowest in 6.5 years.

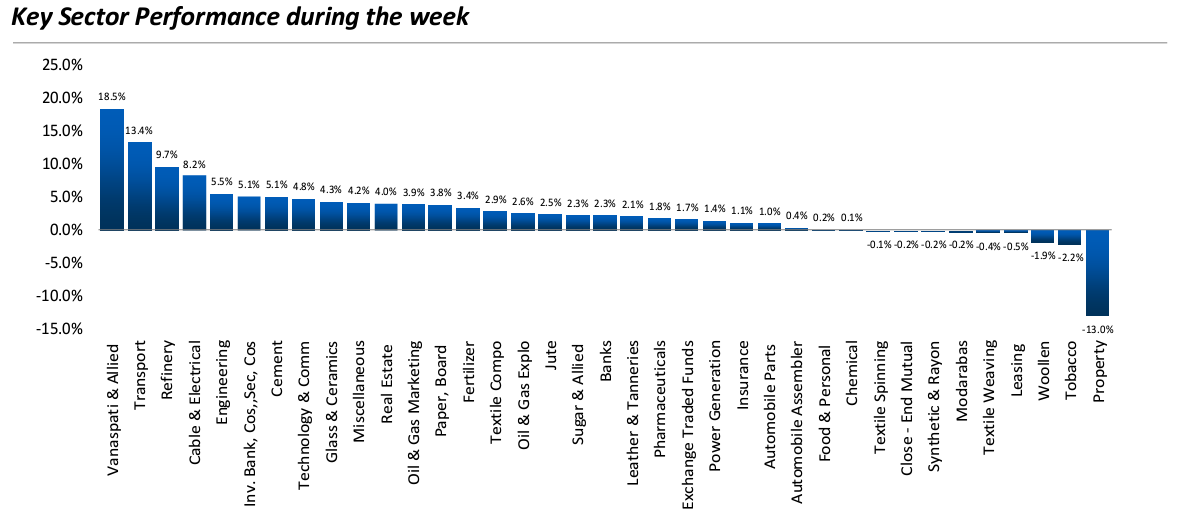

Major sectors driving the rally included commercial banks (+1,434 points), fertilizer (+1,424 points), and oil and gas exploration (+1,148 points). The fertilizer sector rose on news of Engro Corporation’s acquisition of Jazz Tower and the Lahore High Court’s approval of the FFC-FFBL merger.

AKD Research highlighted, “The continued interest in commercial banks is driven by a 21% YoY increase in gross advances as of mid-November, with ADR expected to cross 50% by year-end to avoid ADR-based taxation.”

Source: PSX & AKD ResearchOn the macroeconomic side, the Saudi Fund for Development extended $3 billion deposits for another year, while November’s trade deficit narrowed to $1.6 billion, down 19% YoY. The government’s debt declined by 1% month-on-month to Rs69 trillion in October, and foreign exchange reserves increased by $620 million to $12 billion, boosted by a $500 million Asian Development Bank loan.

Sector-wise, Vanaspati & Allied Products (+23.7%), Transport (+19.3%), and Refinery (+18.5%) led performance. Top gainers included CNERGY (+45.6%) and Airlink (+42.5%), while laggards included EFUG (-8.8%) and JVDC (-8.1%).

The upcoming Monetary Policy Committee meeting on December 16 remains a key focus, as investors anticipate further easing to sustain momentum. Top stock picks include OGDC, PPL, MCB, FFC, PSO, LUCK, MLCF, FCCL, and INDU.