Prime Minister Imran Khan on Tuesday, approved multiple reforms to facilitate the IT, freelancer and startup sector. Included in the reforms were tax benefits as well as other fiscal and non-fiscal incentives.

The approval was made in a meeting chaired by the prime minister where officials of the Ministry of IT & Telecommunication, Pakistan Software Export Board (PSEB), State Bank of Pakistan, Federal Board of Revenue, Special Technology Zone Authority and Ignite National Technology Fund were also present in the meeting.

“Long outstanding issue of IT companies regarding easy inflow/outflow of Foreign Currency, has also been addressed as Specialized Foreign Currency (FCY) accounts for IT/ITES Companies and Freelancers will be introduced to meet their operational needs. PM has directed to allow IT/ITES Companies and Freelancers to retain 100% of remittances received through proper banking channels, in FCY Accounts without any compulsion to convert them into PKR.”, The official press releases stated.

Additionally, outward remittances from FCY account for PSEB registered IT Companies and Freelancers will be facilitated through lifting of restrictions. The Prime Minister also directed SBP to introduce Financing streams for the IT/ITES sector and Freelancers keeping in view operational architecture and industry needs for these sectors. While the proposed reforms also suggested the use of registered Firms/Professional’s USD balance as collateral for financing.

Recommendations of Pakistan Technology Startup Fund was also approved by the Prime Minister for the creation of a public private partnership venture capital fund. As per the official statement,“ Ignite National Technology Fund will create this Fund through Public private partnership.”

The objectives and structure of the fund will include; (1) Providing seed funding to 30-50 startups annually, (2) Rs. 500 Million to 1 Billion to be invested each year by IGNITE – matched by private investor(s) (3) Operations to be managed by a VC from private sector

(4) Overseas Pakistanis to be invited to participate in the fund.

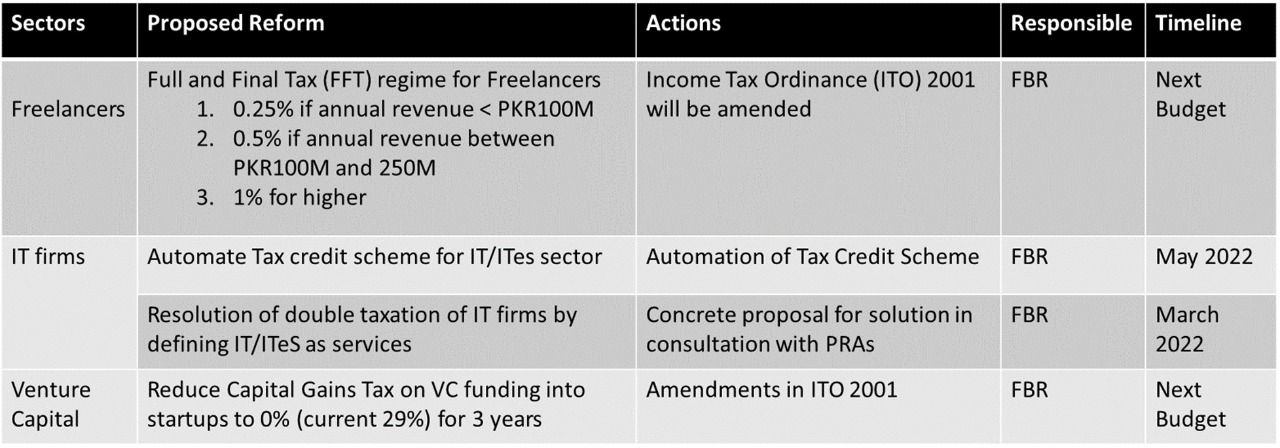

The proposed reforms also included suggestions on amending the tax regime for the IT and ITES Firms and Professionals. As per the document released, “Tax exemption for IT/ITES Firms and Freelancers for 5 years to be implemented through amending the Income Tax Ordinance 2001 by April, 2022.”

The sector suffered from double taxation as its services were charged taxes at a business level as well as at an individual level when the profits were distributed to shareholders. The proposed reforms also aim to resolve this issue by onboarding all stakeholders.

