With over twenty-eight years of hands on multi-disciplinary experience in corporate/investment banking & advisory, financial management and more, Nabeel Syed, current advisor to chairman at the Pathfinder Group Pakistan, sit down for an interview with Profit.

What was the motivation behind the establishment of VRG and the role is it playing in financial inclusion?

Nabeel Syed: According to CGAP, it is estimated that around 1.2 billion adults world-wide were able to gain access to formal financial accounts for the first time between 2011 and 2017, which represents a 35% growth. This tremendous feat was achieved due to the efforts of players other than banks such as mobile money operators and fin-techs which were supported by Government initiatives to bring the “un-banked” within the financial system.

Despite this achievement, 1.7 billion people remain excluded even from having basic accounts which is quite significant and highlights the potential for growth. A major stumbling block for establishing bank accounts is the psyche of banks, as they do not entertain this customer segment of the under privileged. It is quite clear that true financial inclusion is not possible without the deployment of digital solutions and necessitates that it has cost-saving features for all stake holders.

The concept of establishing VRG was initiated in 2012, when the Sehgal family realized that in order to uplift the condition of the under-privileged, the starting point is “financial inclusion”. The foundation of this is to have a bank account/wallet which serves as an identity and then can be engaged for financial support from the formal banking sector for credit (nano-loans, housing, buy now pay later), savings and insurance products. Without having access to finance, the poor are stuck in the vicious circle of poverty wherein the poor run short of money and have to borrow at exorbitant rates from informal channels which in turn leaves no space for paying for essentials such as grocery, education, medical; and never allowing them to rise above the poverty line.

Thus, the Virtual Remittance Gateway (VRG) was established in 2013 and since then has maintained a clear focus of providing financial services as an enabler and a disruptor through a secure/regulated platform for a number of industries. The company has developed cost effective products with advanced technologies under a B2B model that provides convenience in payments to the un-banked / low end customers for their banking, financial needs. VRG has a proprietary system that has been designed and created by its in-house technology team for the sole purpose of digital financial inclusion under a unified payment platform that enables information exchange for creating a knowledge based economy.

In a recent WEF meeting it was stated that there are quite a few challenges in Pakistan for formalization of the economy, resolution of which will in turn lead to easy access to affordable credit, savings, insurance products and far-reaching effect on the economic growth, stability and prosperity. Also the lack of financial knowledge limits the usefulness of the accounts, resulting in low usage and impact.

From a financial institution’s perspective, the critical barriers to serve low or even middle income customers tend to be high operational cost which include distribution costs, IT systems and product development practices. As the FIs have limited physical distribution/outreach, outdated IT systems which are expensive to upgrade, and as product practices are slow to adopt more agile approaches, they are less responsive to customer needs. This niche was picked-up by mobile money operators and FinTechs in many markets to serve large number of low-income customers by taking over the payments arena with wallets / accounts. However, their eco-system and focus remains on the payment functions and low emphasis on credit, savings, insurance, and investment products.

NS: What is the Asaan Mobile Account (AMA) scheme and what synergies does it have with the VRG platform?

VRG’s digital payment platform comprises of all branchless banking institutions and four telecom operators, making it a many-to-many interoperable platform that can enable the entire 196.8 million telecom subscribers in Pakistan to perform digital payments with end-to-end transparency and authenticity at an affordable cost. This is of utmost importance to ensure regulatory compliances of KYC/AML/CFT etc. as well as facilitate the underbanked towards adopting digital payments and make it a cash-lite society.

The AMA scheme is a World Bank initiative by the State Bank of Pakistan (SBP) for a Third Party Service Provider (TPSP). As the telecom operators are an integral part of the many-to-many model, therefore the TPSP is jointly regulated by SBP and Pakistan Telecommunication Authority (PTA).

