We were spoiled for choice this issue of Profit when it came to deciding what our cover story would be. It’s a good problem to have, if I must say so myself.

The first contender on the list, my personal favourite, is our piece (Meiryum Ali on page 16) on the renegade school of thought called Modern Monetary Theory. To put it simply – and simplistically, robbing all nuance – the theory says: government needs money to spend? Just print more money!

Not an unheard of idea, actually. But one that you hear few people above the age of 13 spouting. The nascent but burgeoning number of ‘adult’ economists advocating it, however, is what makes it interesting. And in economist Dr. Asad Zaman, former PIDE boss, we found our MMT crowd in Pakistan. The man makes a passionate case, like all recent converts to new religions do. Hear him out.

Why isn’t this our cover story? Well, the Managing Editor threw a fit. A dangerous idea, he said, – with the certainty of the character in a post-apocalyptic film who turns out to be right at the end – and we shouldn’t even grace it with space in the magazine, what to speak of making it the cover story. The compromise I made with him? We featured it in this issue, without making it the cover. After all, what good is a publication if it can’t encourage discussion and debate on unconventional ideas.

The other contender for the cover story was our feature on Habib Metropolitan Bank. It’s a solid, well-researched feature. The problem? It’s a really boring bank. It’s an interesting read, of course, don’t get me wrong; we always write engaging pieces for our readers. But how interesting can you make this bank? Do read Farooq Tirmizi’s feature (page 10) to see what I mean.

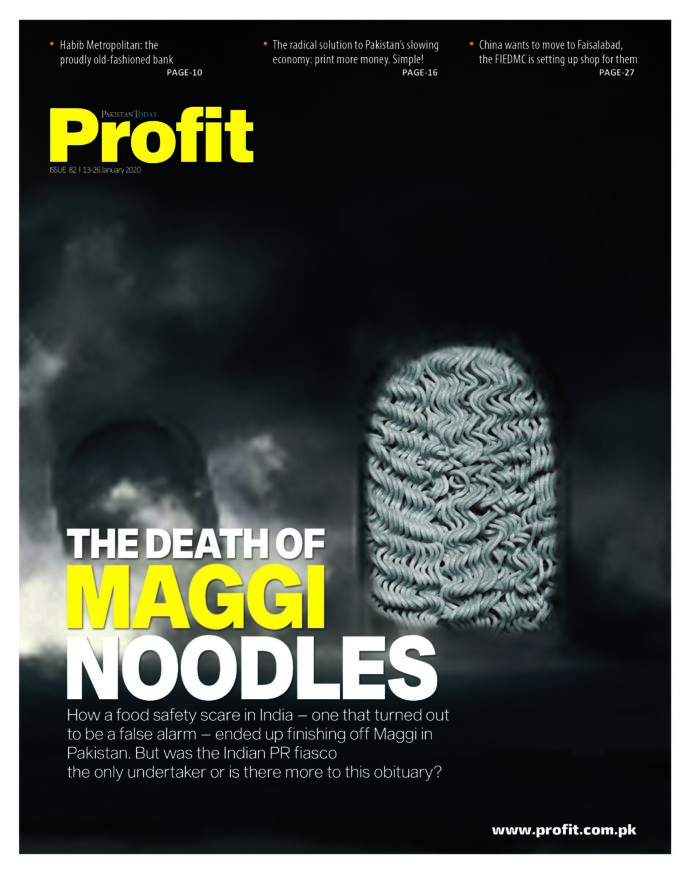

What we finally settled on was the death of Maggi. How Nestle’s PR team handled the Maggi fiasco next door in India is a textbook case of how-not-to-do-PR and we assume many heads have rolled there. Ironically, the victim turned out to be Maggi itself in Pakistan, while the Indian counterpart is up-and-running-again. It appears that in the game of Chinese Whispers that social media has become, Pakistani consumers stopped buying these noodles. Or so it was thought. Our story (Hassan Naqvi on page 22) reveals that this was the mere final nail in the long-overdue coffin and there were other factors at play as well.

We in the business journalism world are tilted more towards financial institutions and macroeconomics and don’t give marketing issues the attention that they deserve. That is a wrong we hope to right in future issues. Expect to see more of the FMCG sector in Profit in the future.

I agree with your Managing Editor – Kudos to him. The article on MMT is really dangerous as some fool here occupying a powerful position will pick it up and may try to implement, the result of which may be irreversibly disastrous! Just because a local economist advocates this theory, does not make it worthwhile as you will equally find millions of people believing in stupid conspiracy theories such as Flat earthers, Malala CIA implant, Israel worrying daily about Pakistan and its progress etc. Believing on MMT is just like that.

You can only see the kind of people liking it to know its worth – socialists like Bernie Sanders and Islamic socialists like Dr Asad Zaman who think the cure of everything is in Shariah compliant Islamic socialist Financial system and the immeasurable ‘barakaat’ one gets after changing the sinful names of ‘Short Term Loan’ and ‘ Financial Lease’ to the ‘beautiful’ Arabic words of ‘Murabaha’, and ‘Ijara’ respectively!

@Shahid Thank you for your feedback. I would argue that similar articles on MMT are being published by all leading financial publications including FT, WSJ and The Economist. So why should we impose self- censorship? As for your concern, in our article we have also covered the problems and the limitations of the theory especially in a Pakistani context.

They also write about bitcoin but I’ve not seen many articles about that here. Why the self censorship about that?

80 plus articles covering the rise and fall of bitcoin:

https://profit.pakistantoday.com.pk/page/8/?s=Bitcoin

@Babar, To answer your question, they are responsible nations with educated, experienced & well grounded economists running the policy making functions.

Anyways, thanks for your response, appreciate it.

They run huge fiscal deficits anyway so even though it’s not given the MMT label it’s equally bad. Only during IMF programs do they even attempt to contain their exuberant spending with newly created money.

It’s funny how they finance government borrowing directly via the central bank when not in an IMF program and in a roundabout way via commercial banks, fueled by regular SBP injections, when in an IMF program.

Comments are closed.