By this time, you must have heard chatter about Pakistan drawing closer to default. Whether it’s a newspaper analyst, your “know-it-all” uncle or a work colleague, Pakistan’s imminent default is dominating the conversation these days.

This conversation was triggered by the arrest of former Prime Minister Imran Khan on May 9, which sparked political unrest across the country. The persisting political instability poses obstacles for the ongoing International Monetary Fund (IMF) deal, and chances are that it might get delayed further.

In 2019, Pakistan had signed a $6.5 billion bailout package with the IMF, the Extended Fund Facility (EFF). When Imran Khan became the Prime Minister of Pakistan in 2018, he initially sought friendly loans from China, Saudi Arabia and the United Arab Emirates to prevent tough IMF conditions.

However, when the economic situation worsened in 2019, his government reached out to the IMF. The loan was negotiated on IMF conditions which involved hike in energy tariffs, removal of energy subsidies and increase in taxation. The PTI government had difficulty fulfilling commitments made to the Fund. Soon after the party’ popularity took a hit due to the deteriorating economic conditions, the IMF became secondary to political capital. When it became clear that the government was going to be removed, a Rs 10 fuel subsidy, in direct contradiction to one of the IMF’s fundamental conditions, was announced. It was perhaps the last major decision the PTI federal government took before Imran Khan was removed from office in April 2022.

With the new Shehbaz Sharif government in place, Finance Minister Miftah Isamil was able to secure a $1.1 billion tranche from the IMF in August of 2022, in addition to increasing the EFF size to $6.5 billion from $6 billion. This was the last tranche the Fund released to Pakistan.

After continuous delays and setbacks, including the replacement of Miftah with Ishar Darm an agreement was reached in February 2023 as part of which the IMF agreed to release another tranche of $1.1 bn to prevent Pakistan from default, given that Pakistan would abide by IMF conditions. Those conditions have so far not been met.

In the context of political turmoil, “it looks increasingly difficult for Pakistan to avoid a default in the absence of fresh funding support coming in,” said Eng Tat Low, an emerging-market sovereign analyst at Columbia Threadneedle Investments in Singapore.

“I am also growing more skeptical about whether an IMF deal is going to come through. Their heavy debt amortisation against precarious reserves would suggest default is imminent,” he informed The Business Standard.

According to Columbia Threadneedle, external debt service is estimated at about $22 bn. Furthermore, dollar bonds due to mature in 2031 declined to the lowest since November on May 17,

Given the crisis, it’ll be worthwhile to revisit the developments related to the IMF bailout package, negotiations for which have been ongoing since February. Profit traces a timeline of these events.

February

In early February 2023, after much deliberation Pakistan reached an agreement with the International Monetary Fund (IMF) to restart the stalled EFF. The agreement entailed conditions as part of which the IMF would release about $1.1 billion in financial aid to Pakistan- critical aid to prevent Pakistan from economic collapse.

In 2019, Pakistan had signed a $6 bn bailout package with the IMF, with an additional $1 bn added to the programme later that year. However, the first payment of $1.1 bn had been stalled since December as Pakistan struggled to meet targets set by the lender .

In August 2022, the IMF board approved the seventh and eighth reviews of Pakistan’s bailout programme, which would release $1.17bn in funds to the cash-strapped economy. Miftah Ismail, the finance minister at the time, played a key role in the negotiations.

The new agreement followed months of deeply unpopular belt-tightening by the government of Shehbaz Sharif, who took power in April 2022 and eliminated fuel subsidies and introduced new measures to widen the tax base. According to Ismail, the government’s “corrective” measures had saved Pakistan from default.

However, Ismail handed in his resignation in September 2022. His departure came after months of speculation that Nawaz Sharif (PML-N leader) and Ishaq Dar (leading PML-N politician) had been unhappy with some of his salient decisions, especially the fuel price hike.

Mr Ismail said, “My job was to save Pakistan from default and I did that. With the floods, the situation has become more challenging but I have faith that we will not be abandoned by the international financial community. I hope the gains made and the fiscal space created will be retained in the long run.”

After assuming power, Dar, the new Finance Minister said, “we will try to make sure that Pakistan completes its second IMF programme in its history.”

