The recent budget proposals that have been made have had one thing in the forefront all along. Tax revenue generation and maximization. With IMF targets to meet and a surplus to be shown, the budget has been designed with that fact in mind. One of the proposals that has been made is to tax the mutual fund industry. The purpose of the taxation is to tax a stream of revenue and income which has earned high amounts of the profits in the last year.

From June 2023, banks and fixed income securities have earned record high profits due to the high level of interest rate. This has been matched by the stock exchange which has also seen a return of almost 92% for the same period. As mutual funds have invested in these two asset classes, they have earned healthy returns.

Now it seems there is a move to tax some of the fixed income mutual funds while equity funds are left unscathed. What are mutual funds? What is the new budget proposal and what long term impact can this tax have on the mutual fund industry of the country? Let Profit explain it all.

What are mutual funds?

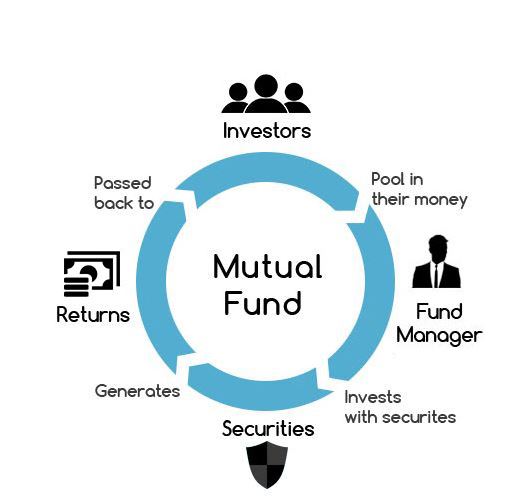

Mutual funds are investment vehicles that are usually operated by Asset Management Companies (AMCs) which carry out the task of earning a return for their investors. These AMCs constitute a mutual fund based on the investment strategy which is defined initially in the offering document and this becomes the sales brochure which is pitched to an investor.

Based on the investment needs of an investor, they weigh the risk and return inherent in the fund and then decide whether they want to invest or not. Once they hand over the funds to the AMC, the company collects all these funds and then invests it based on the recommendation of its Investment Committee. The Investment Committee does not take decisions based on “vibes” and has to justify each recommendation and investment based on credible data. Once the decision is made, the AMC then goes onto actually investing in the assets that conform to its investment mandate.

Just like the investor has initially invested with the company, they can choose to invest more from time to time or look to redeem their investment by asking the company to do so. The investor only interacts with the AMC and communicates with them when they need to carry out an investment action. Similarly, the fund will also look to change its investments in different assets based on which assets have fallen out of favour or do not conform to their mandate and buy new ones which seem more attractive or undervalued based on their research and due diligence. Their main task is to keep balancing the portfolio of funds on a regular basis to make sure their initial investment mandate is being pursued.

So is there only one type of mutual fund?

Types of mutual funds

No. Based on the investment mandate, the mutual fund industry can be divided into a fixed return category or an income fund, balanced fund, index or commodity tracker fund, equity fund and lastly a fund of funds. This means that rather than being limited to one class of asset, mutual funds can invest across a myriad of asset choices available to them to meet the needs of its investors. The reason that funds are categorized by the Securities and Exchange Commission of Pakistan (SECP) is due to the fact that their investment mandate is dictated by what assets and what weightage they can invest in.

Income Fund

An income fund is a fund which is supposed to provide a function of a constant income for their investor. Imagine a pensioner who has retired and needs a constant stream of income which will allow him to meet his daily expenditure needs. The investment has already been made and the investor needs to make sure that they are able to earn a constant return with the initial investment being safe and them earning a return on top of that. The investor has little room to take risk and cannot afford to see a negative return as that will be detrimental to him. The income fund invests in government backed and highly secure securities which have little risk and a limited return.

Recently, the fact that policy rate has been around 22% means that income funds in Pakistan have been able to earn an average return of 22%. Compared to bank return, this seems like a much more attractive investment as this would lead to a higher return for the investor. Income funds are supposed to invest 25% in liquid cash reserves and instruments to meet their liquidity requirements.

