KARACHI: The Monetary Policy Committee (MPC) of the State Bank of Pakistan (SBP) opted to maintain the policy rate at 22% during its meeting on Monday, January 29, 2024, citing persistently high inflation in the country. The MPC also revised its projected inflation figures for fiscal year 2024 from 20-22% to 23-25%, owing to changes in energy prices.

The decision was in line with analysts’ expectations, despite the declining yields in the secondary market.

The central bank last raised the policy rate by 100 basis points to 22% in an emergency meeting in June 2023, ahead of an agreement with the International Monetary Fund (IMF). Subsequently, it held the rate steady in meetings convened on July 31, September 14, October 30, December 12, and now in January 2024.

In the post-MPC meeting briefing with analysts, SBP Governor Jameel Ahmad said that the real interest rate remains significantly positive on a 12-month forward-looking basis. This means that SBP expects future inflation rates to be below the current interest rate of 22%.

According to a report by Topline Securities, the use of the word “significant” indicates the possibility of rate cuts in the coming months.

“The decision was more or less expected by market participants. Most participants expect a rate cut in the coming MPS in March as inflation is expected to decline majorly on base effect,” commented Yousuf Farooq, director of research at Chase Securities.

“It makes sense for the SBP to hold off policy rate at 22% as inflation is still close to 30%, elections are up ahead, IMF third review has to be done and a new IMF program has to be negotiated. There are risks to the external funding outlook and inflation from commodity prices. Hence it makes sense for them to keep the policy rate at 22%”, remarked Mustafa Pasha, chief investment officer at Lakson Investments.

“After March’s MPS meeting, one can expect for there to be more leeway for the SBP to cut the rate, as there will be a new government in place, and a third tranche will have been received from the IMF,” added Pasha.

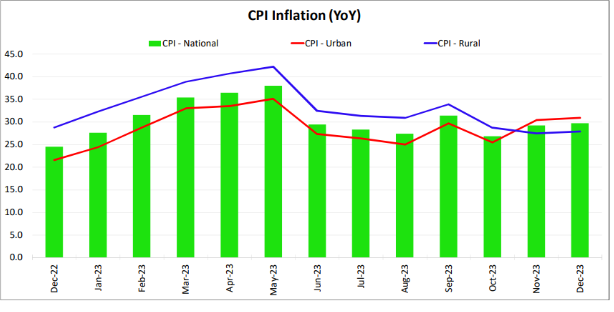

Inflation outlook

Following the IMF agreement, the fund indicated the need for an appropriately tight monetary policy to bring down escalated prices. Inflation clocked in at 29.7% in December 2023, which was higher than expected due to a surge in energy prices. The figure for January is also likely to remain high around 27%.

The committee observed that while non-energy inflation continued to moderate, the frequent and sizable adjustments in administered energy prices have slowed down the pace of decline in inflation anticipated earlier. Owing to these changes in energy prices, the MPC has revised the projected inflation figure for fiscal year 2024 from 20-22% to 23-25%.

In the medium term, the MPC estimates an inflation target of 5-7% by September 2025, revising it from the earlier target set for June 2025. The revised assessment takes into account the recent and expected adjustment in administered energy prices.

“Taking stock of these developments as well as still-elevated levels of both headline and core inflation, the committee emphasized continuing with the tight monetary policy stance. This, along with continued fiscal consolidation and timely realisation of planned external inflows, will help to achieve the inflation target of 5-7% by September 2025. The revised assessment takes into account the recent and expected adjustment in administered energy prices,” read the MPC statement.

However, the central bank has fallen short of its medium-term inflation expectations since 2020. Throughout most of the period from 2020 to 2023, the SBP anticipated a medium-term inflation of approximately 5-7%.

External financing

The committee noted that the external account has improved. The foreign exchange reserves improved to $8.3 billion as of January 19, 2024, owing to the current account surplus in December and significant financial inflows, including the latest IMF Stand-by Agreement trance.

