Faysal Asset Management Limited has successfully transferred the management rights of its conventional funds portfolio to Alfalah Asset Management Limited, effective January 1, 2025, according to a filing at the Pakistan Stock Exchange on Monday.

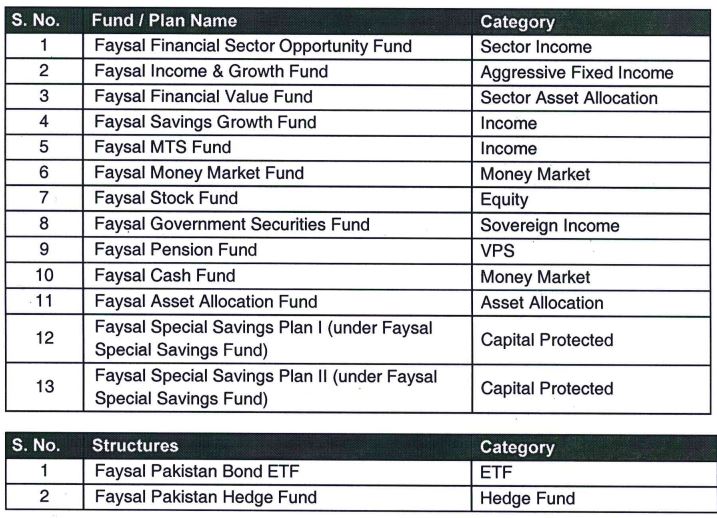

The divestment includes 13 funds and plans, along with two financial structures, marking a significant move for both entities in the asset management sector.

The transferred funds include the Faysal Financial Sector Opportunity Fund, Faysal Income & Growth Fund, Faysal Financial Value Fund, and Faysal Savings Growth Fund across various categories such as sector income, aggressive fixed income, and asset allocation. Other key funds transferred include the Faysal Money Market Fund, Faysal Stock Fund, and Faysal Pension Fund.

Additionally, two structures, the Faysal Pakistan Bond ETF and the Faysal Pakistan Hedge Fund, were also handed over to Alfalah Asset Management.

Faysal Asset Management stated that this divestment reflects its commitment to Shariah-compliant financial solutions and innovation. The move aims to align its operations with Islamic financial principles while ensuring diversity and upholding investors’ trust.

Faysal Asset Management Limited, a public unlisted company, functions as an asset management company and investment advisor under the regulatory framework of the Securities and Exchange Commission of Pakistan (SECP).

Faysal Asset Management Limited said that the move solidifies their commitment to Shariah principles, embracing diversity and innovation while delivering Shariah-compliant financial solutions, and upholding Islamic values and investors’ trust.

In August last year, the Competition Commission of Pakistan (CCP) approved the acquisition of management rights for certain funds of Faysal Asset Management by Alfalah Asset Management Limited.

Alfalah Asset Management, also a public unlisted company, is an AMC and investment advisor. The company operates under a license issued by the SECP under the Non-Banking Finance Companies (Establishment and Regulation) Rules, 2003.

Following the completion of the transaction, the market share of Alfalah Asset Management Limited is anticipated to experience a slight increase, while the market share of Faysal Asset Management Limited will correspondingly decrease.