Prime Minister Shehbaz Sharif on Tuesday urged urgent and aggressive steps to expand Pakistan’s tax net, as the Federal Board of Revenue (FBR) missed its revenue target by Rs831 billion in the first ten months of the fiscal year, primarily due to declining imports and record-low inflation.

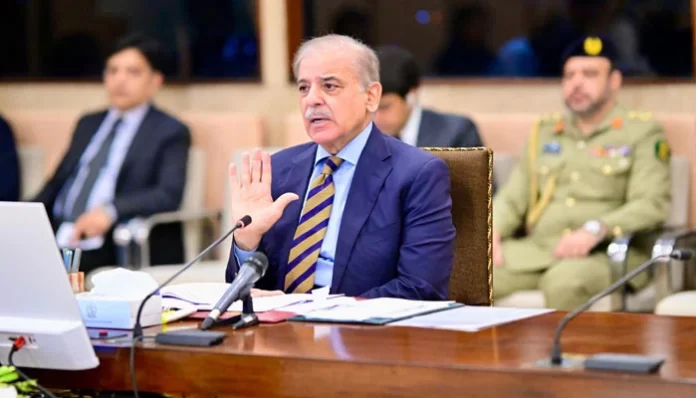

Chairing a high-level review meeting on tax base expansion and revenue enhancement, the prime minister stressed the need to bring all capable individuals and sectors into the tax net and take strict action against tax evaders. “Individuals and sectors capable of paying taxes must be brought into the tax net,” he said, according to a statement from the PM Office. He also ordered firm accountability of tax officials found supporting evasion.

The meeting took place against the backdrop of mounting fiscal challenges. The FBR collected Rs9.299 trillion in July–April FY25 against a target of Rs10.130 trillion, missing the mark by Rs831 billion. In April alone, FBR recorded Rs846 billion in revenue, falling short by Rs117 billion from the monthly target of Rs963 billion.

Despite the overall shortfall, income tax collection offered a silver lining, reaching Rs4.479 trillion, which exceeded its target of Rs4.152 trillion by Rs327 billion, showing a 28% year-on-year growth over last year’s Rs3.505 trillion.

Sales tax performance was weaker. It totaled Rs3.174 trillion against a target of Rs3.948 trillion, reflecting a shortfall of Rs774 billion—though it still marked a 27% increase over last year’s Rs2.498 trillion.

Customs duty also underperformed, missing its Rs1.271 trillion target by Rs228 billion, with actual collections at Rs1.043 trillion. However, it still grew 17% from the previous year’s Rs894 billion. The Federal Excise Duty (FED) brought in Rs603 billion, falling short of its Rs759 billion target by Rs156 billion, despite showing 33% growth over last year’s Rs453 billion.

The FBR also issued Rs427 billion in refunds during the 10-month period, up 1.18% from last year’s Rs422 billion. April refunds remained steady at Rs43 billion, nearly identical to the previous year.

The prime minister praised the government’s economic team for its efforts in difficult circumstances. “By the grace of Allah, the national economy is stable and moving toward growth,” he said, calling for collective effort for development. He reiterated that broadening the tax base was vital to reduce the burden on ordinary citizens by eventually lowering their tax rates.

To address systemic inefficiencies, PM Shehbaz ordered that digital monitoring of the cement and other sectors be completed by next month. He also directed authorities to intensify efforts in the tobacco sector, working jointly with provincial governments. Pending tax-related legal cases must also be aggressively pursued to recover state revenue, he added.

During the briefing, it was revealed that the Track and Trace System, now fully operational at cement plants across Pakistan, had led to a significant increase of billions of rupees in revenue. The system’s rollout in the sugar industry also yielded strong results, boosting tax receipts by 35% between November 2024 and April 2025.

The meeting also addressed revisions from the International Monetary Fund (IMF), which recently reduced Pakistan’s FBR revenue target for FY25 from Rs12.913 trillion to Rs12.333 trillion—a Rs580 billion cut attributed to a slowdown in import taxes, weak manufacturing activity, and inflation falling into single digits, the lowest in decades.

Federal Ministers Azam Nazeer Tarar, Muhammad Aurangzeb, Ahad Khan Cheema, Attaullah Tarar, the Chairman of FBR, and other senior officials attended the meeting.