- Investors yet to recover from 3.80pc rupee depreciation

KARACHI: Bears were out on the hunt on Monday (first trading session of the month) as the Pakistan Stock Exchange received a hammering of sorts owing to the weak macroeconomic outlook of the country.

Investors are yet to recover from the 3.80 per cent depreciation of the rupee on Friday when the central bank announced a discount rate for the next two months. Against stock market consensus, the rate was pushed up by 150 basis points, taking it up to several years high.

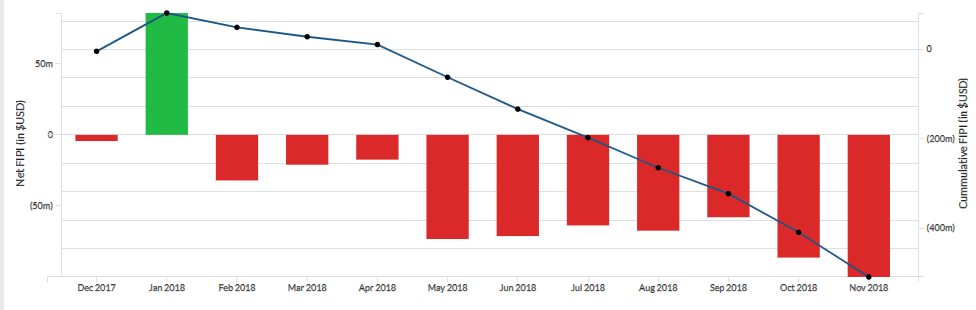

Foreign investors’ confidence has already been weak, evident from the selling trend. They have been net sellers for the past 10 consecutive months, accumulating to a one-year net outflow of $508.77 million.

Amid the chaos, KSE 100 index dropped a massive 3.80 per cent or 1,480 points to fall down to its intraday low. The index broke its 40,000 benchmark, and after losing 1,335.43 points, settled at 39,160.60. The KMI 30 index had a greater fall, it declined by 3.90 per cent to touch an intraday low, and settled with a loss of 2,444.73 at 65,944.23. Meanwhile, the KSE All share index depreciated by 3.01 per cent or 883.36 points to close at 28,498.33. Out of 344 traded scripts, only 39 advanced while 292 declined.

Market volumes declined from 270.58 million in the last trading session to 164.33 million. (BOP -1.81pc) led the volume chart with 20.49 million shares exchanging hands, followed by K-Electric Limited (KEL -5.14pc) and Lotte Chemical Pakistan Limited (LOTCHEM -4.24pc) with 17.39 million and 9.56 million shares exchanging hands respectively.

The transport sector (-6.46pc), refinery sector (-6.08pc), engineering sector (-5.01pc), and tobacco sector (-5.00pc) remained the top losers of the day.

The cement sector lost 4.92pc from its cumulative market capitalization. Lucky Cement Limited (LUCK -5.00pc), Maple Leaf Cement Factory Limited (MLCF -5.00pc), Kohat Cement Company Limited (KOHC -5.00pc) all were floored, while D G Khan Cement Company Limited (DGKC -4.99pc), Fauji Cement Company Limited (FCCL -4.98pc) and Cherat Cement Company Limited (CHCC -5.00pc) also ended negatively.

Even the investors of the banking sector didn’t take the dollar hike well, as the sector lost 1.40pc from its total market capitalization. Major players, MCB Bank Limited (MCB) and Habib Bank Limited (HBL) declined by 2.88pc and 3.90pc, whereas Allied Bank Limited (ABL) was down by 1.70pc, Bank AL Habib Limited (BAHL) by 1.97pc and Askari Bank Limited (AKBL) by 1.22pc.