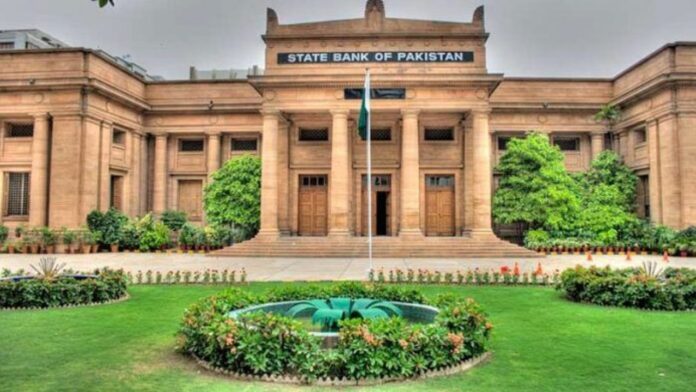

KARACHI: The State Bank of Pakistan (SBP) accepted bids worth Rs132.89 billion on Thursday’s July 14 auction of Pakistan Investment Bonds (PIBs) against a target of Rs150 billion. The entirety was lifted through 3 year and 5 year PIBs.

Interesting to note is the fact that while bids of Rs149.67 billion were placed in 3 year PIBs, the government only raised Rs7 billion despite having a target of Rs50 billion. This was done at a rate of 14%, signifying that the government did not want to lock itself in at this rate for the next three years.

The cut-off yield for 3 month PIBs has increased by 3 bps compared to the last auction on 14 July.

The remaining Rs125.89 billion was raised through 5 year PIBs; which was raised at a rate of 13.45%.

Bids for 10 year and 15 year were rejected; whereas no bids were placed on the 20 year PIB and 30 year PIB.

On Wednesday, the same day as the Treasury Bill (t-bill) auction where banks had a heavy hand, the 6 month KIBOR hit an all-time high after increasing 35 bps in a day reaching 15.87%.

Tahir Abbas, Head of Research at Arif Habib Limited explains, “The KIBOR has adjusted accordingly after the last monetary policy committee decided to hike rates.”

Announcement of Primary Dealers

On Wednesday, the SBP appointed 12 banks as Primary Dealers (PDs) of government securities, along with two companies as Special Purpose Primary Dealers (SPDs) for the FY 2022-23.

Primary Dealers appointed for the fiscal year include Bank Al-Falah Limited, Habib Bank Limited, National Bank of Pakistan, United Bank Limited, MCB Bank Limited, JS Bank Limited, Standard Chartered Bank (Pakistan) Limited, Pak Oman Investment Company Limited, The Bank of Punjab, CitiBank N.A-Pakistan Operations, Industrial and Commercial Bank Of China-Pakistan Operations, and Habib Metropolitan Bank Limited.

SPDs include the National Clearing Company of Pakistan Limited and the Central Depository Company of Pakistan.

Based on an evaluation by the SBP the top three performing PDs during FY 2021-22 were Bank Al-Falah Limited, Habib Bank Limited, and National Bank of Pakistan.