The committee anticipated the current account deficit for the fiscal year 2024 to hover around 0.5-1.5% of GDP.

On external financing requirements, the governor stated that the total external financing requirement for the fiscal year is $24.5 billion. Of this, around $20 billion is the principal and around $3.8 billion is the interest payments. The governor said the bulk of these payments have either rolled over or already been paid. He also stated that net payables for fiscal year 2024 amounted to $5 billion.

“A positive current account has taken the pressure off the currency and the elections and future fiscal policy will decide the direction of the economy”, said Farooq.

Real sector

The MPC affirmed a projected real GDP growth rate (economic growth adjusted for inflation) of 2-3% for the fiscal year 2024. The growth will be driven by the agriculture sector as agricultural output showed promise, with both Kharif and Rabi crop outputs indicating improvements over the previous year where floods impacted produce.

At the same time, the MPC also anticipated growth in the industrial sector in the second half of fiscal year 2024. Despite initial declines in large-scale manufacturing during the first five months of fiscal year 2024, November witnessed an uptick. Moreover, recent surveys indicate a steady rise in capacity utilisation within the manufacturing sector. Similarly, business sentiments across all industries and services have improved since April 2022 as per surveys.

Money supply

The broad money (M2) growth has been hovering at around 14% in fiscal year 2024 (which started in July 2023 and will end in June 2024). It surged to 17.8% year-on-year at the end of first half of fiscal year 2024 in December 2023. The MPC stated that fiscal consolidation remained on track and complemented the monetary policy stance.

Responding to concerns regarding the lack of reflection of fiscal consolidation in monetary indicators, the governor said that with continued fiscal discipline, such improvements would eventually manifest in monetary data. He highlighted the declining trends in currency to deposit ratio, which he attributed to robust bank deposit growth and reduced currency circulation, which has declined from Rs 9 trillion to around Rs 8.6 trillion.

He highlighted that M2 was also declining and labelled recent spikes as a one-off event. “If you look at the subsequent trend, it is already declining. Over time, it will be reflected in the monetary data provided that the fiscal consolidation stance continues.”

Fiscal position

The finance ministry also released the fiscal data for the first half of the fiscal year on Monday, January 29, 2024. During this period, the budget deficit for fiscal year 2024 reached 2.3% of GDP at Rs. 2.4 trillion, compared to 2.0% of GDP in the first half of fiscal year 2023.

The government recorded a primary surplus of 1.7% of GDP at Rs 1.8 trillion, an increase from the primary surplus of 1.1% of GDP in the first half of fiscal year 2023.

In terms of revenue, there was a significant improvement with a 46% year-on-year increase in total revenue for the first half of fiscal year 2024 clocking in at Rs 6.9 trillion. At the same time, total expenditures also saw a 45% year-on-year increase and amounted to Rs 9.3 trillion.

Tax revenue experienced a positive growth of 30% year-on-year during the first half of fiscal year 2024 clocking in at Rs 4.8 trillion. Additionally, non-tax revenue saw an impressive 109% year-on-year increase reaching Rs 2 trillion, primarily driven by the increase in SBP profit and higher collection of petroleum development levy.

The federal government’s markup payments amounted to Rs 4.2 trillion for the first half of fiscal year 2024, increasing by 64% year-on-year, mainly driven by higher interest rates and debt stock.

The SBP governor reaffirmed the central bank’s stance on near term monetary targets. However, analysts remained sceptical about the divergent fiscal position primarily due to excessive money supply injections through massive open market operations in the recent months.

However, considering the expectation of a decline in near-term inflation and the signalling effect of rate cuts from the secondary market, the stage may be set for a potential rate cut in the upcoming MPC meeting.

It seems that market fluctuations are quite stable

Thanks you really good work sir..

Oh yeah, thanks you for this good work sir

good job sir, this is warning for econom