KARACHI: To expand lending, Standard Chartered Bank Pakistan Limited (SCBL) and British International Investment (BII), the UK’s development finance institution and impact investor have entered into an unfunded Risk-Participation Agreement. Under this agreement, which is subject to authorisation from the State Bank of Pakistan, the two institutions will enter into a $40 million (Rs. 11 billion) program, under which BII will cover 50% of Standard Chartered’s risk on local currency loans to the microfinance sector.

Local currency lending to microfinance institutions in Pakistan is relatively low and the sector relies on foreign currency lending which accounts for approximately 50% of microfinance funding. The program focuses on ‘Wholesale Microfinance Lending’ offering loans to microfinance providers so they can maintain and extend more credit to customers. Through such partnerships, Standard Chartered will be able to drive financial inclusion across traditionally underbanked sectors and ensure access to financing while creating opportunities for sustainable growth.

Through the program, BII will assist Standard Chartered in expanding its outreach in the microfinance sector by establishing it as a long-term local currency lender in the market, in line with the bank’s vision for broader financial inclusion.

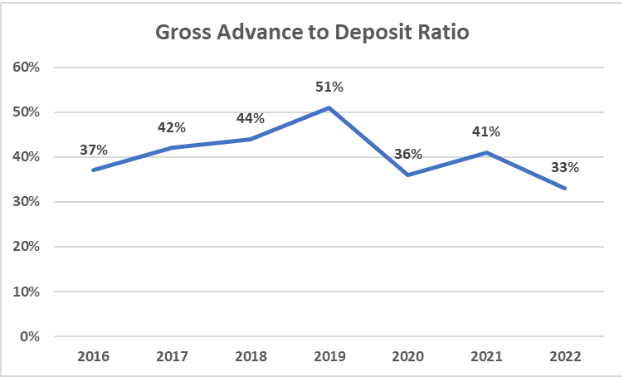

Standard Chartered’s collaboration with BII comes at a crucial time as the bank looks to improve its lending profile after a decline in gross advances. SCBL’s gross advances (loans) witnessed a decline of 7% in 2022, attributed to subdued economic activity, higher interest rates, and a cautious lending approach. As a result, SCBL’s gross advance-to-deposit ratio (ADR) also hit a record low of 33%, which is the lowest in the last seven years for SCBL. It is also the lowest ADR recorded for the banking sector in 2022.

Moreover, the Risk-Participation Agreement also reflects the joint vision of both companies to create a sustainable local currency lender in Pakistan, while also supporting the policy goals of the State Bank of Pakistan, including prioritising lending to sectors such as agriculture, agri-adjacent businesses, small and mediums sized enterprises (SMEs), and women entrepreneurs. Furthermore, this partnership contributes to the United Nations’ Sustainable Development Goals, including enhancing resilience to economic shocks (SDG1), ensuring economic opportunities for women (SDG5), and increasing the formalisation and growth of SMEs (SDG8).

The agreement was celebrated with a signing ceremony in Karachi, commemorating BII’s 75th anniversary and its 35 years of investment worth over $350 million in Pakistan, reaffirming its commitment to financial inclusion

Local currency lending to microfinance institutions in Pakistan is relatively low and the sector relies on foreign currency lending which accounts for approximately 50% of microfinance funding.

This is a wonderful article.

The content you create has always caught my attention.

I just love to read new topics from your blog.

Your writing is perfect and complete.