The pharmacy business in Pakistan is not easy these days. In days past, all one needed to do in order to do well was create a well-run organisation that was not cheating its customers and it could expect to see its sales thriving. Now, however, with stiff competition from national retail supermarket chains like Carrefour, that offer a one-stop-shop experience for consumers, as well as newer online startups like sehat.pk, life for a standalone pharmacy chain is getting difficult to say the least.

The reaction of D. Watson, an Islamabad-based retail pharmacy chain, is to expand into the grocery business, a decision that comes with its own challenges in a family-owned business with ownership split between cousins and each of its outlets operating independently.

Origins of the name

The D. Watson chain was established as a single, small pharmacy shop in 1975 on Murree Road in Islamabad by two brothers, Zahid Bakhtawari and Zafar Iqbal Bakhtawari.

Zafar Iqbal, the elder brother, was in the final year of his Bachelor of Dental Surgery degree program when he caught an eye ailment that almost took away his sight. He went to England to seek treatment, and the doctor who saved him from losing his eyesight forever was named Dr Watson. Upon his return to Pakistan, Zafar Iqbal decided to pay a tribute to his benefactor by establishing a chemist shop under his name.

It is not clear whether that Dr Watson ever found out that there was a pharmacy established with his name in Islamabad, Pakistan, but four decades down the line, D. Watson shop has now morphed into D. Watson Group of Pharmacies and boasts of ten pharmacies in Islamabad and Rawalpindi and a few more in other parts of Pakistan, including one branch each in Lahore, Peshawar, and Murree.

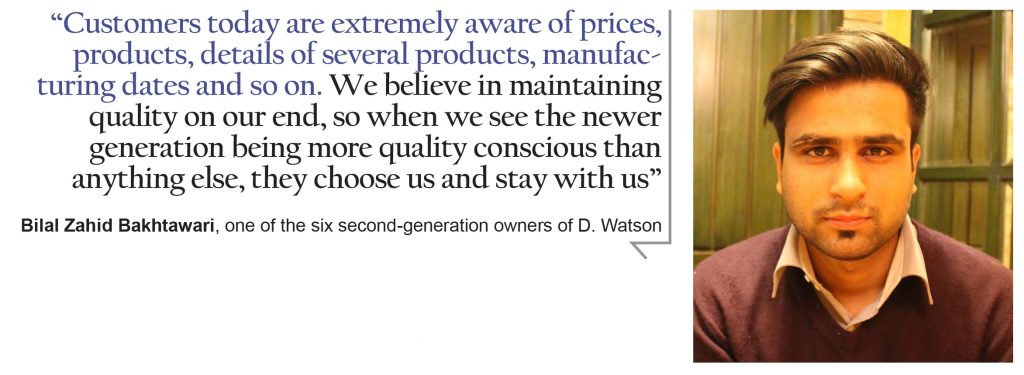

Bilal Zahid Bakhtawari is one of the six second-generation owners of the D. Watson group in Islamabad. He controls two outlets in Islamabad, since the D. Watson shops are divided among the family members who then run them as independent businesses. Among his plans is to go online in the next two years, not just as a pharmacy but as a one-shop store for grocery, glasses, other household items. And the second one involves setting up an aesthetic clinic under his dermatologist wife.

Bilal’s office, which is currently under renovation, is an austere room on the first floor of the D. Watson G-9 outlet, containing only an ancient computer and a couple of plastic chairs. Some folded cardboard boxes placed in front of the door are squeezing the entrance to the room. There are high cupboards on three walls of the room, probably containing medicines, with stickers all over them bearing the words “to be returned” and “close to expiry,” and other versions of these phrases.

On the fourth wall, up and behind the computer a gaping hole opens to a lift area, showing the giant grill door of the lift giving an eerie feel of being trapped in a prison. This is where, in a few minutes, some suppliers will drop their shipments and wait for Bilal to be done with the interview and make their payments.

Right outside this room that, for now, seems to be a part of an abandoned dilapidated building, the sales area is a complete contrast. Bustling with sales staff and customers, this part of the D. Watson showroom has everything a woman might want to have in her dressing room. There is a plethora of makeup, a large collection of perfumes, hand bags, toiletries, lingerie, equipment like hair dryers and straighteners and so much more.

There are products for men and children as well displayed on all shelves and walls. A small space between these heavily loaded shelves expose the narrow staircase that goes to the ground floor, which is even more congested and crowded.