Balanced Fund

A balanced fund is a fund which is allowed to invest in income generating assets while also allowing for investment in equities. SECP mandates that a balanced fund can invest between 30% to 70% of its assets in equities while the remaining can stay income generating securities like government securities. As the stock exchange saw staggering returns since July, balanced funds earned an average return of 65% in Pakistan till June of 2024.

Index Fund

Index fund or a commodity fund is a fund which invests in a specific asset. An index fund will invest in the equities that make up the KSE-100 index to replicate the returns earned by the index. A similar fund can be a gold fund where the AMC invests in gold and then as the price of gold moves, so does the price of the fund and its units. Rather than investing in the asset directly, an investor can earn similar returns and leave the decision making up to the experts. In the last year, the index tracker funds yielded a return of 70% which is close to the actual return of the index of 92%.

Equity Fund

An equity fund is considered to be on the other end of the spectrum as they are allowed to hold equities and are mandated to at least hold 70% of their assets in the form of an equity investment. These can be considered to be the most risky investments and can yield the highest return for the investors as well. With that being said, there is also a chance of making a negative return and actually losing money on your investment if the market takes a turn against the fund’s expectations. Investors who can afford to lose money on their investment choose these funds as they are fine with losing some money with a chance that they will earn a return higher than the fixed income funds. In the last year or so, equity funds earned an average return of 90% till date.

Fund of Funds

The last type of fund is the fund of funds. As the name suggests, it is a fund which invests in funds rather than an asset directly. Mutual funds are investments which are seen to be less volatile as compared to assets as the diversification of the portfolio allows the returns to be smoothed out to an extent. These funds can be considered a further smoothening of the returns that are earned by the funds themselves as well. On average, these funds earned a return of 50% in the last 12 months.

If an investor feels that these funds are not compliant to their Islamic values, funds have also started to issue units for Shariah compliant funds which can be invested in by people who are skeptical in investing in conventional funds. Shariah complaints funds also encompass the same types of funds as discussed earlier.

Do they work?

Mutual funds make sense for an investor who is either not privy to the economic level information in relation to the capital markets or does not want to think about his investments on a regular basis. They feel it is better to hand over this responsibility to someone else who has better tools and knowledge at their disposal. They would have an army of researchers and a group of people who can read the tea leaves and make a better decision in their place.

Similarly, the fund can invest across a variety of assets and allow an investor to get exposure in assets which might not be available to small investors which can unlock returns which are not available to the investor usually. In addition to that, the market for mutual funds is liquid which means they can sell or buy units from the AMC whenever they want and there will always be a buyer when they want to sell their units.

So what is the cost of having access to this plethora of knowledgeable people? Who says there is free lunch?

The biggest disadvantage of investing in a mutual fund is that the costs will be charged regardless of the fact that the fund makes a positive or negative return. AMCs have their bills to pay and their managers’ salaries to take care of which means that they will still charge you additional costs even if the fund suffered a loss. In addition to that, there is a lack of control as investors have little say in where and how the funds are invested. The most they can do is sell their investment once they feel their investing needs are not being met.

The data available to an investor is always lagged when it comes to a mutual fund. An investor might see that the return earned by the fund was high in the last year. Based on that, they assume that next year will be another stellar year. The performance of the past has no bearing on future performance and that is a caveat which is always parrotted by the mutual funds themselves. This means that a mutual fund might suffer a loss after an amazing year as the workings of the economy cannot be predicted or forecasted beforehand. This is a risk that is being taken when investment is being carried out in a mutual fund.

In addition to these disadvantages there are objectives costs that are deducted by the AMC based on different calculations. These deductions have an impact on the return earned as they are taken away from the returns.

So what are the costs that are actually taken by the fund?

What does it cost?

The most basic cost that is levied is the management fee. This is the fee that the management company charges from the investors which is a percentage of the net assets that the fund has under its own management. Normally these vary between 1.5% to 2.5% in Pakistan. When taken in context of billions of rupees in net assets, the end figure becomes huge. AMCs charge management fees from each fund that they are managing and running. These management fees add up and become part of the AMCs earnings. The funds don’t need to beat the market or even make a profit to qualify for management fees. These are unavoidable and have to be paid.

