The Senate Standing Committee on Finance has instructed the State Bank of Pakistan (SBP) and the Federal Board of Revenue (FBR) to develop a strategy to tackle widespread over-invoicing and under-invoicing in imports and exports.

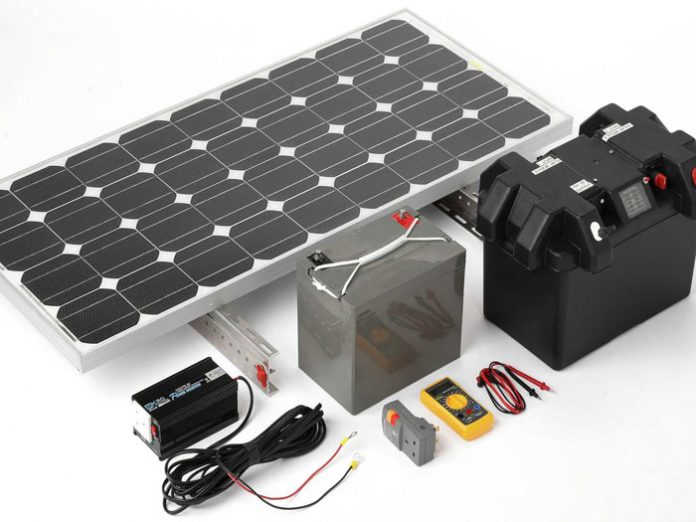

According to a media report, this comes in the wake of a shocking revelation of a Rs110 billion fraud and trade-based money laundering, specifically linked to solar panel imports.

The committee, chaired by former finance minister Saleem Mandviwalla of the PPP, discussed the findings of the Subcommittee on Resolving Issues Related to Solar Panels.

The subcommittee, led by PTI Senator Mohsin Aziz, found that over 80 companies were involved in fraudulent activities under the guise of solar panel imports, with some companies identified as dummy firms.

The FBR’s investigation revealed significant over-invoicing and fraudulent transactions in the solar panel sector. One company’s owner had even falsely identified himself as a salaried individual in official records.

The FBR flagged 80 suspicious companies, with 63 of them accounting for Rs69 billion in inflated transactions. As a result, the FBR has filed 13 FIRs against the implicated companies.

The committee gave the SBP and FBR one month to finalise a report on how to address the issue of trade-based money laundering.

Additionally, the SBP deputy governor briefed the committee on efforts to restructure the power sector’s circular debt, with ongoing negotiations to raise approximately Rs1.28 trillion from banks.