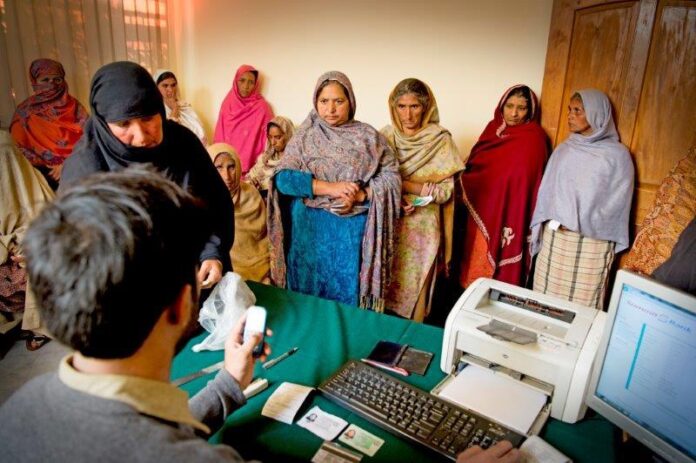

As the only TPSP license holder, VRG has become a natural partner for the Asaan Mobile Account (AMA) Scheme enables anyone with a basic or feature mobile phone to open a digital transaction account swiftly through a USSD (Unstructured Supplementary Service Data) code/string from anywhere at any time. This will also transform banking services allowing banks to shift their focus from ‘Over-the-Counter’ (OTC) services to branchless banking (BB) accounts. The AMA Scheme is also critical for Women Empowerment and we have had reasonable success in attracting women to open accounts which presently stand at 32% of the total accounts opened under this scheme.

AMA scheme is accessible by dialing *2262#, the system guides the end user to open a bank account with any of the branchless financial institutions by providing CNIC# and issuance date only. The system does real-time verification of the persons’ ID using CNIC/MSISDN pairing and routes the bank account opening request to respective bank using the AMA scheme platform. After the KYC is performed by the bank, an account is opened and intimation is given to the account holder; the complete process of account opening takes ~90 seconds. The end user can then avail banking services such as Balance Inquiry, Mini Statement, Local Fund Transfer, Inter-Bank Fund Transfer, Utility Bill Payment, Mobile Top-up after setting up the M-Pin. In future this scheme will enable many other digital payment services like school fee, transportation fare, challans/invoices, grocery, saving account, micro loans and insurance products.

Another upcoming unique feature of this platform is the concept of “interoperability” on the telecommunication side for access to USSD network which remains blocked by telecom operators and dependent on their own Branchless banking (BB) agents. This hampers growth as these BB agents (612K at present) must hold bank accounts with all relevant banks to undertake liquidity transfers for performing cash-in and cash-out services. The TPSP license provides VRG the first mover advantage, as it is the only company that can solve this problem and allow Branchless Banking Institutions to access all the BB agents and thus doing away with the need to have multiple bank accounts.

How do you envisage the role of VRG’s financial services & AMA scheme in reaching out to the masses who are less tech-savvy and financially literate?

NS: VRG has been able to bring together on its platform an Integrated National ID system (NADRA), on-line Financial Access (Banks/FIs) and IT/Telecom infrastructure which are the key aspects in developing a low cost end-to-end eco-system for financial inclusion.

There are various business models for financial inclusion however the key element is to unbundle value chains in such a way that provide benefit to low-income customers. The innovation by fin-techs provides access through different touch points, at lower cost, with fewer pre-conditions, and less administrative formalities all of which are available in VRG’s products. VRG’s products are bi-lingual therefore these can be understood by the masses. As youtube and facebook are among the top social media platforms in Pakistan, VRG has developed tutorials on operations of accounts. The advertisement campaign for the launch is also in urdu which will go a long way towards creating awareness.

We wish to elaborate that total financial transactions performed till Jun 30 are 5.85 Million. These include Interbank Fund Transfer (IBFT), Local Fund Transfer (LFT) and Utility Bill Payment (UBP). In terms of financial transaction types, LFTs contribute 48.9% followed by IBFTs & UBPs at 35.4% and 15.8% respectively. In regional terms, Punjab leads the way contributing 58.2% of total transactions followed by KPK and Sindh at 21.25% and 11.1% respectively. In gender terms, transactions by females in Punjab are high as compared to other provinces, accounting for 81.2% of total financial transactions conducted by females. However, female inclusion remains low in Balochistan & KPK and expected to improve considerably after the formal launch of AMA scheme.

