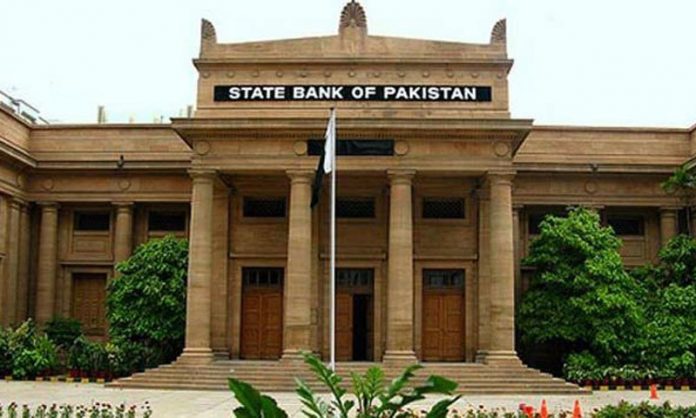

Karachi: The State Bank of Pakistan (SBP) has revised the ‘Guidelines on Outsourcing Arrangements’ with the objective of enabling financial institutions (FIs) including commercial banks, microfinance banks and development finance institutions (DFIs) to effectively manage the potential risks associated with outsourcing arrangements.

The revised instructions are termed “Framework for Risk Management in Outsourcing Arrangements by Financial Institutions”.

The SBP earlier introduced the Guidelines on Outsourcing Arrangements for banks/DFIs in 2007. The guidelines were issued in view of the increasing use of outsourcing of services by banks/DFIs and potential impact of associated risks and obligations to customers. The framework is based on international standards and best practices, which is aimed at enhancing the proactive environment in FIs on various aspects of outsourcing.

These include, but are not limited to, governance, risk management, outsourcing of foreign branches of banks, insourcing of services, group outsourcing, information technology outsourcing and collaboration/outsourcing arrangements by FIs with financial technologies (Fintechs).

Besides, the framework also encompasses the list of critical functions/activities that cannot be performed by employees of the third party service providers. All new outsourcing arrangements by FIs will be governed under this framework.

The FIs are required to ensure that their existing outsourcing arrangements are aligned with this framework latest by June 30, 2018.