On the left side of the stairs are the pharmacy products and on the right mirrors and glass cover the entire area with sunglasses and spectacles peeking out of them. Small hangers and shelves are also blocking movement from the right side of the shop to the left, with some of the products that are available upstairs in much larger number and variety.

The family-owned structure

- Watson pharmacies has kept on opening outlets within and outside the Islamabad metropolitan area, but they have kept the ownership strictly inside the family. Their Lahore branch is perhaps the only one so far not under direct control of the Bakhtawaris, but that is also managed and looked after by Bilal’s maternal uncle.

“Where D.Watson is today, it is because of my uncle’s [Zafar Iqbal] hard work and I believe that he does not want to share the results with anyone outside the family,” said Bilal.

He also said that they had the example of Shaheen Chemist & Grocers, another popular chain of pharmacies, who did experiment with a franchise model but then backed out because it did not work.

“The amount of effort and dedication that an owner puts in a business is not found in a franchise owner. So, we would rather keep it in the family and maintain the standard that D. Watson has instead of franchising it out to outsiders,” he said.

Bilal and his cousins appear to agree with their uncle’s choice of not franchising out the business, but when it comes to running the operations, they have changed the way things used to work at the pharmacy with their fathers’ generation, starting with record keeping.

“Technology is perhaps the biggest difference in the ways my father worked and the way I work. Being an accounting graduate, I am more inclined towards accounting for everything that enters and leaves my shop.” He has an automated system of medicine records that keeps updating the time left for different shelves before the expiry date, and when a medicine either needs to be on the shelves or returned to the manufacturer.

“Secondly, now there is a lot of focus on training of employees which was almost non-existent in the days of my father. It could be because back then it was about survival and now it’s about growth,” Bilal said.

The third thing that is different now from how things used to be, according to Bilal, is the division of work introduced by his elder cousin Ahsan Bakhtawari. “Now there is a separate IT team, a separate HR team, and the work is divided according to departments. Previously everyone did everything and the division of jobs was not that clear.”

It is not just the inside operations of D. Watson that have undergone transformation, but the market and competition landscape have also changed. According to Bilal the biggest change has perhaps come from customers. “Customers today are extremely aware of prices, products, details of several products, manufacturing dates and so on,” he said.

To him this goes in his favor, “We believe in maintaining quality on our end, so when we see the newer generation being more quality conscious than anything else, they choose us and stay with us.”

Another conspicuous change is the popularity of online stores for medicines, among other things. While Fazal Din & Sons from Lahore had realized this and capitalized on the momentum by creating Sehat.pk, Bilal says it will take him two more years until when he is able to launch his online store.

However, he has some newer plans to introduce as well. “I saw something in Canada with regards to glasses. There was an online platform where you upload your picture, try out different frames and choose the one you like, and then add your eyesight details and place the order,” he shared.

The supermarket expansion plans

- Watson as a group is also contemplating on some changes to stay relevant. Bilal said, “The general perception might be that Shaheen and Medi Plus are our competitors, but we have been operating for ages now and have found the room to co-exist. It has been more of an oligopoly for a long time. The actual challenge is coming from the likes of Punjab Cash and Carry, Green Valley, MCC, and Hyperstar. The places that have everything available at the same place and now medicines too. They not only buy in bulk but also operate on a large scale. We have also been thinking that we need a large supermarket too. To compete with them in the future, we also need a store along the lines of a large supermarket.”

Grocery items have already become the biggest source of revenue for the D. Watson Group. While the pharmacy remains the identity of the company, many stores in Islamabad now also sell groceries. This decision did not come without its fair share of criticism from the founders of the pharmacy chain.

“My uncle actually said rather scornfully to my cousin, Ahsan, who brought grocery into the mix that now you will be selling bread and eggs. But he went through with it and now some of our biggest D. Watson shops are the ones that are selling grocery items along with other products,” said Bilal.

Source of growth

As of now, Bilal claims to not be aware of his own market share or growth rate. Like most businesses in Pakistan, chemists also remain a primarily privately owned business which means determining market share, sales growth, and profitability is difficult. For his own growth rate and the confusion surrounding it, he had an elaborate explanation.

“My growth rate is average 20% right now, but it is very difficult to ascertain whether it is actual growth or mere inflation. Since we operate on margins, so when the price of medicines, for instance, goes up, even though our cost is going up but at the same time so is the nominal amount of our margin.”