He assured that the government would implement fiscal measures demanded by the IMF, including raising Rs. 170bn ($627m) through taxation. Additionally, commitments to increase fuel taxes would be completed with diesel levies to be doubled to Rs5 per litre on March 1 and again on April 1 in 2023.

Other measures demanded by the IMF included reversing subsidies in the power, export and farming sectors, and raising the key policy rate.

By February 16, the government of Pakistan had tabled a Rs 170bn ($643m) finance bill to help the cash-strapped economy secure funds from the IMF and avoid default. These measures included increasing the general sales tax by 18% and following hikes in the price of fuel and gas earlier that week to meet the IMF conditions of the release of $1.1bn loan, originally due in November 2022.

The bill’s approval was expected to unlock IMF’s $1.1 bn instalment and provide and encourage Pakistan’s allies to provide it with the much-needed external financing. The delay in securing approval had wreaked havoc on the economy however.

Pakistan continued to battle an economic meltdown, aggravated by a balance of payment crisis, record inflation and currency devaluation. Inflation skyrocketed to 27.5%, the country’s highest in nearly 50 years.

Prime Minister Shehbaz Sharif lamented that the economic situation had become “unbearable.”

The crisis was compounded by catastrophic floods in 2022 (June-October), which had caused damage worth $3obn and raised concerns about food security. The ensuing political chaos added more fuel to the fire.

Consequently, Pakistan’s foreign exchange reserves declined to $2.9bn during the week ending February 3. Experts stirred alarm that reserves would last less than 20 days and a delay in an IMF payout could have dire repercussions.

Economist Haris Gazdar informed Al Jazeera that “political commitment” was necessary for the IMF to confer its advantage upon the government of Pakistan.

“IMF conditions are not unfamiliar to Pakistan, which has entered into more than 20 such programmes with the global lender since 1958,” said Gazdar.

“What they (IMF) have asked of us include revenue collection, non-interference with exchange rate etc. Since the relationship between these variables and actual economic outcomes is never precise, there is room for genuine disagreement on targets that must be met,” he added. “So, negotiation is part of the deal. But how much space Pakistan gets in the end is partly political.”

Sajid Amin Javed, a senior economist associated with the Sustainable Development Policy Institute in Islamabad further reinstated this, “the overarching problem behind the failure to prevent the IMF programme sooner was the lack of political stability in the country.”

The political instability followed the Prime Minister Imran Khan’s removal through a parliamentary vote of no confidence in April 2022.

March

On March 9, Dar announced that Pakistan was “very close” to signing a staff level agreement with the IMF. This could offer a critical lifeline in tackling the balance of payment crisis.

The Pakistani government began formal negotiations with the IMF on February 1, 2023, to discuss a plan to rescue the economy. They sought to negotiate funds which were part of a $6.5 billion bailout package that the IMF had approved in 2019.

The IMF deal would pave the way for other critical bilateral and multilateral financing avenues for Pakistan.

According to a report from Reuters, Islamabad had met most of the lender’s demands to clear the review. The last one left to be fulfilled involved an assurance on external finance to fund Pakistan’s balance of payment gap for the present fiscal year, which ends on June 30.

Only China had announced the refinancing of a $2 bn loan, and Pakistan’s central bank had already received $1.2 bn of that demand.

On March 24, it was announced that the agreement will be signed after the completion of a few remaining conditions, which included a fuel pricing scheme.

This time, the latest issue was a plan announced by the Prime Minister Shehbaz Sharif to charge affluent consumers more for fuel. The money raised would subsidise prices for the poor, who had been deeply affected by inflation. The plan involved a difference of around Rs100 a litre between the prices paid by the rich and poor, according to the petroleum ministry.

The IMF demanded an explanation for this. Esther Perez Ruiz, IMF’s representative resident in Pakistan said that the government had not consulted the fund about the scheme.

By the week ending March 17, only $4.6 billion in foreign exchange reserves were held by the central bank in Pakistan. This was barely enough to cover about four weeks of necessary imports. Pakistan was therefore desperate for the release of a $1.1 bn tranche from the $6.5 bn IMF bailout.

