- ‘FBR cannot collect sales tax from any businessperson without registering him/her’

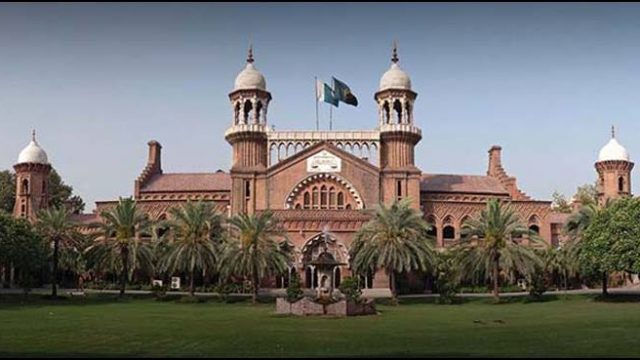

LAHORE: The Lahore High Court (LHC) has set aside the suo moto powers of Federal Board of Revenue (FBR) to collect sales tax from the business community without registering them under the Sale Tax Act 1990 and Sale Tax Rules 2006.

A two-member bench, comprising Justice Sajid Mahmood Seithi and Justice Muzammal Akhtar Shabir, on Wednesday announced the verdict by upholding the judgment of LHC’s tax tribunal on the petitions moved by SK Steel Mills and others.

The court held that the FBR could not collect the sales tax from any businessperson without registering him/her. The FBR will register the business community as taxpayers and then will proceed to collect sale tax under Section 3 of Sale Tax Act 1990, it maintained.

Representing the petitions, Advocate Ajmal Khan said for the last nine years, the business community has been fighting for justice against the suo moto powers of the FBR.

“In order to achieve tax collection targets, the FBR was collecting the sales tax from the business community without registering them and without giving any notice of recovery to them,” Ajmal Khan said, adding that this practice is tantamount to “harassment of the business community”, which is already paying huge taxes and duties to the government.

He further argued that the FBR proceeded against the business community under Section 3 (charging section), 7 (determination of the tax liability) and under other sections of Sales Tax Act 1990 without registering them under the act.

The FBR counsel maintained that the department had the powers to collect sales tax from any businessperson where it feels necessary and that there is no bar under the act which restrains the FBR from doing so. “The FBR has powers to collect the sales tax from the registered persons as well as from those liable to be registered persons,” he added.

Replying to the arguments of the FBR counsel, Ajmal Khan pointed out that there was section 19 in the act which empowers the FBR for compulsory registration but this section was omitted and was inserted again in the Sales Tax Rules 2006. Under rule 6 of the STR 2006, the FBR is bound firstly to register a businessman and then proceed under section 3 and 7 by granting the registered person an opportunity of raising objections on the FBR demand notices, he added.

Ajmal Khan pointed out that ‘registered persons’ and ‘liable to be registered persons’ are two different things.

After hearing the arguments, the two-member bench set aside the powers of the FBR to collect sales tax from the business community without registering them under the Sale Tax Act 1990 and Sale Tax Rules 2006.

“The FBR will firstly register a businessman and then will apply section 3 of Sale Tax Act,” the verdict stated.

It added that all such collections from unregistered businessman will be unlawful.