NS: What technology is deployed for the AMA scheme and other products offered by VRG?

VRG’s robust and intelligent TPSP platform is a PA-DSS certified and VA/PT audited platform making VRG an ideal financial services enabler for Banks, telecom operators and FinTechs. SBP, PTA and law enforcement agencies have inspected and approved VRG’s platform from security, reliability, robustness and operational standpoints.

VRG’s in-house technological capabilities allow it to improve specific functions of the banking value chain which are outsourced end-to-end, to third-party suppliers like VRG. Its Unique Selling Proposition (USP) is to develop discrete modules having the features of Customization, Flexibility and Plug and Play. This modularization works under an outsourcing or partnership arrangement and provides technology at a lower cost, higher speed, and improved quality.

For customer financial services, this approach enables new and existing players to provide user-friendly, lower-cost solutions into the hands of less privileged customers so that they can use them to improve their lives.

It is important to highlight that VRG is fully aware and working on the new digital banking models that require the following elements:

- Distribution: Physical touch points for distributing products

- Capital: Provision of capital, risk management

- Products: Design and roll-out tailor-made financial products and services

- Customer relationships: Customer acquisition and service

NS: Given that VRG was established in 2013 and has only recently been allowed to offer commercial launch, how has it been able to sustain itself i.e. the funding sources?

This is an extremely important question, and sets VRG apart from the fin-techs and start-ups which were launched over the last few years and now in the doldrums as funding from VCs and investors has now dried-up and future seems uncertain.

VRG is an 100% equity financed entity by Mr. Ikram Sehgal and his family with no external financial support from any government or donor related entities. Thus the completion risk, operational risk and technology risks have been fully mitigated as the required investments for infrastructure, software business development, and HR have been undertaken and operations are underway. We are now seeking growth capital that is required for scalability and enhancement in the platform and new business initiatives.

It is interesting to mention here that a few years back, our Chairman Mr. Ikram Sehgal approached the highest level in the Karandaaz Board for having technical financing. Despite an initial positive nod, they expressed their inability to finance VRG as some internal modalities could not be worked out, much to our dismay as we considered them staunch proponents of not having an Elitist State and Institutional Reforms for Governance.

We are quite proud and content that no external financing has been taken to-date and that the induction of a partner may have distracted our focus. As VRG’s case is quite different from other start-ups and early stage financing, as we have already commenced full operations, our approach is to acquire private equity, thus the present bearish trend in the VC financing has minimum impact for us.

NS: What growth do you expect from VRG after the up-coming formal launch of the SBP AMA Scheme and which new products will be launched in future?

We consider that VRG is a key player for implementing the National Financial Inclusion Strategy (NFIS). The target of having by 2023 at least 50% of Pakistan’s adult population and 25% of the total adult women population, warrants that access to transactional accounts can only be undertaken by a technology driven platform that can reach the masses without the bricks and mortar branch network. Thus the SBP AMA Scheme is the stepping stone for affordable credit, insurance and saving products. We consider this as a pathway for the low-end customers, to realize their dream of owning a house “Makan”.

We believe that VRG is a game changer for Pakistan and other countries that do not have the know-how, branch/agent network, and infrastructure to undertake financial inclusion on a fast track basis. Our model for providing financial access to the underprivileged can be replicated across the globe and which can have wide ranging social and economic benefits for the masses. As SBP and PTA have been fully supportive of our initiatives we consider that new product development and adding more features to existing product portfolio is a limited regulatory risk.

VRG has the flexibility and scalability to add B2C business or develop joint products for end-customers. Even within the financial sector, the same platform can be leveraged for expanding into value added services such as other payment mechanisms, remittances, credits assessment, wealth management and insurance can be undertaken by collaborating with established players. Furthermore, this capability can now be applied beyond national borders for a global digital economy.

We expect that after the formal launch of the AMA scheme shortly, with a massive advertisement campaign, the number of customers may reach 20 million within a period of three months.