Let’s say D. Watson makes a 20% gross margin on its products. If a product’s price increases from Rs1,000 to Rs1,500, at the same 20% margin, the gross margins of D. Watson grow from Rs200 to Rs300. “On the flipside, the demand also goes down for some products when there is inflation, so to tell you exactly how much I am growing is almost impossible.”

It is not actually impossible, and Bilal is confusing gross margins and revenue, and even without that confusion, if one has good documentation of what their volumetric sales are, it should be relatively straightforward to calculate what proportion of one’s growth came from price increases, what proportion came from increases in volumes, and what proportion came from the changes in the product mix sold.

Perhaps Bilal simply did not want to share the details and pretended it was more confusing than it actually is.

The regulatory challenges

Operating in retail pharmacy has its regulatory complications as well, the biggest of which remains the choice of selling or not selling without a proper prescription, especially when it comes to medicines that can be used as narcotics.

“The environment is changing slowly, and the culture of prescriptions is also rising, but the legal details still remain our biggest drawback,” he said. “This cannot be solved by a single company or single pharmacy, and not even just from the chemists side. There are more stakeholders involved. If doctors are not particular about their prescriptions, because I frequently get the excuse that doctor’s next appointment is three months away so what is a patient supposed to do until then. Then there is also no standardized method of prescriptions, to verify the prescription and so on.”

Under current circumstances, it is also unfair to customers. They are not prepared to be asked for a prescription, and what if there is a patient who really needs the medicine and some pharmacy refuses to serve them in the absence of a prescription. In the best-case scenario, the patient will go somewhere else and the worst case scenario is that the patient will not get the medicine, and not because it’s the pharmacy’s fault rather than the doctors, said Bilal.

“When it comes to Xanax and other such medicines, in that case, of course we do not give those medicines unless we can see that there is a prescription and it looks legitimate. And in the rare cases we do give out such medicines without prescription, it is not more than one or two tablets, and that too if our pharmacists see that there is a genuine requirement.”

“Under the law, I am supposed to have only one qualified pharmacist, and they are expensive resources, but I have three just for one shop. That is the exact reason, that we have to navigate the space between keeping the customers satisfied and also making sure that we are not selling to a drug abuser,” he said.

Compliance costs

“Very recently there was a case when Xanax [a medicine commonly used for anxiety] was being abused by some people. The drug inspectors came to us and required details of every single tablet we have sold, the date they were sold, the numbers they were sold in and the copy of the prescription for each of those. It was a year’s data, and our record was off by just four pills. We had details of every other single pill, and these four were also the times when the pharmacist perhaps adds a pill when he can see that a patient is clearly in pain. Otherwise doctors and pharmacists need to be on the same page. I am not blaming the doctors, but this is something that has to be accepted and changed across all platforms at the same time.”

There is also a monetary cost to adding more and more products, and that constitutes approximately 2-3 percent of the revenues of each of their shops. “The medicines that get expired or are close to expiry are returned to the producers, but other products have to be thrown away or burnt. We cannot trust that the manufacturer wouldn’t resell the same products to us or to someone else, so instead of returning them, we dispose them.”

There are some products like perfumes or creams and lotions, that according to Bilal are not entirely the producers’ responsibility to take back either. “And if they do, it shows it’s fishy.”

Bilal doesn’t have enough space, as of now, to add grocery items in the G-9 Markaz shop, but otherwise this outlet also has everything that D. Watson has on its portfolio, makeup, perfumes, cosmetics, clothes, hand bags, optical, optometrist consultant, toiletries, electrical items and pet products.

Bilal Bakhtawari isn’t currently planning on expanding to grocery himself, rather he has plans to add an aesthetic clinic to go with his pharmaceutical business. He said, “My wife, Dr. Saniyah Wajahat, is a dermatologist and has just finished her Masters in aesthetics from Queen Mary University of London. And I believe that aesthetic clinics are the future. So that is what I want to add to my particular outlets, I am already in the process of doing that. That will include laser machines, whitening, weight loss, Botox etc. and I am already adding these to my plans.”

Slightly confused why it is so difficult to decipher the growth rate. Adjust the YoY Revenue for inflation and that is your growth. The fact that demand goes down for some medicines is irrelevant.

Anyone plz tell me the actual latest price to own the d’watson Frenchis??

Comments are closed.