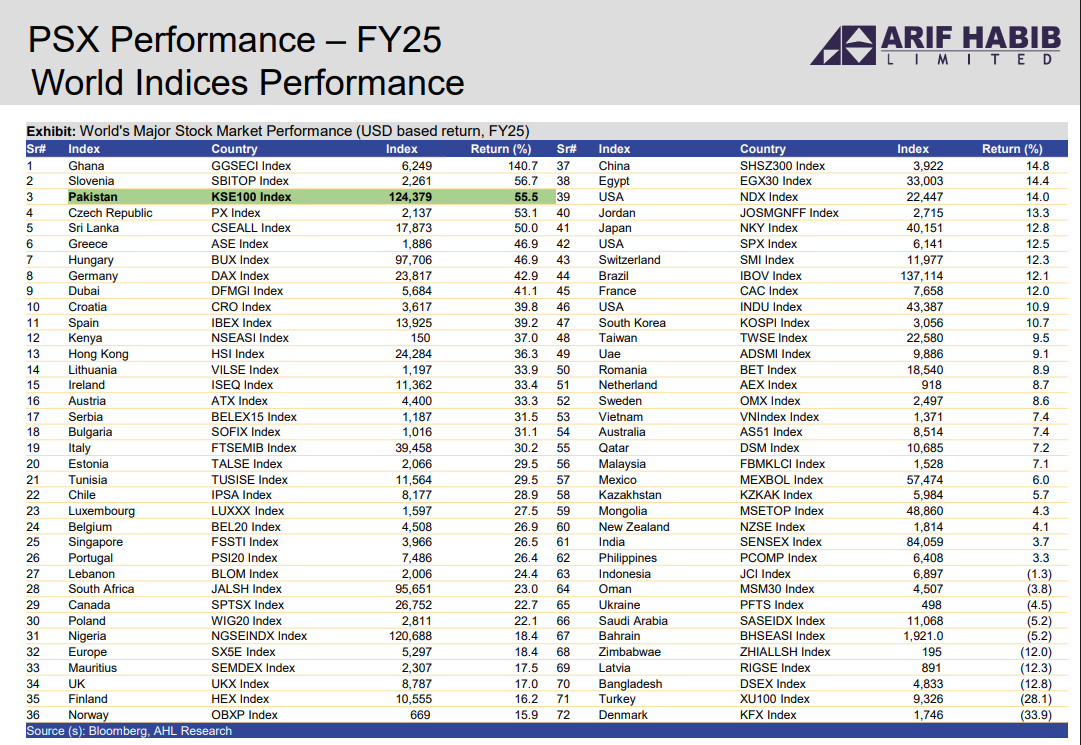

The Pakistan Stock Exchange (PSX) stood out as one of the top-performing stock markets globally in FY25, with the KSE-100 Index delivering a remarkable 55.5% return in USD terms and 58.6% in PKR terms, ranking third worldwide, according to a report by Arif Habib Limited (AHL).

The KSE-100’s impressive performance was surpassed only by Ghana’s GGSECI Index, which posted a 140.7% return, and Slovenia’s SBITOP Index, which gained 56.7%.

When compared to major global markets, Pakistan’s performance far outpaced several developed and emerging economies. Singapore’s FSSTI Index returned 26.5%, the EURO STOXX 50 18.4%, the UK’s UKX Index 17%, China’s SHSZ300 Index 14.8%, the US Nasdaq Index 14%, Germany’s DAX 46.9%, India’s BSE Sensex 3.2%, and Japan’s Nikkei 12.8%.

Several regional markets underperformed, with Turkey and Bangladesh seeing negative returns of -28.1% and -13.6%, respectively.

According to AHL, the benchmark KSE-100 Index delivered a stellar performance in FY25, rising by 58.6% in PKR terms and 55.5% in USD terms, closing at 124,379, up from 78,445 at the end of FY2024-25. This remarkable rally was driven by aggressive monetary easing, improved market liquidity, and the unlocking of fundamental value across key sectors.

In FY25, a mixed trend in net buy/(sell) positions across investor categories and sectors was observed on the local front. Among investor types, Banks/DFIs led with a net buy of $391.9 million, followed by Companies at $92.5 million, Individuals at $66.8 million, Other Organizations at $12.5 million, and NBFCs at $2.2 million. In contrast, Insurance (-$11.2 million), Brokers (-$18.1 million), and Funds (-$236.4 million) recorded net selling, with Funds experiencing the largest outflow.

Sector-wise, significant net buying was observed in Banks ($107.8mn), Fertilizer ($66.6mn), E&Ps ($65.7mn), Foods ($41.3mn), Other Sectors ($26.2mn), and Power ($21.3mn). Conversely, Technology ($22.5mn), Cement ($3.6mn), Textile ($1.5mn), and OMCs ($0.9mn) recorded net selling.

Despite the strong performance, the PSX saw an outflow of $300 million in foreign portfolio investment as widespread selling was evident by foreign investors across all listed regions. Taiwan saw the highest outflow at $28.8 billion, followed by South Korea with $23.6 billion, and India at $11.3 billion. Other markets also experienced outflows, including Malaysia ($3.5 billion), Vietnam ($3.1 billion), and Thailand ($3.2 billion).

Smaller net selling was recorded in Indonesia ($1.6 billion), the Philippines ($477 million), Pakistan ($300 million), and Sri Lanka ($41 million).

The AHL report suggests that several factors contributed to this widespread trend, including geopolitical tensions, the US’s reciprocal tariffs, high global interest rates initially prompting capital withdrawals, pressure from a strong US dollar, and a shift in investments towards developed markets.