April

On April 14, Dar tweeted that the United Arab Emirates (UAE) had confirmed to the IMF that it had committed $1 billion in financial support to Pakistan.

Additionally, Jihad Azour, director of the Middle East and Central Asia department at the IMF, informed reporters that Pakistan needed to manage double-digit inflation and maintain monetary policy to promote sustainable growth.

According to a report from VOA News, that week the IMF forecast 27% inflation for Pakistan and reduced the country’s growth outlook to just 0.5% in the coming year.

Economists however worried that the country’s debt problem would harm its citizens.

Uzair Younus, director of the Pakistan Initiative at the Washington-based think tank the Atlantic Council, told VOA that, “given the ongoing crisis, it is likely that Pakistan will require debt restructuring, which would unleash even more pain on ordinary citizens.”

May

The arrest of Imran Khan on May 9 increased risk of default and raised concerns about the possible further delay of the IMF deal. At the same time, external debt service rose to $22 bn.

Pakistan is presently seeking solutions to revive the delayed $6.5 IMF bailout programme. According to a report published in The News, the only apparent solution is to ask China for help.

The Former finance minister and acclaimed economist, Hafiz A Pasha said, “if the IMF doesn’t move forward, then Pakistan would have no alternative but to request China to devise a mechanism to help Islamabad avert this crisis.”

He suggested the Asian Infrastructure Investment Bank (AIIB) as an instrument that could help prevent the payment crisis. “This is not its mandate, but there should be an institution to assume the role of an Asian IMF,” he added.

According to Dr Khan Najeeb, the former finance ministry adviser, “given the weak position of the SBP with reserves at just $4.38 billion and the precarious balance of payment position, the IMF is being extra careful in ensuring that financing needs are adequately met.”

“In case the two sides are unable to reach an agreement, Pakistan would have to continue with heightened import restrictions, a clogged economy, and borrowing and rollovers from friendly countries and others wherever possible,” he concluded.

According to a Business Recorder report from May 17, Saudi Arabia had agreed to deposit $2 billion to meet one of IMF’s conditions, as part of which Pakistan had been asked to arrange external funding reportedly up to $6 bn. Pakistan is to pay four percent annual profit to Saudi Arabia on deposits of $2 bn with the SBP for a period of one year.

In addition to this, the United Arab Emirates (UAE) had also agreed to deposit $1 billion with the SBP.

On 18 May, Aisha Ghaus Pasha, the Minister of State for Finance said that the way forward for Pakistan was to remain in the IMF programme. Both the Finance Division and the Federal Board of Revenue (FBR) are deeply engrossed with the fund.

“The government has made considerable progress with regards to the IMF programme and does not want to detract. Therefore, the government is trying to reach an agreement, and the Prime Minister has also expressed repeatedly to remain in the IMF programme,” she added

