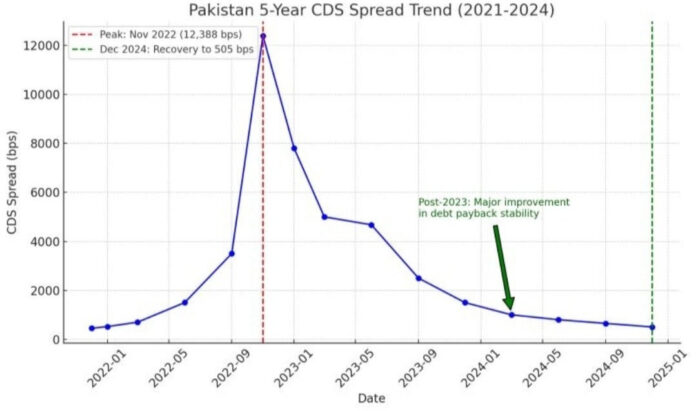

Pakistan’s sovereign default risk has dropped by 93% as its 5-year Credit Default Swap (CDS) spreads fell sharply to 505 basis points in December 2024 from a peak of 12,388 basis points in November 2022. The decline marks a notable recovery in Pakistan’s debt repayment stability, aided by improved macroeconomic conditions and investor confidence.

The Advisor to the Finance Ministry, Khurram Schehzad, highlighted that the CDS recovery places Pakistan ahead of several emerging and frontier markets in risk premiums. He attributed this improvement to better debt management, higher foreign reserves, and fiscal discipline, which have collectively restored market confidence in Pakistan’s ability to meet sovereign obligations.

Schehzad also pointed out that the current global economic environment, characterized by falling interest rates, presents a timely opportunity for Pakistan to re-enter international capital markets at lower borrowing costs. This re-entry, coupled with increasing liquidity, is expected to ease external financing pressures and improve economic prospects.

Increased investor optimism has spurred a rally in Pakistan’s international bonds, reinforcing market sentiment about the country’s financial stability. Analysts note that this turnaround reflects Pakistan’s successful implementation of IMF-backed reforms under the Extended Fund Facility (EFF), which addressed critical fiscal and external vulnerabilities.

Pakistan’s CDS spreads previously soared to a record high in 2022 amid deteriorating reserves, rising external debt obligations, and global economic pressures. A year later, swift fiscal consolidation, disinflation, and steady foreign exchange reserves have substantially reduced sovereign default concerns.

However, experts remain cautious, emphasizing the need for sustained structural reforms to maintain stability. The IMF’s recent Article IV report underscores the importance of broadening the tax base, managing debt risks, and fostering private-sector-led growth for Pakistan to achieve long-term economic resilience.

With its improved credit profile, Pakistan is well-positioned to attract foreign investment flows and boost economic recovery. The dramatic decline in CDS spreads signals a significant shift from default risk toward renewed global market access, marking a milestone in the country’s financial turnaround.