- Supplementary bill will help govt meet IMF conditions, constitute Sarmaya-e-Pakistan and remove tax conditions on purchase of properties

ISLAMABAD: As the incumbent government is facing severe economic issues, it is likely that another supplementary budget would be introduced soon through a financial bill, sources revealed on Saturday.

According to sources, Pakistan Tehreek-e-Insaf (PTI) government is making arrangements to introduce another mini-budget that would be aimed at meeting the conditions of International Monitory Fund (IMF), the constitution of Sarmaya-e-Pakistan and removal of the condition of filers for the purchase of properties.

Sources said another supplementary finance bill would be imperative to meet the revenue shortfall, adding that the government was working on the same lines. However, the bill would only be introduced in case the government failed to get major assistance from friendly countries.

In case the supplementary budget is introduced, this would be the second mini-budget that the incumbent government would present in the current financial year, as it had presented the first one in September 2018.

According to sources, in order to decide about subsidies, taxes, tariffs, and duties, as suggested by IMF, the government needs to amend the Finance Bill 2018. Apart from these measures, the constitution of Sarmaya-e-Pakistan Company was is also needed after approval from the parliament.

According to details, Sarmaya-e-Pakistan Board of Governors will be headed by the prime minister, while other members of the board will include three federal ministers, whereas seven members of the board would belong to the private sector.

Sarmaya-e-Pakistan would submit its recommendations to the federal cabinet. Following recommendations, the federal cabinet would hand over the government control of the state-owned enterprises to the company. This step, as claimed by the government, would minimise the government control of SOEs and help manage them professionally.

The model of Sarmaya-e-Pakistan was taken from Singapore and Malaysia. Prime Minister Imran Khan, during his visit to Malaysia, was briefed about the success of ‘Khazana model’.

Apart from the new company being constituted to manage the affairs of SOEs efficiently, the PTI government would also be taking another major ‘U-turn’ by removing the condition of filers on the purchase of properties in the country.

“Prime Minister has recently been informed by the members of Pakistan Business Council that the removal of condition on the purchase of property, vehicles etc. could give a much-needed boost to investment and business activities. The premier was almost convinced by the idea and he may direct the finance ministry to remove the conditions through the supplementary budget,” said an insider.

In the previous supplementary budget, introduced in September, the incumbent government had decided to remove the restrictions on non-tax filers with regard to purchase of real estate and automobiles. However, after criticism from opposition parties, the decision was reversed, keeping the restrictions imposed.

In the last budget of the Pakistan Muslim League-Nawaz government, a ban had been imposed on non-filers of tax returns to purchase new cars and properties. The car manufacturers and real estate developers were up in arms against the decision that had plummeted car and property sales by up to 50pc.

According to sources in the automobile sector, the manufactures/assemblers were presently facing a cut in demand by 25 to 30pc due to the said restrictions on non-fliers.

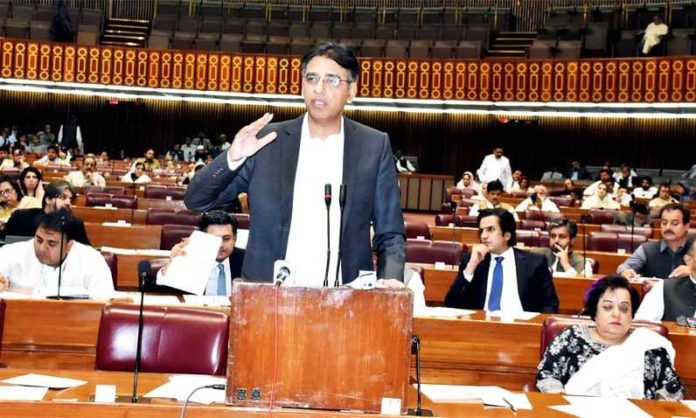

The issue of filers was also taken up by the automobile sector’s representatives with the prime minister at the recently held Pakistan Economic Forum, organized by Pakistan Business Council. While deciding about the removal of the condition earlier, Finance Minister Asad Umar had claimed that the ban was interfering in the ability of overseas Pakistanis to do business and invest in Pakistan.

However, sources believe, the decision of removing the condition on non-filers will also give a negative signal to investors and the existing filers at a time when the government is forcing people to become filers.

A source at the finance ministry claimed that the government would delay the introduction of the mini-budget in case it receives assistance from China after the scheduled Joint Coordination Committee (JCC) of CPEC meeting on December 20. “If the balance of payment issue is addressed for next five months, the government can avoid introducing another supplementary budget and take the initiatives by May 2019 in the next budget of 2019-20,” he said. “The preparation of another supplementary budget will depend on the urgency of IMF’s next programme.”

Interestingly, the finance minister, while introducing the supplementary budget, had claimed that the mini-budget for the current year had become inevitable because of severe economic crisis and necessitated by the “unrealistic” budget announced by former finance minister Miftah Ismail.

Further Tax rate must be increased from 3 to 10 Percent . It will bring massive revenues for the government.