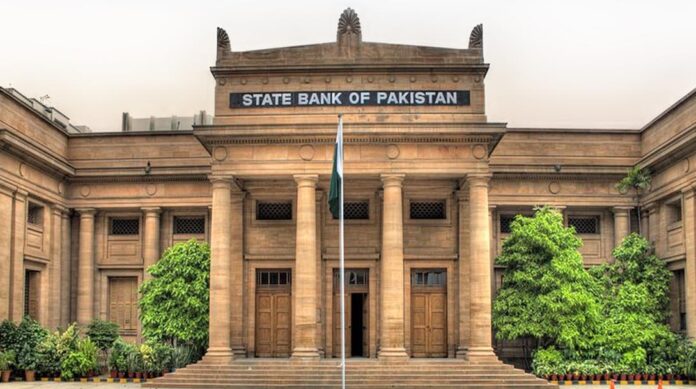

The State Bank of Pakistan (SBP) on Thursday injected Rs1.14 trillion into the money market through a combination of conventional and Islamic Open Market Operations (OMOs) to ease liquidity pressures in the banking system.

Of the total, Rs970 billion were injected through conventional reverse repo OMOs, while Rs178 billion were provided via Shariah-compliant Modarabah-based OMOs, according to data released by the central bank.

Breakdown of conventional OMO:

-

7-day tenor: Rs250 billion accepted at 11.10%

-

14-day tenor: Rs720 billion accepted at 11.08%

Breakdown of Shariah-compliant OMO:

-

6-day tenor: Rs90 billion accepted at 11.10%

-

14-day tenor: Rs88 billion accepted at 11.10%

SBP uses OMOs to regulate liquidity in the interbank market. Injection OMOs allow the central bank to lend money to banks against collateral such as Market Treasury Bills (MTBs) and Pakistan Investment Bonds (PIBs), addressing short-term liquidity shortages. For Islamic banks, GOP Ijara Sukuk are used as eligible securities under Bai-Muajjal and Modarabah-based structures.

These operations signal the central bank’s efforts to maintain market stability and monetary transmission amid evolving macroeconomic conditions.