Pakistan’s cement sector is doing well – just last November, the sector posted a profit after four consecutive quarters of losses. Part of this has to do with the uptick in demand for cement: the federal government announced a construction package in April 2020, in an effort to boost the sector.

For instance, investors will be granted a waiver of up to 90% on tax, if they are investing in construction projects under the Naya Pakistan Housing Scheme. The industry will also have a fixed tax regime, instead of taxes on profits. Commercial banks were also told to allocate 5% of their total lending to the construction sector (banks’ current exposure to the sector is only at 1% of overall advances).

All of the above means more cement. And one company has noticed: Cherat Cement. In a notice issued to the Pakistan Stock Exchange on January 18, the company said that in the most recent board meeting, the directors decided to undertake BMR (balancing, modernization and replacement), for Cement Line 1 and install a main Crusher. The improvement of Cement line 1, and the new crusher will cost Rs. 3.5 billion, for which Cherat Cement is taking out long term loans.

“These measures will help improve the operational efficiencies of the company,” Cherat Cement said.

Some context: Cherat Cement was started in 1981, and produces cement and clinker. The company’s head office is in Karachi, while its sales offices are in Peshawar, Lahore and Islamabad. Its factory is in Nowshera, which explains why its main export partner is Afghanistan. While it distributes to 73 cities across Pakistan, it delivers to six cities in our western neighbour: Jalalabad, Kabul, Kadhar, Khost, Kunduz and Mazar-i-Sharif.

It is part of the Ghulam Faruque Group, founded by Ghulam Faruque, who served as the chairman of the Pakistan Industrial Development Corporation (PIDC) in the 1960s, which is also the decade he managed to get control of PIDC assets like the Mirpurkhas Sugar mill (founded in 1964). Cherat Packaging, which makes cement bags, was started in 1992. The group also owns Greaves Pakistan, which specializes in engineering equipment. Faruque Group, the parent company, owns 21.92% of Cherat Cement, while Cherat Packaging owns 2.74%, Mirpurkhas Sugar Mills owns 3.27%, and Greaves owns 1.25%. The company is still run by a member of the Faruque family: Azam Faruque, the CEO of Cherat Cement. Faruque is a computer science graduate from Princeton University, and an MBA holder from the University of Chicago, Booth School of Business.

In 1985, the production capacity of the company stood at 1100 tons a day, which increased to 1400 tons a day by 1988, and 2300 tons by 1994. That year a roller press was also installed at the mill and cement area. In 2002, the Cherat Electric was merged with Cherat Cement, and the company switched from using furnace oil to incorporating a coal mill. By 2005, the expansion was increased to Rs3300 tons a day.

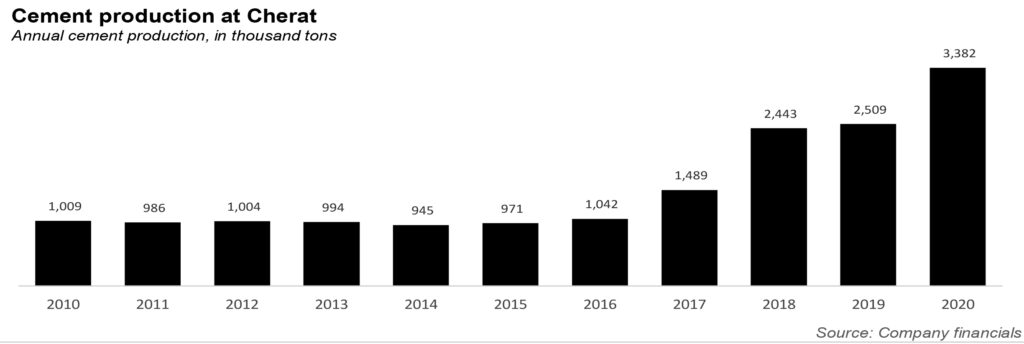

The company for the next few years focused on improving its existing infrastructure: installing a waste heat recovery in 2010, a refuse derived fuel processing plant in 2013. Then in 2014, work started on a second cement line, with a clinker capacity of 4200 tons a day, which began production in 2017. A third line was commissioned that very year, which then started production in 2019, with a capacity of 6,700 tons a day. Today, the company has an annual installed capacity exceeding 4.5 million tons.