Difficult Times Ahead

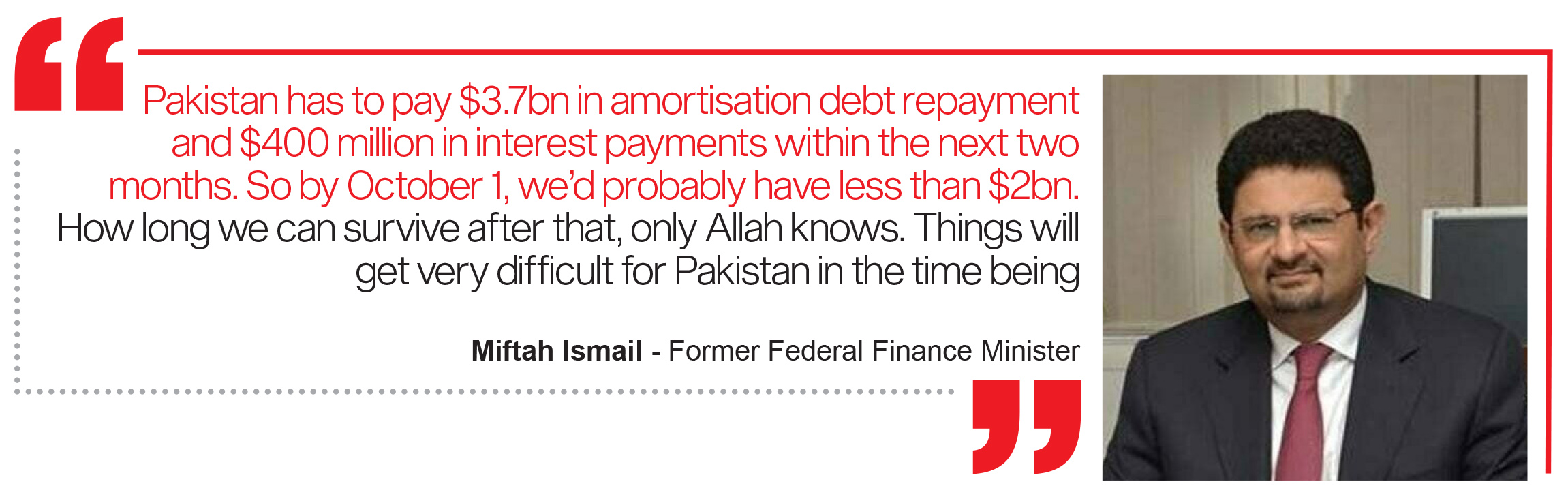

Miftah Ismail, the former PML-N leader and finance minister, believes that the economic situation will further deteriorate in the coming months. The prevalent economic crisis is “unlike the recessions we’ve had before,” lamented Miftah Ismail in a meeting of businesspeople at the German consulate on May 18.

Liquid foreign exchange reserves of the central bank are expected to decrease below the critical level of $2 billion by the end of September. Already, the central bank’s liquid foreign exchange reserves have dropped to $4.4bn, due to the persistent abeyance of the $6.5bn International Monetary Fund (IMF) loan programme.

To make matters worse, “Pakistan has to pay $3.7bn in amortisation debt repayment and $400 million in interest payments within the next two months,” bemoaned Ismail.

Simply put, the outflow of dollars in terms of external loan-related payments amounts to $4.1bn, while the total reserves of the State Bank of Pakistan (SBP) stand at only $4.4bn.

Of the $4.1bn figure, $1bn is a safe deposit from China. This essentially means that $1bn has been deposited by the Chinese central bank with the SBP. China is anticipated to re-roll it, which will bring the total expected outflow to $3.1bn.

Ismail added that Islamabad owes another $1.5bn to two Chinese banks, which may also re-roll the sum.

“So by October 1, we’d probably have less than $2bn. How long we can survive after that, only Allah knows. Things will get very difficult for Pakistan in the time being,” he stressed.

According to Ismail, the domestic debt servicing is also increasingly exasperated by the interest rate soaring to unprecedented highs.

At the same time, the fiscal practices of the provinces seem disinterested in raising revenues by taxing real estate, agriculture and services- which is adding to the abysmal economic situation. As a consequence of this, the provinces acquire Rs4.5 trillion out of the annual federal tax revenue of Rs7.5tr. This sum is not even remotely adequate to balance the fiscal account, as the domestic debt servicing is reaching Rs61tr a year.

“When you have to borrow money to pay interest, you’re in a debt trap,” he poignantly said.

The default debate

As things stand, a breakthrough with the IMF eludes Pakistan. In fact, the two are not even talking to each other. Additionally, even when the two are talking, the IMF communicates new conditions. It therefore is continuously shifting goal posts.

Many maintain that Pakistan is too important a regional player to fail. But from the looks of it, the IMF doesn’t give much credence to this notion. It seems to have had enough, linking its money to Pakistan’s ability to raise a couple of billions of dollars from ‘friendly countries’ first. It seems the IMF is playing the long game, unfortunately, time is something Pakistan’s economy has very little of at the moment. [/restrict]

Good post ! Paragon City is a hub of innovation and progress. The city boasts state-of-the-art research and development centers, where brilliant minds push the boundaries of science and technology. From groundbreaking discoveries in medicine to advancements in renewable energy, the city serves as a catalyst for global advancements, attracting visionaries and experts from various fields.