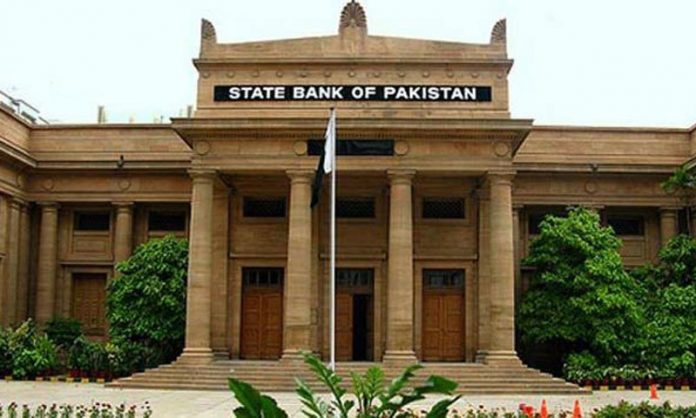

The State Bank of Pakistan (SBP) and Bank Markazi Jomhouri Islami Iran (BMJII) have devised a payment settlement mechanism to settle the trade transaction between the two countries.

In order to facilitate trade between Pakistan and Iran, SBP has asked the authorised dealers interested to work under this mechanism to send their written consent to the Director, Domestic Markets and Monetary Management Department, SBP, Karachi latest by May 31, 2017.

The said mechanism will be available as an additional mode and does not restrict the use of other permissible mechanisms for settlement of the trade transactions as per instructions issued by SBP from time to time.

Key features of this mechanism are as under:

1) This mechanism will be available for the payment of goods and services traded between Pakistan and Iran.

2) Transactions eligible for settlement under this mechanism will be denominated in Euro or JPY and based only on documentary Letter of Credits (L/Cs) conforming to the Uniform Customs and Practice for Documentary Credits UCP 600 published by the International Chamber of Commerce (ICC).

3) The modus operandi for processing of transactions under this mechanism will be as under:

- a) Payment of imports by Pakistan: Importers’ bank in Pakistan will credit the foreign exchange (i.e. amount due under L/C) in Nostro account of SBP for onward payment to the exporter in Iran and inform the same to SBP as per format attached as Annexure-A. On confirmation of receipt of funds in Nostro account, SBP will instruct BMJII to pay the exporter’s bank for onward payment to the exporter in Iran.

- b) Receipt of funds against Exports from Pakistan: On receiving payment instructions from importer’s bank in Iran, BMJII will instruct SBP to make payment in Pakistan. SBP, on receiving the instructions from BMJII, will credit the Nostro account of exporter’s bank in Pakistan in FCY.

4) Participating banks shall ensure that transactions conducted under this mechanism are not proscribed and do not involve individuals/entities proscribed under international sanctions.

5) Execution of transactions under this mechanism will be subject to compliance of all applicable foreign exchange rules and regulations.