- Dr Hafeez Shaikh says continuous dialogue between centre and provinces has resulted in better budget and expenditure management

- IMF mission chief stresses ‘single tax base’ in Pakistan as it directly impacts ease of doing business and boosts investor confidence

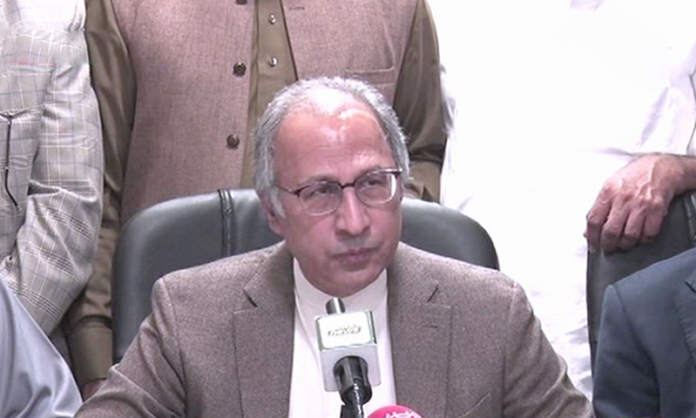

ISLAMABAD: Advisor to Prime Minister on Finance and Revenue Dr Abdul Hafeez Shaikh has said the federal and provincial governments are in continuous dialogue to improve coordination and create harmony on issues related to fiscal and budget management, multiplicity of tax rates and reconciliation of input adjustment.

He made this observation while chairing a meeting at the Finance Division to review the implementation of fiscal policies in the provinces under the International Monitoring Fund (IMF) programme.

IMF Mission Chief Ramirez Rigo Ernesto, Punjab Finance Minister Makhdoom Hashim Jawan Bakht, Khyber Pakhtunkhwa Finance Minister Taimur Saleem Khan Jhagra, Balochistan Finance Minister Zahoor Ahmed Buledi, Federal Finance Secretary Naveed Kamran Baloch, Sindh Special Finance Secretary Baqir Abbas Naqvi, senior officials from the Finance Division and local IMF officials were also present on the occasion.

Dr Hafeez Shaikh pointed out that tax harmonisation, as well other fiscal issues within the constitutional framework, was a challenging process but continuous dialogue and coordination between the centre and the provinces and among the provinces themselves had resulted in better budget and expenditure management.

He added that definitional issues related to what constituted a service and what rate of tax applied to it in different regions were also being resolved in a spirit of mutual understanding and accommodation.

The provincial ministers also shared their experiences and briefed the IMF mission chief about various measures and strategies put in place in their respective provinces to achieve better fiscal and budget management.

IMF Mission Chief Ramirez Rigo Ernesto said he was impressed by what he described as “good financial and fiscal management and maintenance of expenditure within the budget”.

However, he stressed upon complete use of development budget to achieve the development goals. He also emphasised upon harmonisation in the tax system and creation of a single tax base as it directly impacted the ease of doing business and went a long way in creating an enabling business environment and boosting the confidence of investors and businessmen.

Ernesto said that Pakistan had a continental-size economy, much like Western Europe where everybody had the same definition of tax rate and services. “The same could be achieved in Pakistan through uniform tax rates and a single tax administration instead of two or three tax authorities in each province.”

He appreciated the current level of understanding between the centre and provinces and hoped such efforts would continue to build consensus and bring about greater harmony.