Weak economic indicators and slight devaluation of rupee in the open market aggregated panic in the market

KARACHI: It was doomsday for the investors at the Pakistan Stock Exchange (PSX), as indices bled for the sixth consecutive session. Weak economic indicators and slight devaluation of rupee in the open market aggregated panic in the market.

On the economic front, as per the report released by the World Bank, Pakistan’s Gross Domestic Product (GDP) growth is expected to fall to 4.80 per cent in Financial Year 2018-19 (FY19) due to the policies for macroeconomic stabilization indicating a tighter fiscal and monetary policy.

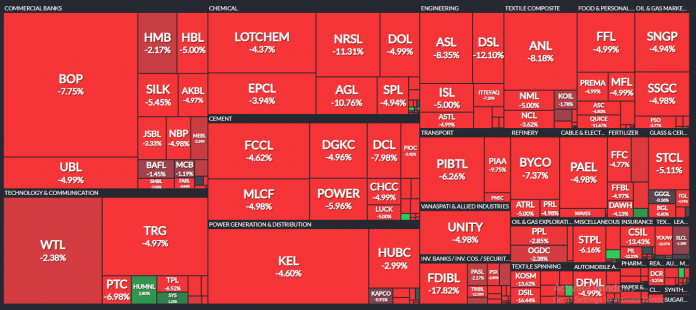

The KSE 100 index declined by 3.50 per cent and is just 0.42 per cent away from touching its 52-week low of 37,736.73. The index depreciated by 1,450 points to touch intraday low of 37,769.51. It then settled with a loss of 1,328.06 points at 37,898.29. The KMI 30 index declined by 3.68 per cent and after losing 2,443.59 points, it ended the day at 64,024.50. KSE All Share index closed the session lower by 852.89 points at 27,943.10. The advancers to decliners ratio stood at 37 to 297.

Trade volumes improved from 153.50 million in the previous trading session to 186.01 million. The Bank of Punjab (BOP -7.75 per cent) led the volume chart exchanging 18.39 million shares. This was followed by K-Electric Limited (KEL -4.60 per cent) and Worldcall Telecom (WTL -2.38 per cent) with 12.19 million shares and 10.28 million shares respectively.

The cement sector lost 4.91 per cent from its cumulative market capitalization. Lucky Cement Limited (LUCK -5.00 per cent) touched its lower-lock while D G Khan Cement Company Limited (DGKC) declined by 4.96 per cent. Bestway Cement Limited (BWCL) was down by 4.95 per cent, Maple Leaf Cement Factory Limited (MLCF) by 4.98 per cent and Cherat Cement Company Limited (CHCC) by 4.99 per cent.

Kohinoor Power Company Limited (KOHP -1.63 per cent) released its financial results for FY18. Sales declined by 58.07 per cent year-on-year (YoY), while the earning per share declined further from Rs -0.48 in the previous year to Rs -1.51.

Roshan Packages Limited (RPL -4.74 per cent) announced its financial performance for the year ending June 30,2018. The company also declared bonus shares of 20 per cent along with financials. Sales declined slightly by 1.6 per cent YoY. The earning per share was also down from Rs2.13 in the preceding year to Rs-0.77 in the current year.