Cherat has been fixated on fixing its fuel supply. For instance,in 2019 the company installed three dual fuels generators of 9.7 MW. It also completed its 5 MMCFD Gas Pipeline Project in 2020, on which work had started in 2010. The project will supply gas to the new fuel generators. It also started work on a solar project of 13 MW in 2020 as well, acquiring land for the project. It is also receiving cheaper electricity through an energy purchase agreement from Pakhtunkhwa Energy Development Organization.

All in all, the company generates around 80.2% of its electric needs. There is a specific reason why Cherat Cement is so obsessed with fuel efficiency: imported fuel (coal) represents a significant part of costs of sales, at 33%. According to the company’s latest financials, a fluctuation in the exchange rate by 10% causes a 3.22% increase in the cost of sales.

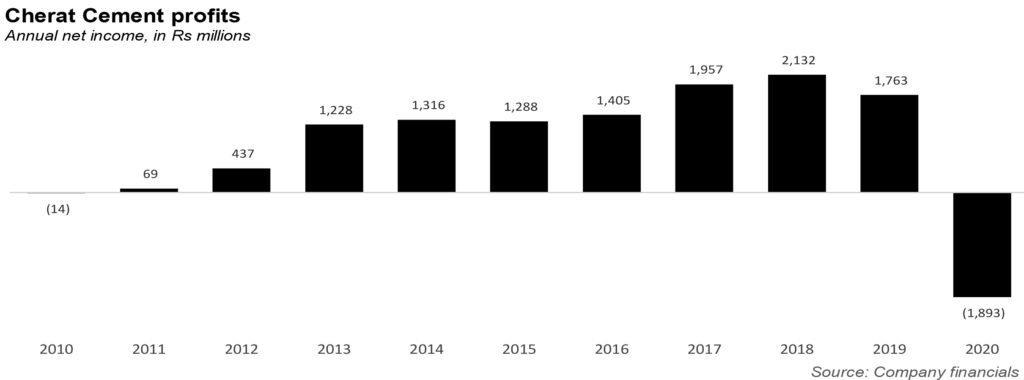

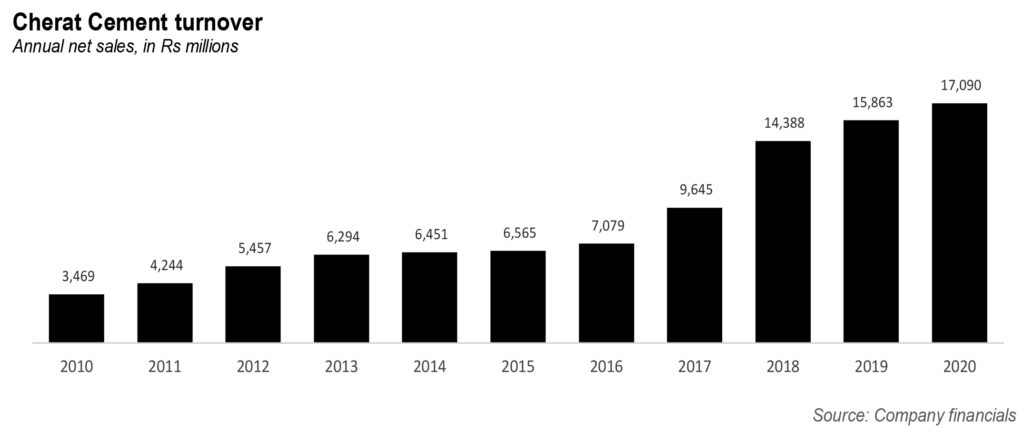

The costs of sales have been a bother for the company. For instance, according to the company’s annual report, between 2015 and 2018, the company’s top line showed significant growth mainly due to increased production capacity to meet the growing industry demand, which led to a sharp rise in turnover.

But Cherat Cement noted: “Vulnerabilities in cement retention price have also been observed over the years. The gross profit and net profit have shrunk over the past two years mainly due to decrease in cement retention prices, inflationary pressures on production costs and significant increase in finance cost.”

Still, the year 2020 was a good one for the company, even if it was the only year in 10 years that experienced a loss. According to Chert, there was a 35% increase in the aggregate cement dispatches, due to the higher production capacity for the entire year following the commissioning of cement line III in January 2019. Local sales of the company increased by 36%, and export sales to Afghanistan rose by 32%. In fact, exports could have been higher were it not for the closure of the border due to the Covid-19 pandemic.