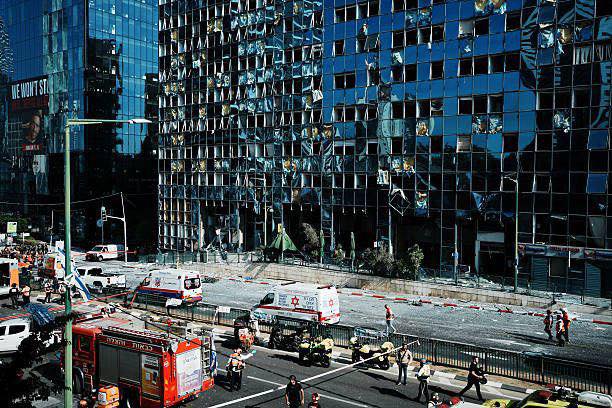

Iran launched missile strikes across multiple locations in Israel on Thursday, including Tel Aviv and Be’er Sheva, damaging key infrastructure such as the Tel Aviv Stock Exchange (TASE) building.

According to Al Jazeera and other local media, the TASE building sustained significant damage, while Israel’s Magen David Adom rescue service confirmed that at least 32 people were injured in the attacks.

The strikes followed Israel’s recent operation, codenamed Operation Rising Lion, which involved targeted airstrikes on Iranian nuclear facilities, missile sites, and military leadership. Defence Minister Israel Katz declared a “special situation” and issued threats against Iran’s Supreme Leader.

Iran warned the U.S. against intervening, saying “all options are on the table.”

Despite the direct hit on its building, the Tel Aviv Stock Exchange rallied sharply.

The TASE index rose 4.26% intraday to 6,311 on Thursday, marking a nearly 14% gain since the conflict escalated. The All Share Index increased 0.5% to reach 2,574.89 points.

The blue-chip Tel Aviv-35 and broader Tel Aviv-125 indices hit fresh 52-week highs at 2,810.85 and 2,850.08, respectively. TASE closed the day at 6,161.00 Israeli shekels, up 1.67% from Wednesday.

The TA-125 index climbed 5% in June, adding to a 6.55% gain in May and 4.53% in April. Experts cite strong market fundamentals, robust liquidity, and limited expectations of prolonged escalation as reasons behind the rally.

Finance Minister Bezalel Smotrich described the market’s resilience as Israel’s economic strength, while Defence Minister Katz indicated easing domestic restrictions.