KARACHI: Why would a South Sudanese bank want to invest over $50 million in a small Pakistani commercial bank? The question was raised early on Thursday morning when a notification hit the Pakistan Stock Exchange (PSX) announcing that the International Commercial Bank of South Sudan (ICB) had expressed its interest in investing up to 50 million euros ($54.5 million) in Pakistan’s Silkbank Limited (SILK).

Silkbank’s Board of Directors (BoD) held a meeting on April 5, 2023, in which it reviewed and considered the letter of intention and granted its approval to the management to formally pursue the potential investment. But what does it mean?

What’s in it for Silkbank

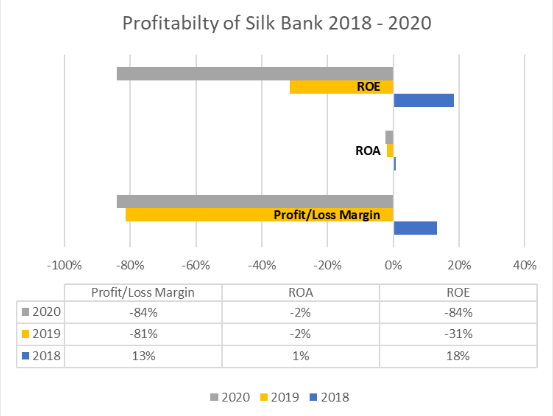

In short, the bank needs the money. Silkbank, formerly the Saudi-Pak Commercial Bank, despite its relatively small size has a fairly good position in the consumer segment with a portfolio of services consisting of consumer loans, and credit cards. But it has been struggling recently and has found itself in a less than desirable financial position in the last few years. The bank reported a profit of Rs 13.2 billion in 2018. Thereafter, it reported a net loss of Rs 3.95 billion in 2019 which increased to Rs 6.57 billion at the end of 2020.

The bank’s return on equity (ROE), and return on assets (ROA) followed a similar suit. ROA and ROE stood at 1% and 18% respectively. In 2019, ROA and ROE deteriorated to -2% and -31% respectively. They continued to decline in 2020. In 2020, ROA stood at -2% whereas ROE was -84%.

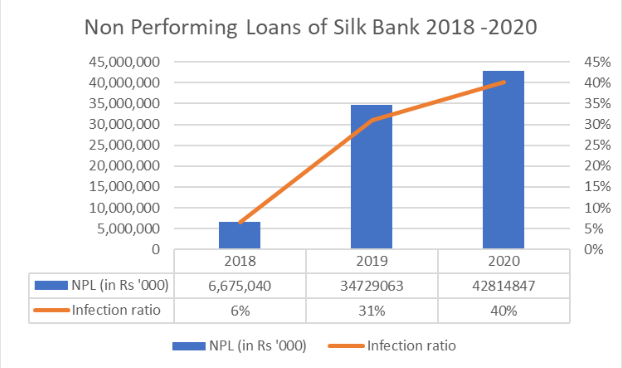

The bank’s non performing loans have been increasing consistently. The increasing trend in the infection ratio from 6% in 2018 to 31% in 2019 and further to 40% in 2020 shows that the bank’s loan portfolio has experienced a significant deterioration in terms of loan performance and credit quality over the three-year period.

Earlier this year, Silkbank said in a press release that the bank is on a growth trajectory. But annual reports have not been made available to the public. The bank did experience some positive indicators as well during this time period. Deposits increased from Rs 132.7 billion in 2018 by 12% to Rs 148.9 billion in 2019. This trend continued in 2020 where deposits increased by 8% to Rs 160.2 billion.

The Sudanese equation

The South Sudanese bank in question was founded in 2011 by a group of businessmen and is backed by the International Investment Consortium, an investment fund from Malaysia. The fund, according to its website already has invetsment interests in many developing countries including Pakistan. So this much is clear, this will not be the first time international Investment Consortium will be looking at Pakistan, nor the first time it will be investing in a bank.

And the interest in Silkbank is nothing strange either, and nor is this the first time that the Silk bank has attracted the attention of acquirers. In early 2021, Fauji Foundation, which has a stake in Askari Bank, expressed interest to acquire a major stake in Silk Bank. When that deal fell through, Habib Bank Limited (HBL) and Bank Alfalah separately interested in acquiring Silk Bank’s cosnumer portfolio in mid 2021. In May 2022, Park View Enclave (Private) Limited (PVEL), owned by businessman and politician Aleem Khan, expressed interest in acquiring 51% of the stake in Silk Bank.

Who has stakes in Silk Bank?

According to Silk Bank’s latest annual report for the year ending December 2020, around 62.91% of the bank’s shares are held by associated companies and related parties. This includes the Arif Habib Corporation which holds 28.23%, seasoned banker Shaukat Tarin who holds 11.55%, the International Finance Corporation which holds 7.74%, Zulqurnain Nawaz Chattha who holds 7.76%, Nomura European Investment Ltd which 3.93%, and Bank of Muscat which holds 3.48%.

Separately, the directors and chief executive hold 4.62% of the bank’s shares.

A ready platform a basic model! Diversification is a mother of all intelligent investments. The city is fool proof model to recession rather immune! The market is consumer driven therefore idependent of economical distress when it comes to banking. The fintechs are very closely integrating with financial sector. Smart

Can you please comment on doing the investment in shares of SILK Bank. Thanks

Yes plz @snober salim