Furthermore, certain sectors of Islamabad are proposed to be declared as special technology zones after which a similar concept is to be replicated in Lahore, Karachi, Peshawar and Quetta.

The reforms are an attempt by the government to encourage the IT and ITES sector to bring in their foreign remittances to Pakistan (currently, parked in offshore accounts). While also encouraging foreign businesses and Vc firms to invest in Pakistan and Pakistani startups that will help create jobs for the skilled youth bulge of the country.

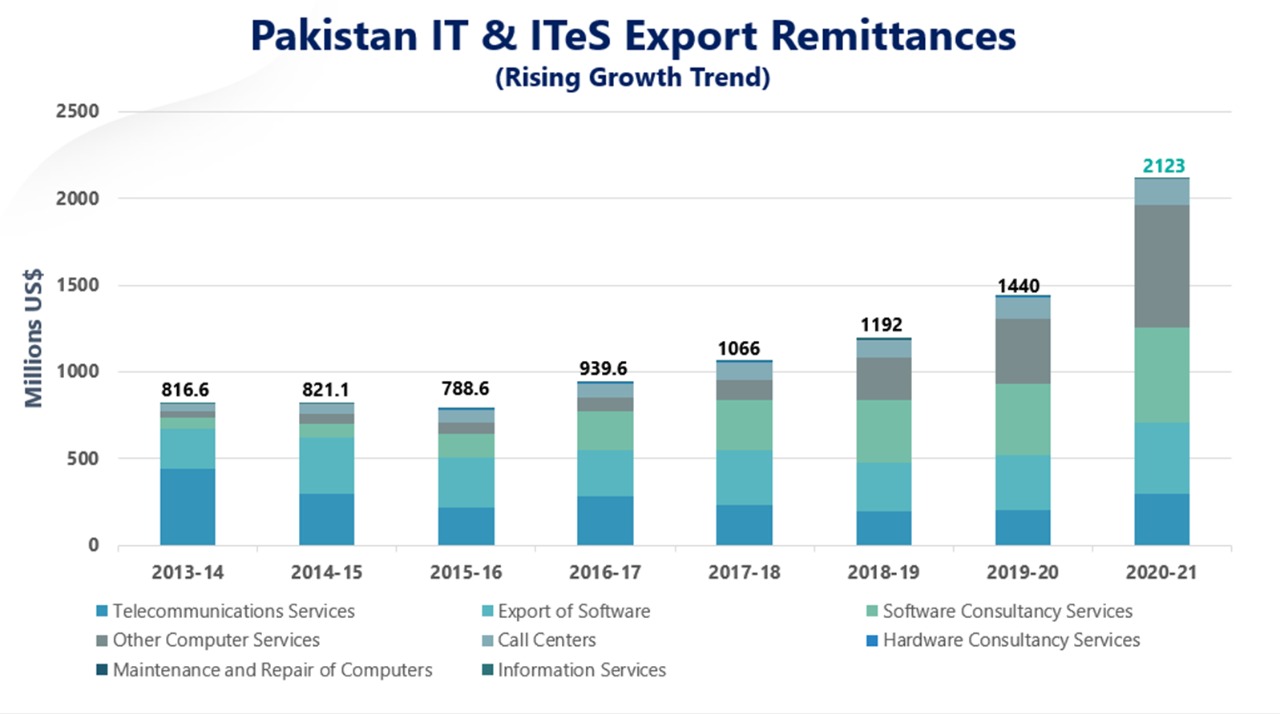

The IT and ITeS sector has been labeled as the backbone of Pakistan’s future growth. The industry brought in more than $2 Billion of revenues in the last fiscal years. While as per MoiTT, Pakistani freelancers alone generated $216.788 million by exporting their services in the first half of fiscal year 2021-22 from July to December 2021, an increase of 16.74 percent from the same period last year.

Ahtasham Ahmad good article writer and that is good article written.

I Think this is best news for IT sector and specially for Freelancers

Prime Minister Imran Khan on Tuesday, approved multiple reforms to facilitate the IT, freelancer and startup sector. Included in the reforms were tax benefits as well as other fiscal and non-fiscal incentives.