Back end load and front end load are fees that are charged from the investor based on different goals that the fund wants to achieve. Front end load is charged when the investor invests in a fund. The fund manager does not want any new investment to come into the fund due to which they want to place a penalty on the investors investing in. A front end load of 2%, for example, would mean that the fund will invest Rs 98 rather than the Rs 100 that the investor gave to the AMC. A fund manager might place such a load as it would discourage an investor from investing.

A back end load is charged when the investor is redeeming or selling his investment in the fund. If a fund manager does not want to see investments moving out, he might place such a load as it will discourage the investor from taking his investment away. A 2% back end load charge will mean an investor will only see Rs 98 redeemed from an investment which was at Rs. 100 at redemption.

Other than these, there are also fees like brokerage fees, SECP related fees, trustee fees and rating agencies fees which are charged from the investor and paid by the AMC allowing it to operate in a free manner.

Lastly, there is a spread or a gap between what the fund is selling its units for and buying them back for. Consider an exchange rate quoted by a bank. The bank will sell you a dollar for Rs 300 and buy it back from you at Rs 299. If you buy from the bank and sell it back, you have ended up making a loss of Re. 1. This is the same with mutual funds. In order to buy or sell a unit of a fund, the only customer and seller is the AMC itself. This means they quote a selling price and a buying price. The spread between the two prices is the additional cost that is borne by the investor.

The tax being proposed

Till now, one of the biggest attractions investors to the mutual funds was the fact that they were seen as being a tax relief for the investors. The SECP even promoted mutual funds as a way to avoid higher levels of taxation. Consider the different scenarios that were available to investors. An investor who wanted to invest in the stock market, for example, could buy a stock for lets say Rs 10. Now when the stock increased to Rs 11 and the investors sold it, the investor had to pay capital gains tax applicable at 15%. If they invested in a stock fund, they would have to pay a tax rate of 12.5%. This tax went down to 10% if the dividend income earned by the stock fund was more than the capital gains it had earned.

Similarly, the investor had a chance to deposit this money into a bank account. Once he earned profit on debt, he would be liable to pay a tax of 15%. For a mutual fund, the taxation on the dividend that was paid out by the mutual fund was charged a tax rate of 15% as well. However, this created an opportunity to arbitrage as the investor was able to earn more when he was getting dividends from a fund which was primarily earning interest income or profit on debt. The new proposal would see the dividend income being taxed at 25% which would eliminate this arbitrage.

Even though this seems like a simple move, there can be an impact of this move which will see many funds move from fixed income based investment towards equity investments. In order to keep providing a tax holiday and relief to their investors, mutual funds will be moved to invest in equity and the stock market in order to decrease their income from profit on debt by buying dividend yielding stocks and stocks which provide income through capital gains.

The SECP provides a band of percentages within which a fund can allocate its funds. Income funds are mostly reliant on debt related securities and need to have 25% in cash reserves meaning they have to invest 75% of their funds in securities which are deriving their income from debt or profit from debt. These funds would have little choice but to see their withholding tax charged at a higher rate. One thing that can be done in order to avoid the taxation is to not give out any dividends and allow investors to sell their mutual fund units in case they need to liquidate some of their investment. The Berkshire Hathaway model so to say.

Other funds like a balanced fund, equity fund or even fund of funds would look to invest as much as they can in stocks and equities in order to reduce the tax burden. Mutual funds have to make them look attractive to an investor and one of the most attractive aspects of any such investment is the tax relief that they can offer. This proposal means that investors would still want to be wooed by the funds and the funds will alter their asset mix in order to make sure this advantage is not lost.

The biggest gainer from such a situation will be the stock market which will see renewed interest and investment from the mutual fund industry. Funds which might have taken it easy by parking their funds in safe and secure investments will now look to venture into the stock market and this renewed vigor will bring in more investment in a stock market that is already reaching new highs. This might be one of the unintended consequences of the tax proposal being made but it can have lasting effects in the market for months to come.