KARACHI: It was a rewarding day at the Pakistan Stock Exchange (PSX) where the indices were seen climbing up all day long.

The bullish trend seen in the market on Wednesday was mainly due to Finance Minister Asad Umar’s statement about the impending balance of payments crisis. According to the statement, Pakistan is out of the balance of payments crisis as China has agreed to provide financial assistance, for which further negotiations will be conducted in the current week. It is likely that China will provide an assistance of up to $2 billion. China has also agreed to triple its imports from Pakistan.

It has been noted that the government is planning to implement policies that will increase exports, and bring balance of payments and current account values to a surplus. A major point to note is that these policies are not only for the long-term, but major focus has been put on the short-term developments; this emphasis has given investors renewed confidence.

Also, the International Monetary Fund (IMF) team, currently in Pakistan, is expected to negotiate on a potential bailout package of $6-7 billion. The package would not only provide short-term relief to the falling reserves but will also help the government be in a better position to negotiate further potential inflows from the World Bank, Asian Development Bank and Islamic Development Bank.

Experts say there might not be an agreement at all if the IMF places tough conditions. However, the government is not in a strong position to counter those conditions, as an inflow of funds is the need of the hour for Pakistan. Till now, the foreign reserves have fallen 42% since January, standing at $8 billion. Although Moody’s credit rating for Pakistan is still standing at ‘stable’ for 2019, the rating agency has claimed that quick reforms and implementation will be needed to further sustain or upgrade the rating in the near future.

The KSE 100 index on Wednesday jumped up by 1.54 per cent midday and after gaining 639.40 points, the index reached intraday high of 41,597.93. It finally settled higher by 585.45 points at 41,543.98. The KMI 30 index gained 1,261.64 points and closed at 71,589.61 after an appreciation of 1.79 per cent, while the KSE All Share Index managed to gather 261.50 points to end at 30,022.96. Out of the total traded scripts, 256 advanced while 82 declined.

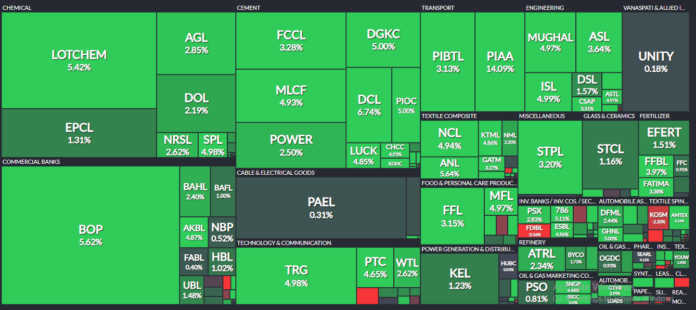

Trading volumes improved from 230.36 in previous trading session and were recorded at 276.93 million. The Bank of Punjab (BOP +5.62%) led the volume chart with 35.03 million shares exchanged, followed by Lotte Chemical Pakistan Limited (LOTCHEM +5.42%) and Pak Elektron Limited (PAEL +0.31%). The scripts had traded 21.24 million and 16.04 million shares respectively.

The engineering sector (+4.33%), transport sector (+4.14%), leasing companies’ sector (+3.92%), cement sector (+3.90%) were the major gainers of the day, whereas the top losers included tobacco sector (-2.46%), close-end mutual fund sector (-2.21%), jute sector (-1.70%) and chemical sector (-0.63%).

Khyber Tobacco Company Limited (KHTC) touched its lower circuit breaker after the company announced its financial performance for FY18. A final cash dividend of Rs8.31 was declared by the company. Sales appreciated by nearly 10% YoY. The earnings per share also increased from Rs 39.50 in the same perod last year to Rs41.60 in the current year.