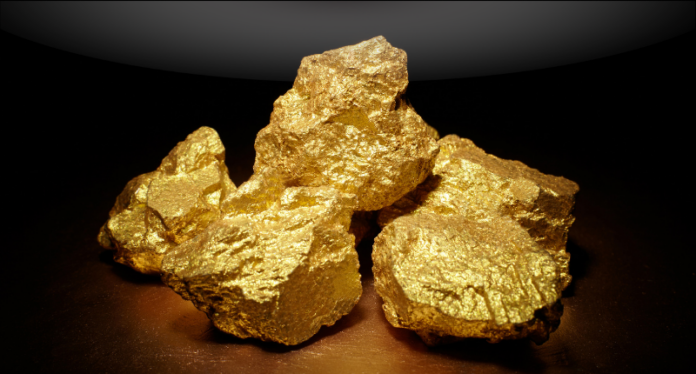

Gold hit a record high on Thursday, rising for a fifth session, as investors ramped up their safe-haven bets amid rising trade tensions between the world’s two largest economies, a U.S. federal government shutdown and heightened rate-cut bets.

Spot gold was up 0.8% at an all-time peak of $4,241.77 per ounce, as of 0311 GMT. U.S. gold futures for December delivery gained 1.2% to $4,253.70.

U.S. officials on Wednesday criticised China’s expanded rare-earth export controls, describing them as a threat to global supply chains, while signalling potential retaliatory measures. The two countries introduced reciprocal port fees on each other’s ships on Tuesday.

“The commentary from the Fed that emphasized higher prospect of rate cuts going forward is supportive, while U.S President Donald Trump turning around and labelling this a trade war is clearly providing a pretty strong impetus for gold,” said OANDA senior analyst Kyle Rodda.

U.S. Treasury Secretary Bessent added that Washington had further measures it could deploy, including export controls, if Beijing proceeded, and was also ready to impose tariffs on China over its purchases of Russian oil, as long as European partners joined in.

The two-week-old federal government shutdown may cost the U.S. economy as much as $15 billion a week in lost production, a Treasury official said on Wednesday.

Investors anticipate a near-certain 25-basis-point rate cut at this month’s U.S. Federal Reserve meeting, followed by another in December.

Non-yielding gold, which has gained 61% so far this year, on a combination of factors, including geopolitical risks, interest rate cut bets, central bank buying, de-dollarization, and robust inflows into gold-backed exchange-traded funds, tends to do well in a low-interest-rate environment.

ANZ said that it expects gold prices to reach $4,400 per ounce by year-end.

Holdings of the SPDR Gold Trust, the largest gold-backed ETF, increased to 1,022.60 tons on Wednesday, their highest since July 2022.

Spot silver was up 0.2% at $53.17 per ounce on Thursday, after having hit a record high of $53.60 earlier this week, tracking gold’s rally and short squeeze in spot market.

Platinum gained 0.7% at $1,671.65 and palladium rose 0.8% to $1,548.75.