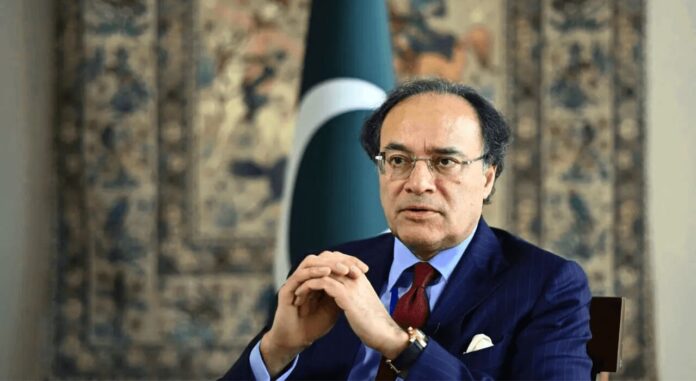

ISLAMABAD: Federal Minister for Finance and Revenue, Senator Muhammad Aurangzeb, said on Thursday that Islamic finance and Islamic capital markets could play a pivotal role in helping Pakistan achieve macroeconomic stability and sustainable growth.

Addressing the inaugural session of the Second International Islamic Capital Markets Conference & Expo in Karachi, the minister stated that while Pakistan had faced significant economic challenges in recent years, these issues were now being effectively addressed, and the country was on the right trajectory toward stability.

He noted that Islamic finance, particularly Islamic capital markets, could contribute significantly through instruments such as sukuk, equity funds, and Shariah-compliant investment vehicles, which not only attract investment but also reduce reliance on interest-based borrowing.

Prominent attendees included Shaikh Ebrahim Bin Khalifa Al-Khalifa, Chairman of the AAOIFI Board of Trustees, Dr Sami Al-Suwailem, Acting Director General of the Islamic Development Bank Institute, SECP Chairman Akif Saeed, and Deputy Governor of SBP Saleemullah.

The minister described the conference as reflective of Pakistan’s commitment to fostering a robust Islamic capital market and highlighted the government’s dedication to transforming the financial ecosystem in line with Shariah principles.

He said that as of June 30, 2024, 56% of the Pakistan Stock Exchange’s market capitalisation comprised Shariah-compliant securities. “In the collective investment segment, 48% of mutual fund assets, 66% of voluntary pension fund assets, and 95% of REIT assets are Shariah-compliant. These statistics highlight the progress we have made,” he added.

The minister emphasised the need for “an economic system aligned with our faith and capable of driving inclusive, sustainable growth.” He added that Islamic finance could mobilise resources for key sectors like infrastructure development and poverty alleviation, maintaining adherence to ethical principles. Adding that Pakistan has the potential to emerge as a leading global hub for Islamic finance.

Aurangzeb noted the rising global interest in Shariah-compliant products, reflecting a demand for ethical and sustainable financial solutions. He said the steady growth of Islamic finance was reshaping preferences towards value-based systems, attracting interest across sectors, and contributing to a comprehensive ecosystem.

However, he stressed that realising the full potential of Islamic finance required collaborative efforts from scholars, institutions, regulatory bodies, and practitioners to overcome challenges, develop innovative products, and build public trust.

“We must ensure Islamic finance remains rooted in Shariah principles while being practical and capable of meeting evolving needs,” he said.

He commended the SECP for its efforts to create an enabling environment for Islamic finance through regulatory frameworks, Shariah-compliant indices, and governance guidelines. He also urged the SECP to continue promoting innovation and inclusivity in Islamic capital markets.