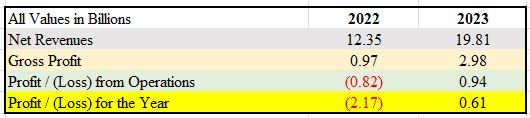

After generating net losses for many years, Fauji Foods Limited (FFL) earned a profit after tax (PAT) of Rs 0.61 billion in FY2023, but the company has announced no cash dividend, bonus, or right shares for its shareholders, according to its financials announced on Tuesday.

Fauji Foods highlighted that the three strategic pillars; margin accretive growth, cost of goods sold (COGS) reduction, and capability development helped deliver a net revenue of Rs 19.81 billion in FY2023.

A potential reason for retaining all profits is to ensure the continuation of infrastructure improvements, growth, and expansion plans. The company has been investing heavily in brands and distribution infrastructure improvements to improve business growth.

Fauji Foods is following the margin accretive growth strategy – achieving business growth from internal expansion or through mergers and acquisitions.

A prime example of this internal expansion strategy is the board and shareholders’ authorisations in Q4 2023 to acquire Fauji Cereals and Fauji Infraavest (Pasta).

A breakdown of the financials indicates that Fauji Foods earned a profit of 0.61 billion in 2023 after reporting a loss of 2.17 billion in 2022.

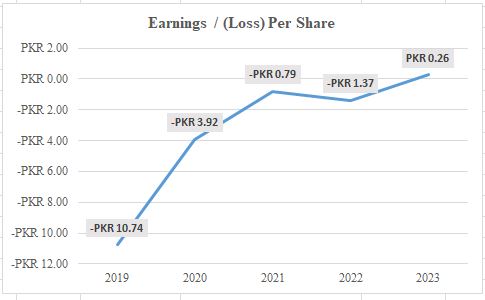

The company’s earnings per share (EPS) also improved to Rs 0.26 in 2023 after remaining in negative values from 2019 to 2022.

The company said its Annual General Meeting (AGM) will be held on March 25, 2024.